Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bruno Ltd acquired 100% interest in Mars Ltd on 1 January 2021. Consideration consisted of $300,000 in cash and 10,000 shares with a fair value

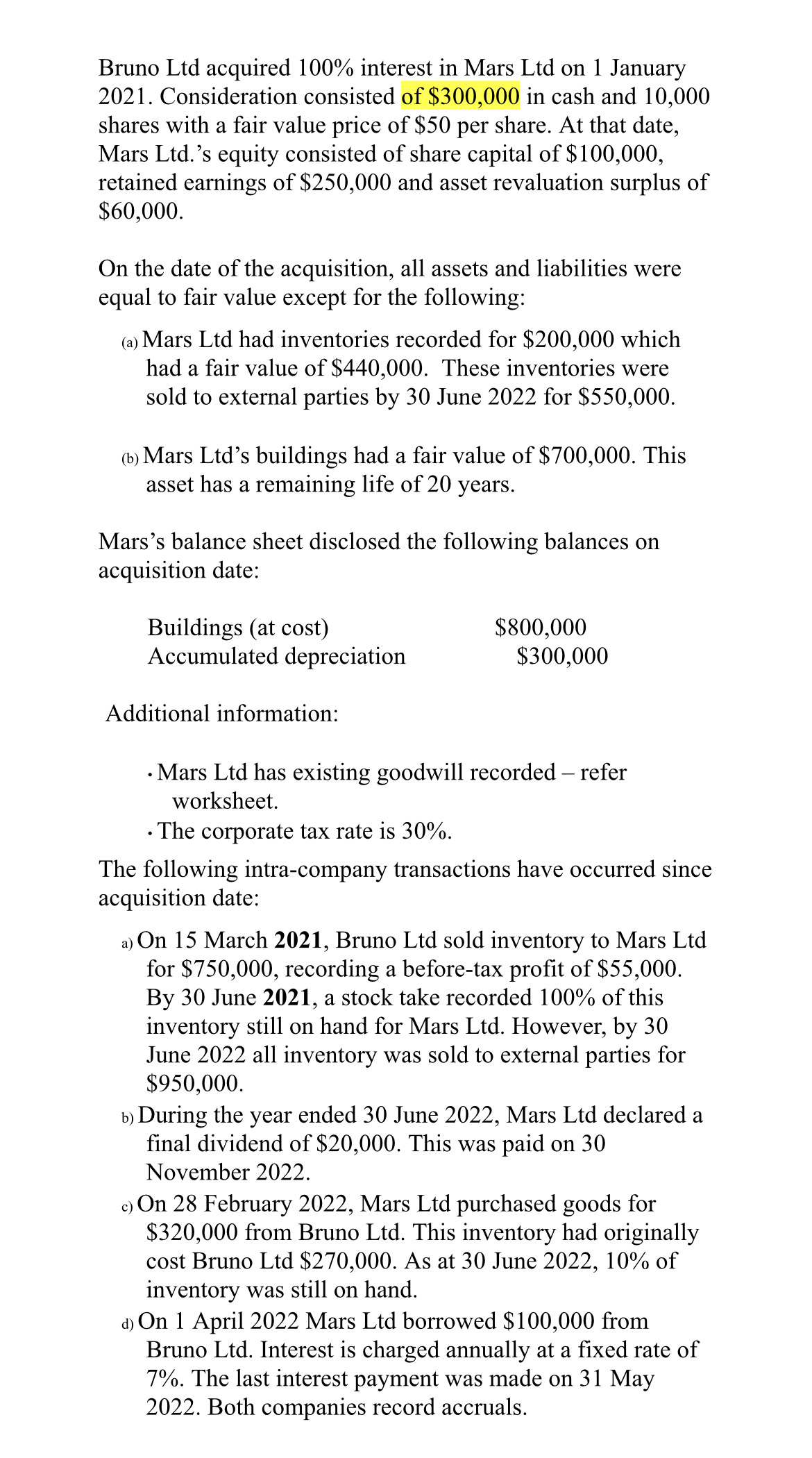

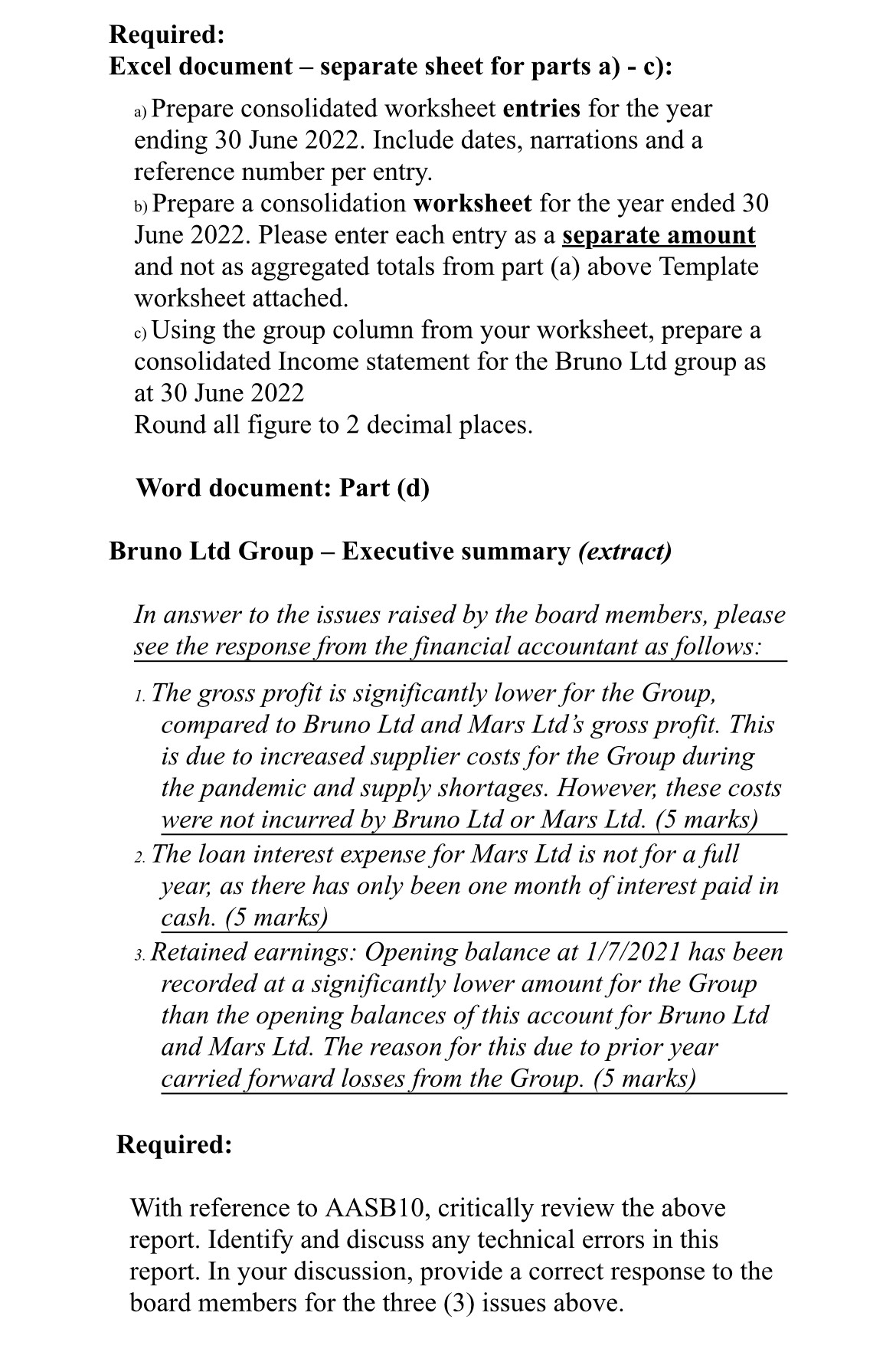

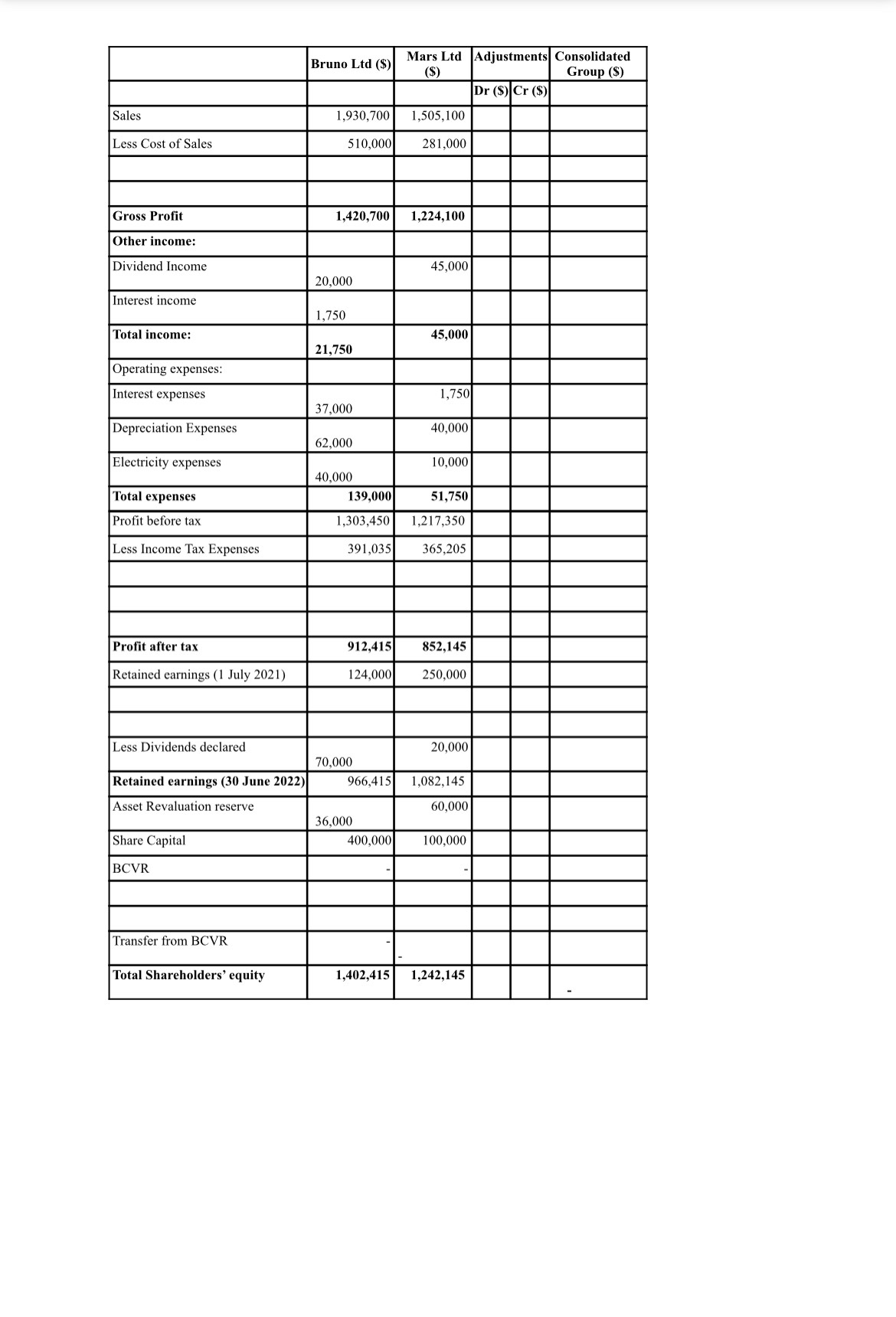

Bruno Ltd acquired 100% interest in Mars Ltd on 1 January 2021. Consideration consisted of $300,000 in cash and 10,000 shares with a fair value price of $50 per share. At that date, Mars Ltd.'s equity consisted of share capital of $100,000, retained earnings of $250,000 and asset revaluation surplus of $60,000. On the date of the acquisition, all assets and liabilities were equal to fair value except for the following: (a) Mars Ltd had inventories recorded for $200,000 which had a fair value of $440,000. These inventories were sold to external parties by 30 June 2022 for $550,000. (b) Mars Ltd's buildings had a fair value of $700,000. This asset has a remaining life of 20 years. Mars's balance sheet disclosed the following balances on acquisition date: Additional information: - Mars Ltd has existing goodwill recorded - refer worksheet. - The corporate tax rate is 30%. The following intra-company transactions have occurred since acquisition date: a) On 15 March 2021, Bruno Ltd sold inventory to Mars Ltd for $750,000, recording a before-tax profit of $55,000. By 30 June 2021, a stock take recorded 100% of this inventory still on hand for Mars Ltd. However, by 30 June 2022 all inventory was sold to external parties for $950,000. b) During the year ended 30 June 2022, Mars Ltd declared a final dividend of $20,000. This was paid on 30 November 2022. c) On 28 February 2022, Mars Ltd purchased goods for $320,000 from Bruno Ltd. This inventory had originally cost