Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bruce is the sole shareholder of Big - Ltd . which has a fiscal year end of December 3 1 s t initial all the

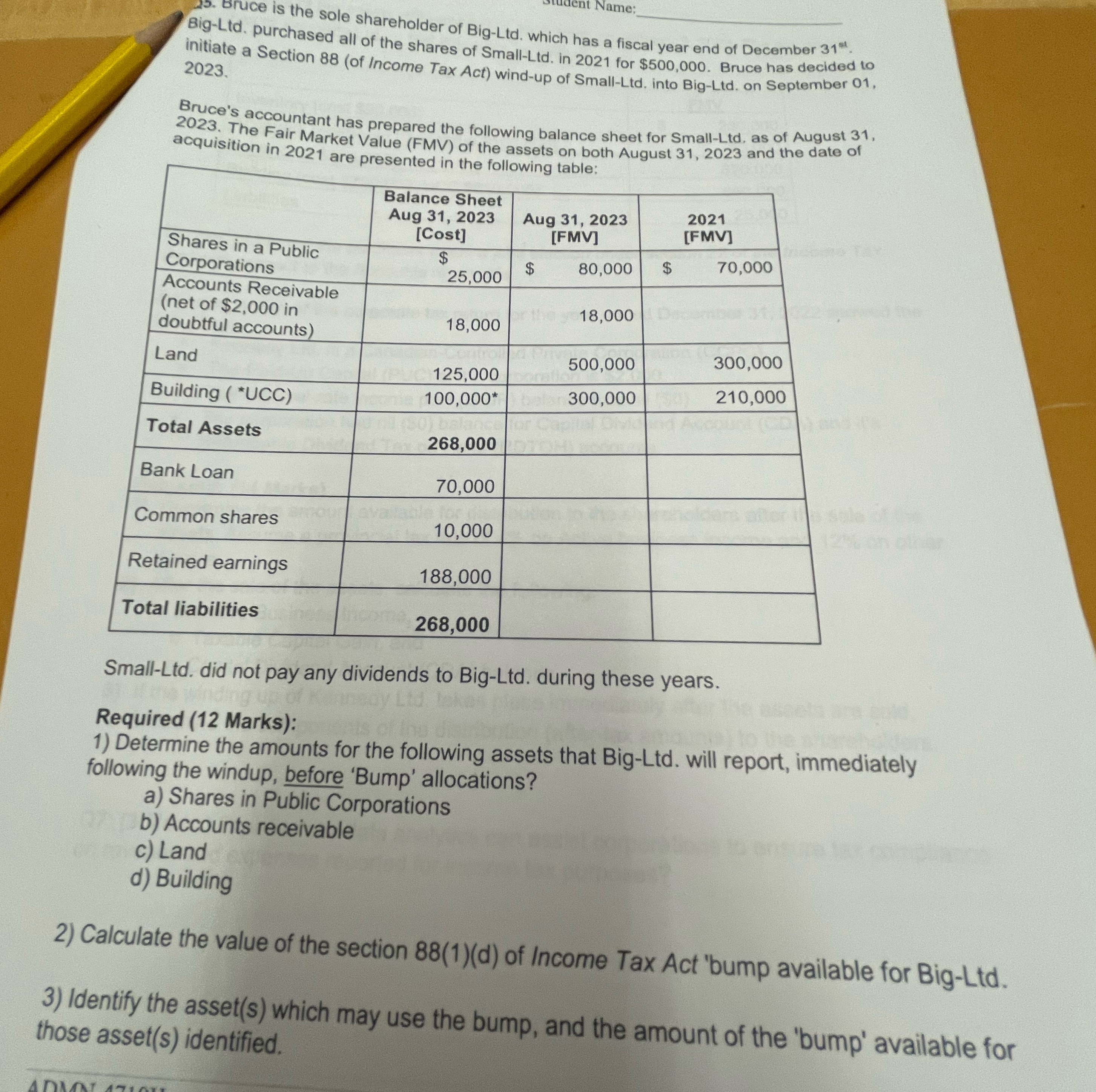

Bruce is the sole shareholder of BigLtd which has a fiscal year end of December initial all the shares of SmallLtd in for $ Bruce has decided to f Income Tax Act windup of SmallLtd into BigLtd on September

Bruce's accountant has prepared the following balance sheet for SmallLtd as of August The Fair Market Value FMV of the assets on both August and the date of acquisition in are presented in the following table:

tabletableBalance SheetAug tableAug tabletableShares in a PublicCorporationsAcrutiontable$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started