Answered step by step

Verified Expert Solution

Question

1 Approved Answer

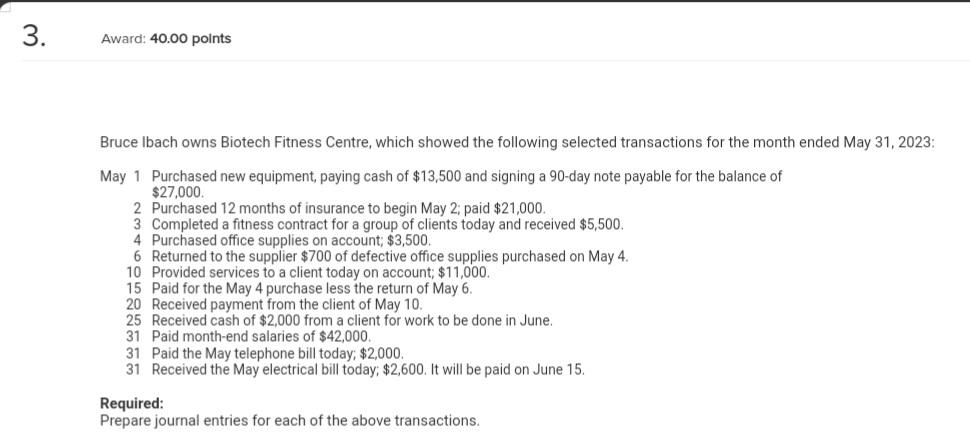

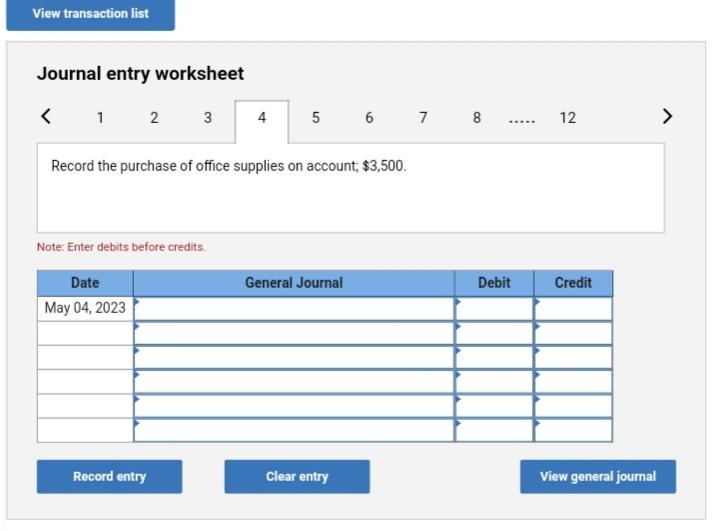