Bruno Ltd $270,000. As at 30 June 2022, 10% of inventory was still on hand. d) On 1 April 2022 Mars Ltd borrowed \$100,000 from Bruno Ltd. Interest is charged annually at a fixed rate of 7%. The last interest payment was made on 31 May 2022. Both companies record accruals. Required: Excel document - separate sheet for parts a) - c): a) Prepare consolidated worksheet entries for the year ending 30 June 2022. Include dates, narrations and a reference number per entry. b) Prepare a consolidation worksheet for the year ended 30 June 2022. Please enter each entry as a separate amount and not as aggregated totals from part (a) above Template worksheet attached. c) Using the group column from your worksheet, prepare a consolidated Income statement for the Bruno Ltd group as at 30 June 2022 Round all figure to 2 decimal places. Word document: Part (d) Bruno Ltd Group - Executive summary (extract) In answer to the issues raised by the board members, please see the response from the financial accountant as follows: 1. The gross profit is significantly lower for the Group, compared to Bruno Ltd and Mars Ltd's gross profit. This is due to increased supplier costs for the Group during the pandemic and supply shortages. However, these costs were not incurred by Bruno Ltd or Mars Ltd. (5 marks) 2. The loan interest expense for Mars Ltd is not for a full year, as there has only been one month of interest paid in cash. (5 marks) 3. Retained earnings: Opening balance at 1/7/2021 has been recorded at a significantly lower amount for the Group than the opening balances of this account for Bruno Ltd and Mars Ltd. The reason for this due to prior year carried forward losses from the Group. (5 marks) Required: With reference to AASB10, critically review the above report. Identify and discuss any technical errors in this report. In your discussion, provide a correct response to the board members for the three (3) issues above

