Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BS Inc., a calendar year S corporation, has 2 unrelated shareholders, Brad and Sophie. Brad owns 40% of the stock and Sophie owns 60%

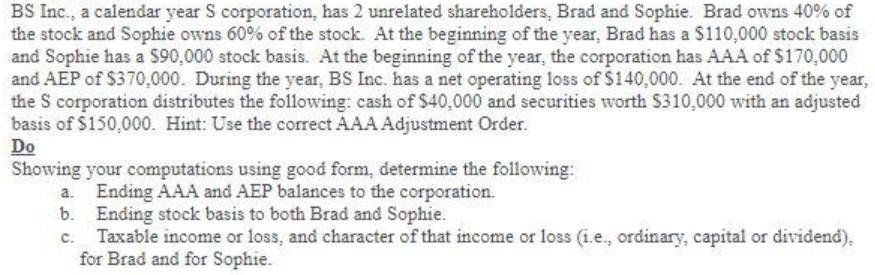

BS Inc., a calendar year S corporation, has 2 unrelated shareholders, Brad and Sophie. Brad owns 40% of the stock and Sophie owns 60% of the stock. At the beginning of the year, Brad has a $110,000 stock basis and Sophie has a $90,000 stock basis. At the beginning of the year, the corporation has AAA of $170,000 and AEP of $370,000. During the year, BS Inc. has a net operating loss of $140,000. At the end of the year, the S corporation distributes the following: cash of $40,000 and securities worth $310,000 with an adjusted basis of $150,000. Hint: Use the correct AAA Adjustment Order. Do Showing your computations using good form, determine the following: Ending AAA and AEP balances to the corporation. Ending stock basis to both Brad and Sophie. Taxable income or loss, and character of that income or loss (i.e., ordinary, capital or dividend), for Brad and for Sophie.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Quiz a The ending AAA and AEP balances for BS Inc a calendar year S corporation are as follows AAA 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started