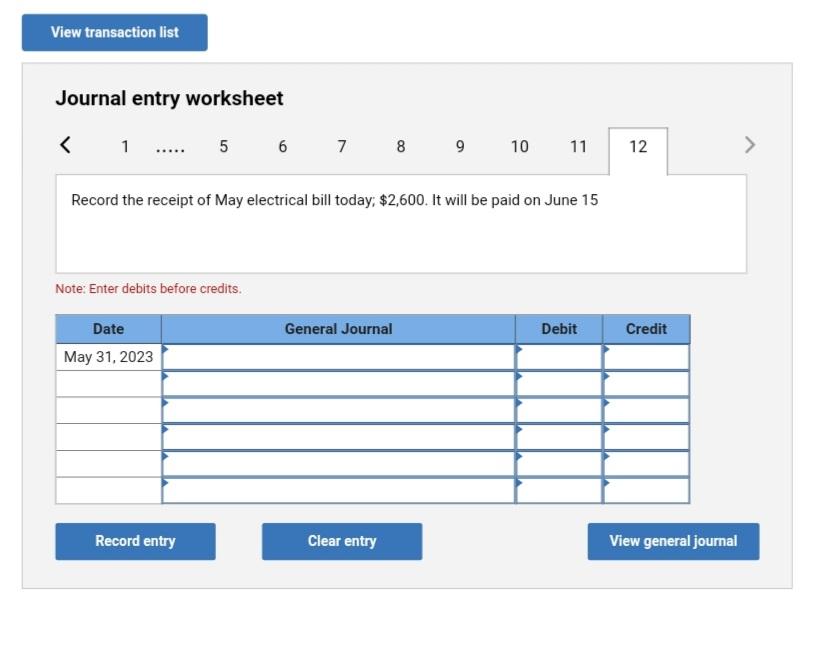

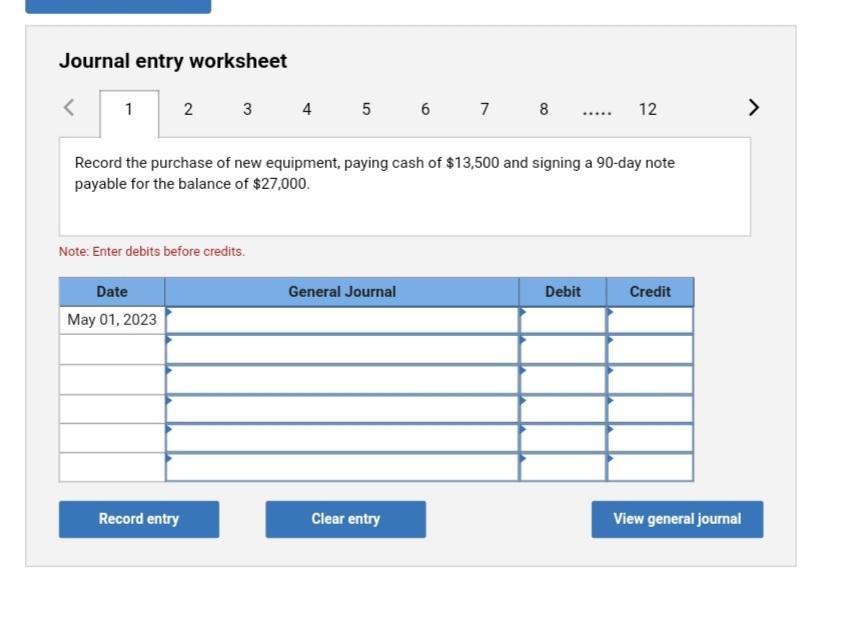

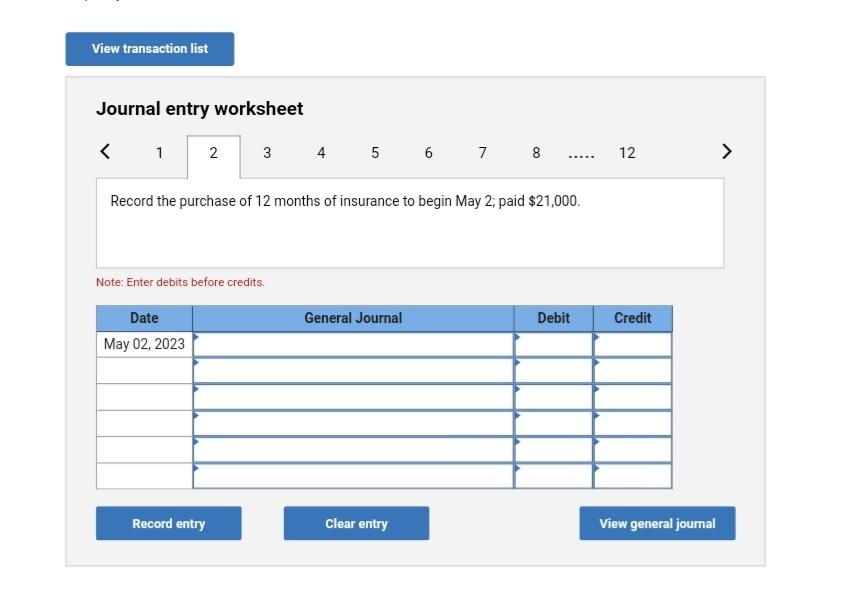