Bruno Ltd acquired 100% interest in Mars Ltd on 1 January 2021. Consideration consisted of $300,000 in cash and 10,000 shares with a fair value price of $50 per share. At that date, Mars Ltd.'s equity consisted of share capital of $100,000, retained earnings of $250,000 and asset revaluation surplus of $60,000. On the date of the acquisition, all assets and liabilities were equal to fair value except for the following: (a) Mars Ltd had inventories recorded for $200,000 which had a fair value of $440,000. These inventories were sold to external parties by 30 June 2022 for $550,000. (b) Mars Ltd's buildings had a fair value of $700,000. This asset has a remaining life of 20 years. Mars's balance sheet disclosed the following balances on acquisition date: Additional information: - Mars Ltd has existing goodwill recorded - refer worksheet. - The corporate tax rate is 30%. The following intra-company transactions have occurred since acquisition date: a) On 15 March 2021, Bruno Ltd sold inventory to Mars Ltd for $750,000, recording a before-tax profit of $55,000. By 30 June 2021, a stock take recorded 100% of this inventory still on hand for Mars Ltd. However, by 30 June 2022 all inventory was sold to external parties for $950,000. b) During the year ended 30 June 2022, Mars Ltd declared a final dividend of $20,000. This was paid on 30 November 2022. c) On 28 February 2022, Mars Ltd purchased goods for $320,000 from Bruno Ltd. This inventory had originally cost Bruno Ltd $270,000. As at 30 June 2022, 10% of inventory was still on hand. d) On 1 April 2022 Mars Ltd borrowed \$100,000 from Bruno Ltd. Interest is charged annually at a fixed rate of 