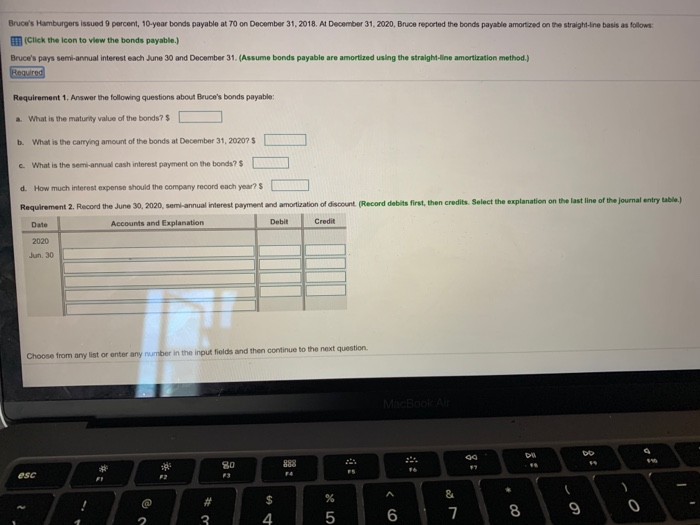

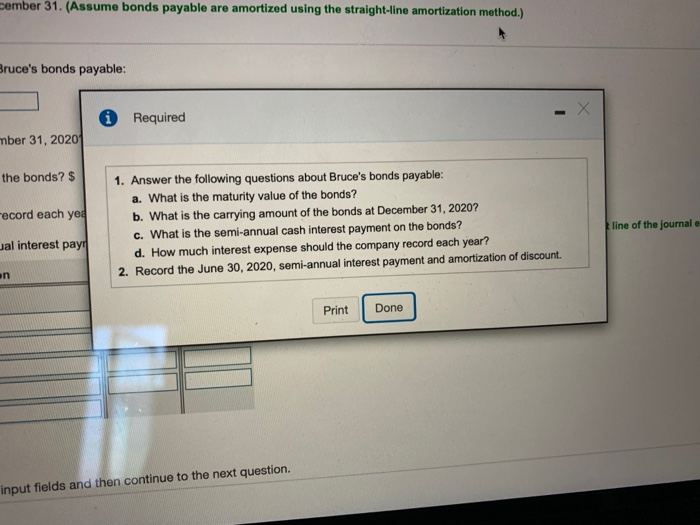

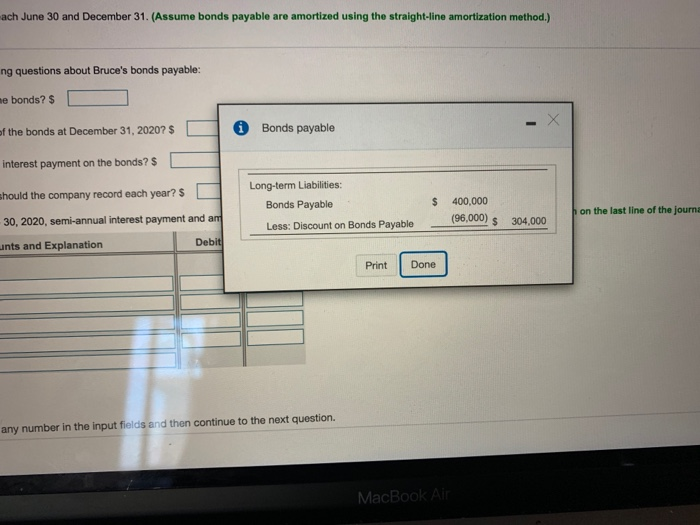

Bruce's Hamburgers issued 9 percent, 10-year bonds payable at 70 on December 31, 2018. At December 31, 2020, Bruce reported the bonds payable amortized on the straight-line basis as follows: (Click the icon to view the bonds payable.) Bruce's pays semi-annual interest each June 30 and December 31. (Assume bonds payable are amortized using the straight-line amortization method.) Required Requirement 1. Answer the following questions about Bruce's bonds payable: What is the maturity value of the bonds? b. What is the carrying amount of the bonds at December 31, 20207 c. What is the semi-annual cash interest payment on the bonds? $ d. How much interest expense should the company record each year? $ Requirement 2. Record the June 30, 2020, semi-annual interest payment and amortization of discount. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit 2020 Jun 30 Choose from any list or enter any number in the input fields and then continue to the next question 80 888 esc %23 3 $ 4 % 5 & 7 00 9 0 6 2 ember 31. (Assume bonds payable are amortized using the straight-line amortization method.) Bruce's bonds payable: A Required mber 31, 2020 the bonds? $ ecord each yed 1. Answer the following questions about Bruce's bonds payable: a. What is the maturity value of the bonds? b. What is the carrying amount of the bonds at December 31, 2020? c. What is the semi-annual cash interest payment on the bonds? d. How much interest expense should the company record each year? 2. Record the June 30, 2020, semi-annual interest payment and amortization of discount line of the journal e al interest payo en Print Done input fields and then continue to the next question. ach June 30 and December 31. (Assume bonds payable are amortized using the straight-line amortization method.) ng questions about Bruce's bonds payable: me bonds? $ of the bonds at December 31, 2020? S 0 Bonds payable interest payment on the bonds? $ should the company record each year? $ 30, 2020, semi-annual interest payment and an unts and Explanation Debit Long-term Liabilities: Bonds Payable Less: Discount on Bonds Payable $ 400,000 (96,000) on the last line of the journa $ 304,000 Print Done any number in the input fields and then continue to the next question. MacBook Air