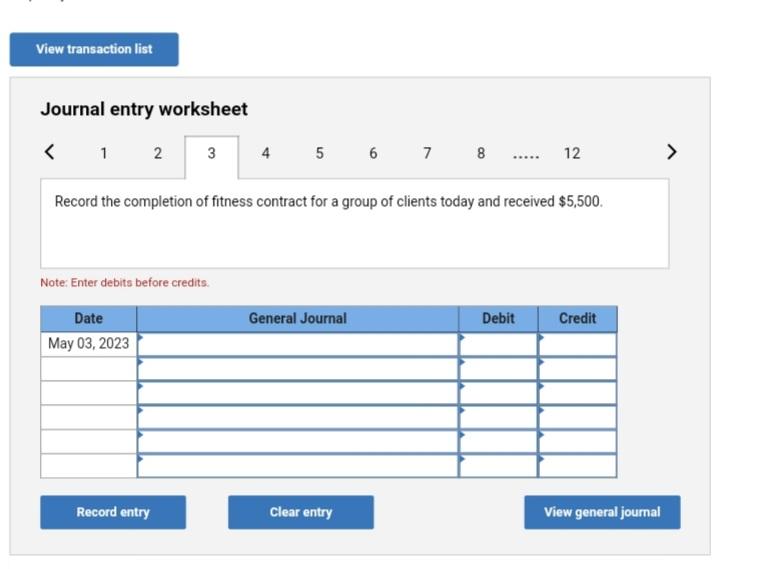

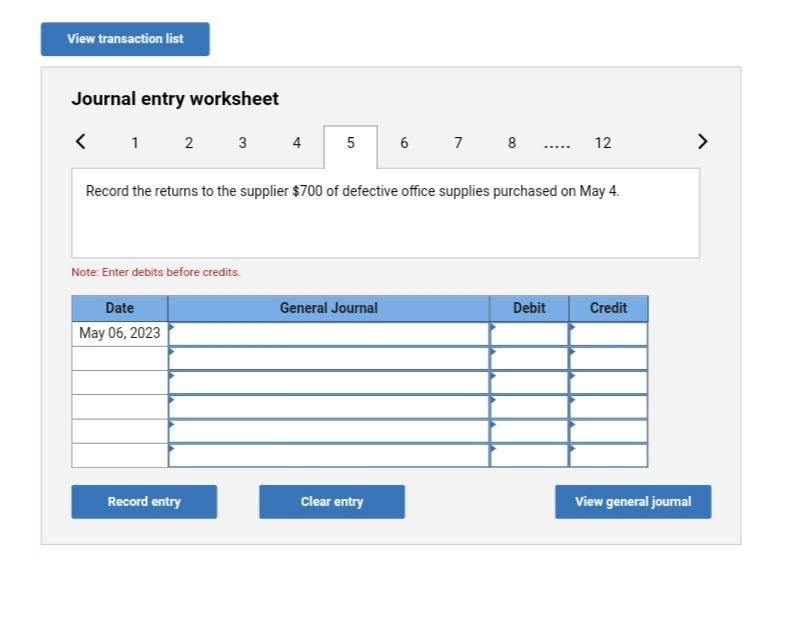

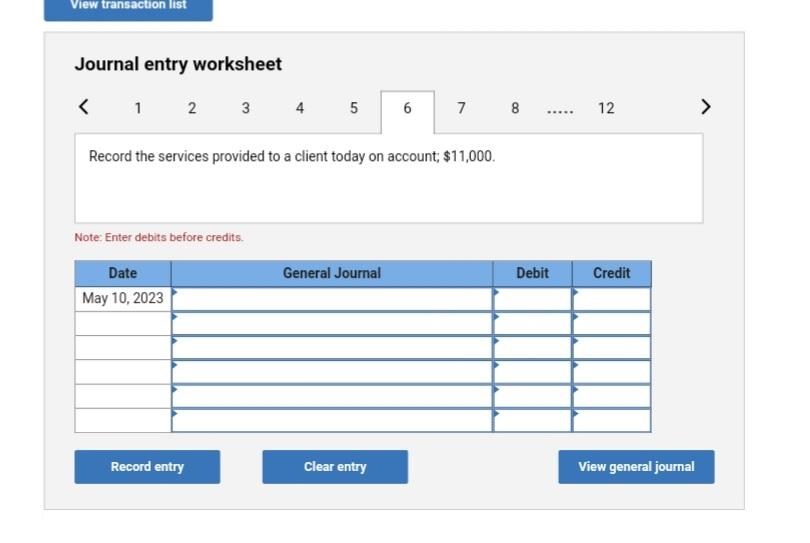