7%. The last interest payment was made on 31 May 2022. Both companies record accruals. Required: Excel document - separate sheet for parts a) - c): a) Prepare consolidated worksheet entries for the year ending 30 June 2022. Include dates, narrations and a reference number per entry. b) Prepare a consolidation worksheet for the year ended 30 June 2022. Please enter each entry as a separate amount and not as aggregated totals from part (a) above Template worksheet attached. c) Using the group column from your worksheet, prepare a consolidated Income statement for the Bruno Ltd group as at 30 June 2022 Round all figure to 2 decimal places. Word document: Part (d) Bruno Ltd Group - Executive summary (extract) In answer to the issues raised by the board members, please see the response from the financial accountant as follows: 1. The gross profit is significantly lower for the Group, compared to Bruno Ltd and Mars Ltd's gross profit. This is due to increased supplier costs for the Group during the pandemic and supply shortages. However, these costs were not incurred by Bruno Ltd or Mars Ltd. (5 marks) 2. The loan interest expense for Mars Ltd is not for a full year, as there has only been one month of interest paid in cash. (5 marks) 3. Retained earnings: Opening balance at 1/7/2021 has been recorded at a significantly lower amount for the Group than the opening balances of this account for Bruno Ltd and Mars Ltd. The reason for this due to prior year carried forward losses from the Group. (5 marks) Required: With reference to AASB10, critically review the above report. Identify and discuss any technical errors in this report. In your discussion, provide a correct response to the board members for the three (3) issues above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started