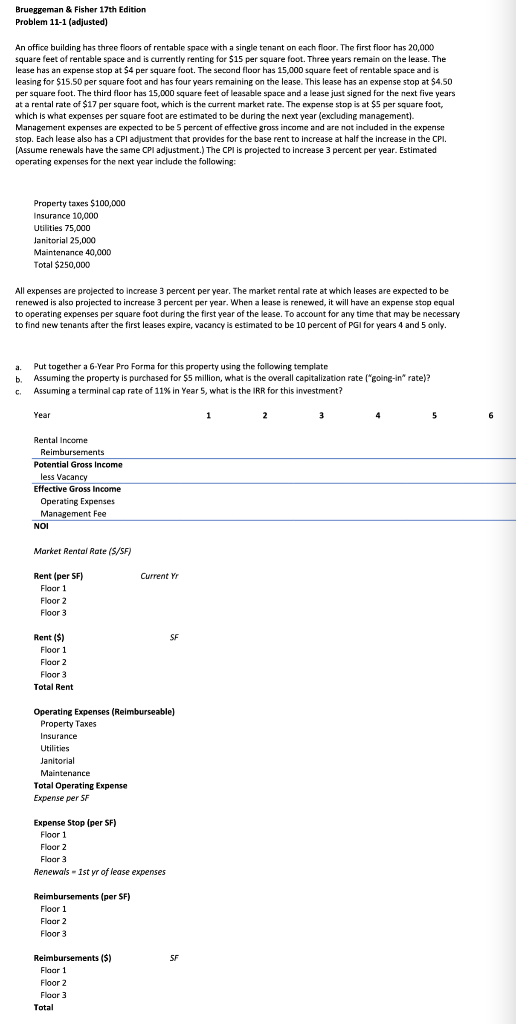

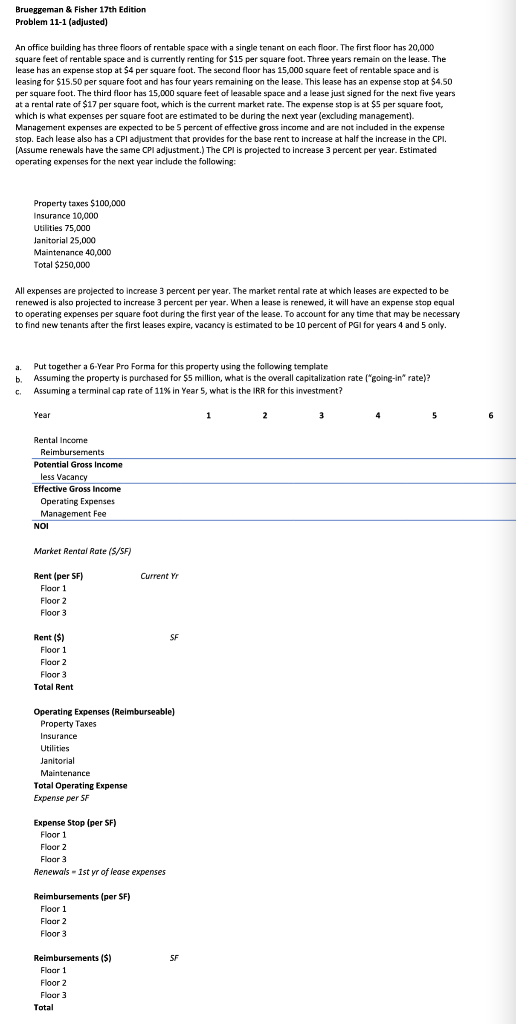

Brueggeman \& Fisher 17 th Edition Problem 11-1 (adjusted) An office building has three floors of rentable space with a single tenant on each floor. The first floor has 20,000 square feet of rentable space and is currently renting for $15 per square foot. Three years remain on the lease. The lease has an expense stop at $4 per square foot. The second floor has 15,000 square feet of rentable space and is leasing for $15.50 per square foot and has four years remaining on the lease. This lease has an expense stop at $4.50 per square foot. The third floor has 15,000 square feet of leasable space and a lease just signed for the next five years at a rental rate of $17 per square foot, which is the current market rate. The expense stop is at $5 per square foot, which is what expenses per square foot are estimated to be during the next year (excluding management). Management expenses are expected to be 5 percent of effective gross income and are not induded in the expense stop. Each lease also has a CPI adjustment that provides for the base rent to increase at half the increase in the CPI. (Assume renewals have the same CPI adjustment.) The CPI is projected to increase 3 percent per year. Estimated operating expenses for the next year include the following: Praperty taxes $100,000 Insurance 10,000 Utilities 75,000 Janitorial 25,000 Maintenance 40,000 Total $250,000 All expenses are projected to increase 3 percent per year. The market rental rate at which leases are expected to be renewed is also projected to increase 3 percent per year. When a lease is renewed, it will have an expense stop equal to operating expenses per square foot during the first year of the lease. To account for any time that may be necessary to find new tenants after the first leases expire, vacancy is estimated to be 10 percent of PGI for years 4 and 5 only. a. Put together a 6-Year Pro Forma for this property using the following template b. Assuming the property is purchased for $5 million, what is the overall capitalization rate ["going-in" rate)? c. Assuming a terminal cap rate of 11% in Year 5 , what is the IRR for this investment? Market Rental Rote (S/SF) Brueggeman \& Fisher 17 th Edition Problem 11-1 (adjusted) An office building has three floors of rentable space with a single tenant on each floor. The first floor has 20,000 square feet of rentable space and is currently renting for $15 per square foot. Three years remain on the lease. The lease has an expense stop at $4 per square foot. The second floor has 15,000 square feet of rentable space and is leasing for $15.50 per square foot and has four years remaining on the lease. This lease has an expense stop at $4.50 per square foot. The third floor has 15,000 square feet of leasable space and a lease just signed for the next five years at a rental rate of $17 per square foot, which is the current market rate. The expense stop is at $5 per square foot, which is what expenses per square foot are estimated to be during the next year (excluding management). Management expenses are expected to be 5 percent of effective gross income and are not induded in the expense stop. Each lease also has a CPI adjustment that provides for the base rent to increase at half the increase in the CPI. (Assume renewals have the same CPI adjustment.) The CPI is projected to increase 3 percent per year. Estimated operating expenses for the next year include the following: Praperty taxes $100,000 Insurance 10,000 Utilities 75,000 Janitorial 25,000 Maintenance 40,000 Total $250,000 All expenses are projected to increase 3 percent per year. The market rental rate at which leases are expected to be renewed is also projected to increase 3 percent per year. When a lease is renewed, it will have an expense stop equal to operating expenses per square foot during the first year of the lease. To account for any time that may be necessary to find new tenants after the first leases expire, vacancy is estimated to be 10 percent of PGI for years 4 and 5 only. a. Put together a 6-Year Pro Forma for this property using the following template b. Assuming the property is purchased for $5 million, what is the overall capitalization rate ["going-in" rate)? c. Assuming a terminal cap rate of 11% in Year 5 , what is the IRR for this investment? Market Rental Rote (S/SF)