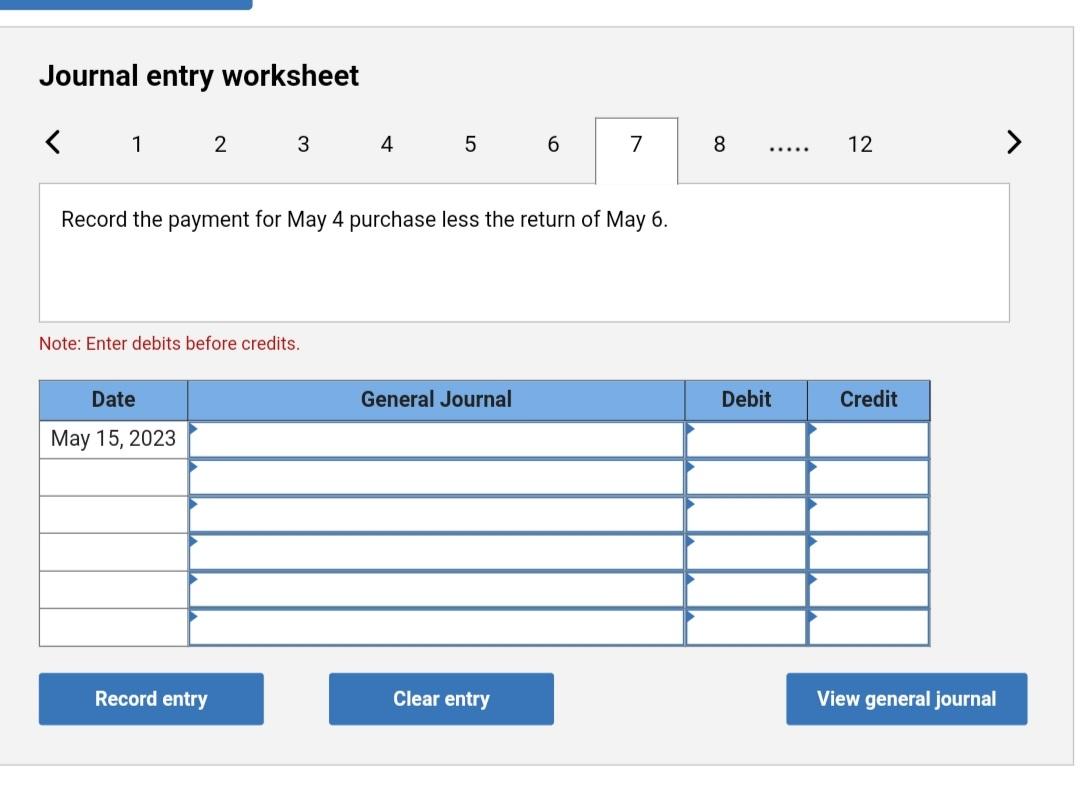

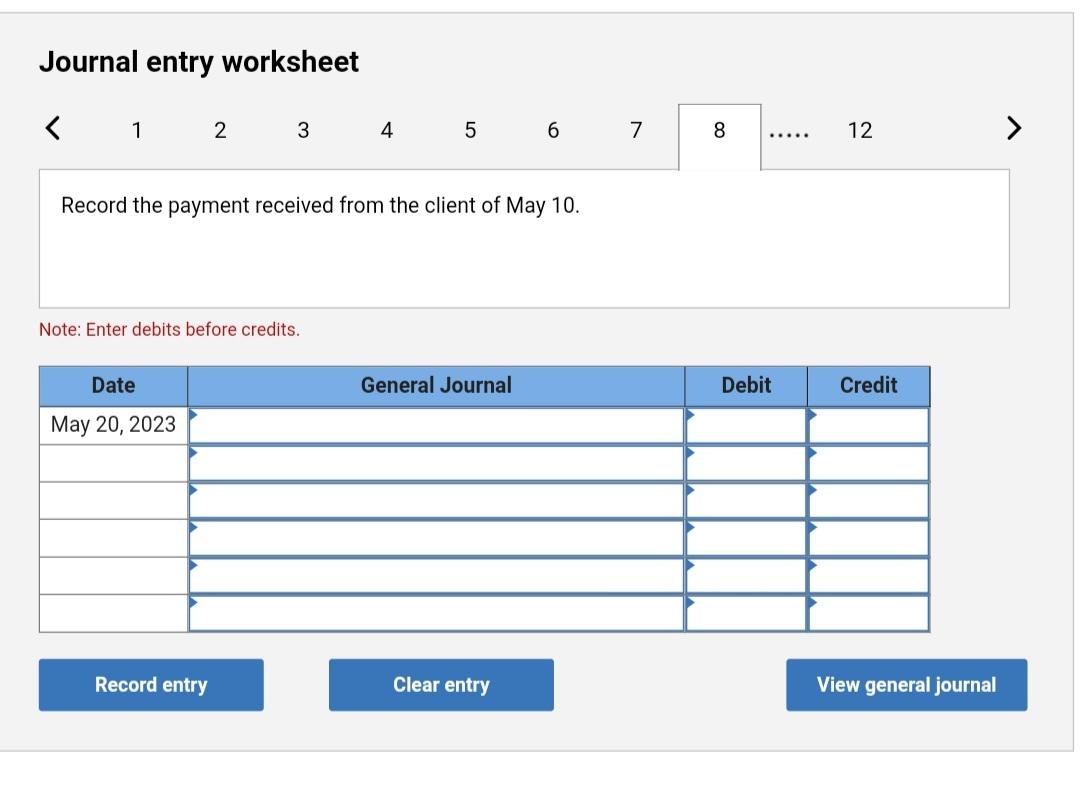

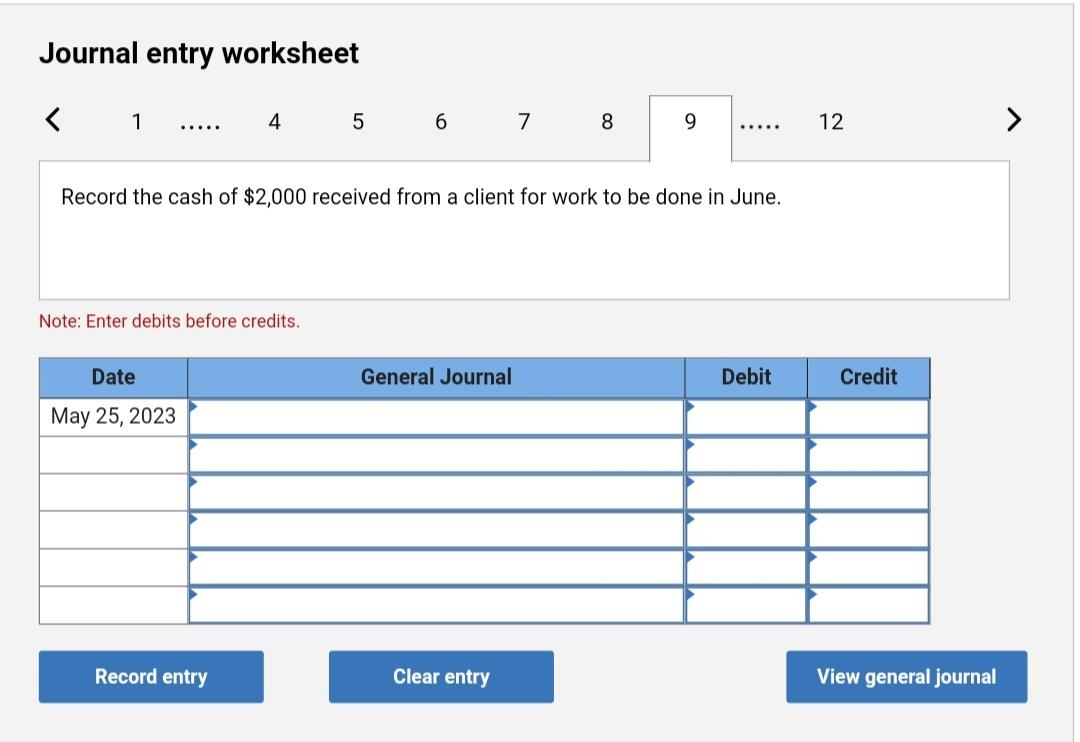

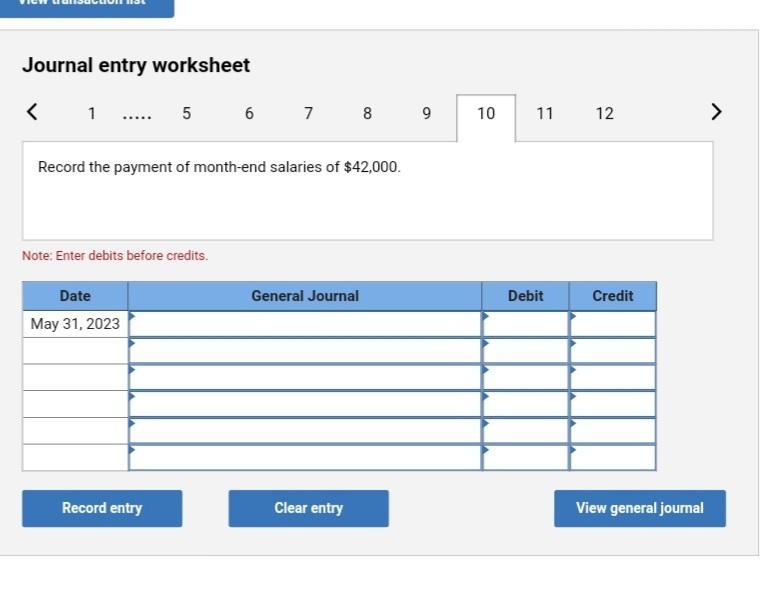

