Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BTL had accounted for certain raw materials costing $200,000 purchased in 20x1, as part of the 20x1 actual costs (as shown in the table

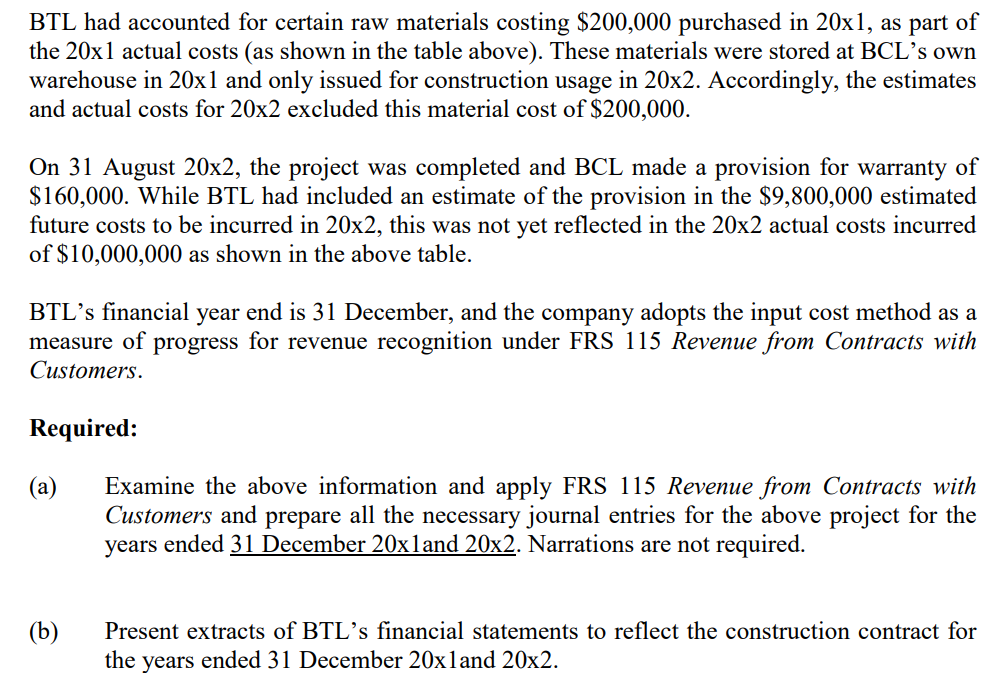

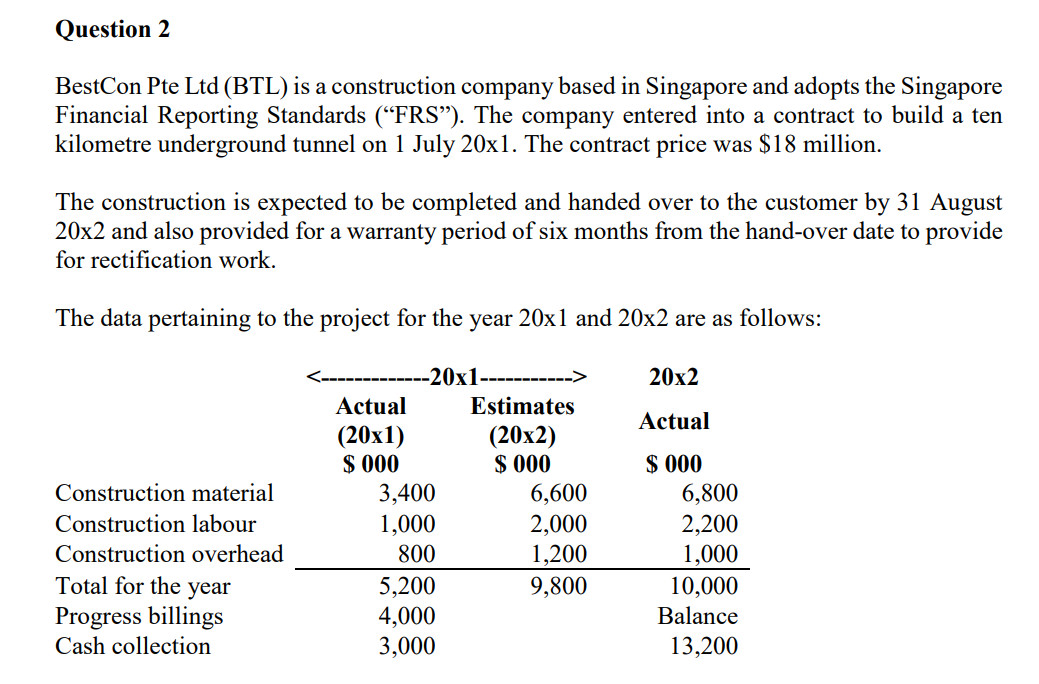

BTL had accounted for certain raw materials costing $200,000 purchased in 20x1, as part of the 20x1 actual costs (as shown in the table above). These materials were stored at BCL's own warehouse in 20x1 and only issued for construction usage in 20x2. Accordingly, the estimates and actual costs for 20x2 excluded this material cost of $200,000. On 31 August 20x2, the project was completed and BCL made a provision for warranty of $160,000. While BTL had included an estimate of the provision in the $9,800,000 estimated future costs to be incurred in 20x2, this was not yet reflected in the 20x2 actual costs incurred of $10,000,000 as shown in the above table. BTL's financial year end is 31 December, and the company adopts the input cost method as a measure of progress for revenue recognition under FRS 115 Revenue from Contracts with Customers. Required: (a) (b) Examine the above information and apply FRS 115 Revenue from Contracts with Customers and prepare all the necessary journal entries for the above project for the years ended 31 December 20x1and 20x2. Narrations are not required. Present extracts of BTL's financial statements to reflect the construction contract for the years ended 31 December 20x1and 20x2. Question 2 BestCon Pte Ltd (BTL) is a construction company based in Singapore and adopts the Singapore Financial Reporting Standards (FRS"). The company entered into a contract to build a ten kilometre underground tunnel on 1 July 20x1. The contract price was $18 million. The construction is expected to be completed and handed over to the customer by 31 August 20x2 and also provided for a warranty period of six months from the hand-over date to provide for rectification work. The data pertaining to the project for the year 20x1 and 20x2 are as follows: -20x1. 20x2 Actual (20x1) Estimates (20x2) Actual $ 000 $ 000 $ 000 Construction material 3,400 6,600 6,800 Construction labour 1,000 2,000 2,200 Construction overhead 800 1,200 1,000 Total for the year 5,200 9,800 10,000 Progress billings 4,000 Balance Cash collection 3,000 13,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started