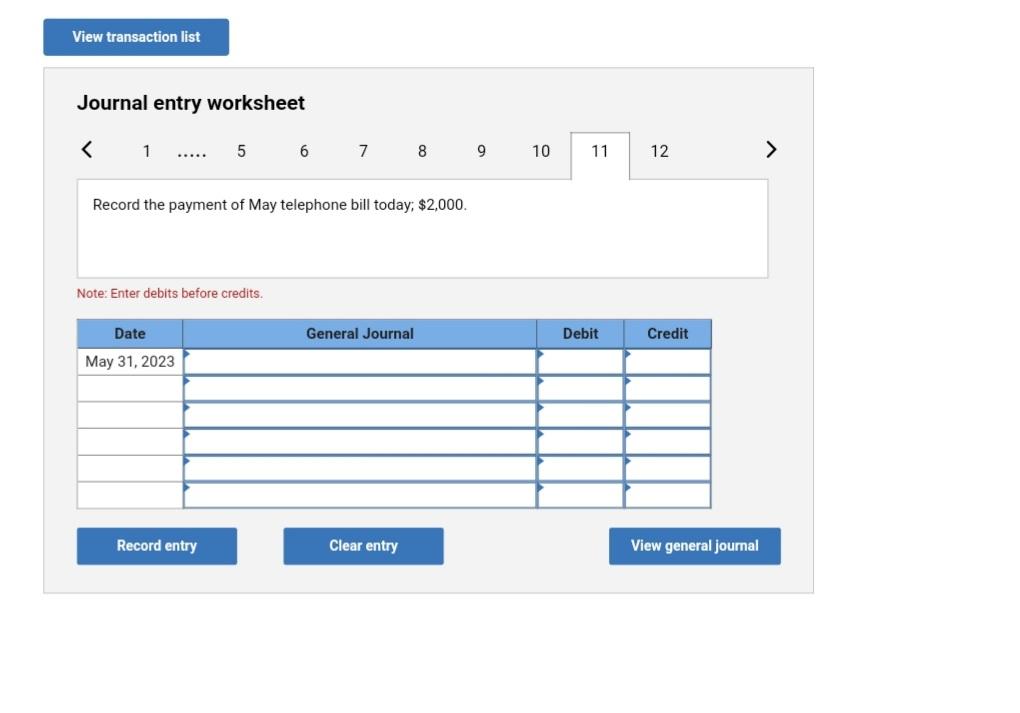

Bruce lbach owns Biotech Fitness Centre, which showed the following selected transactions for the month ended May 31, 2023: May 1 Purchased new equipment, paying

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started