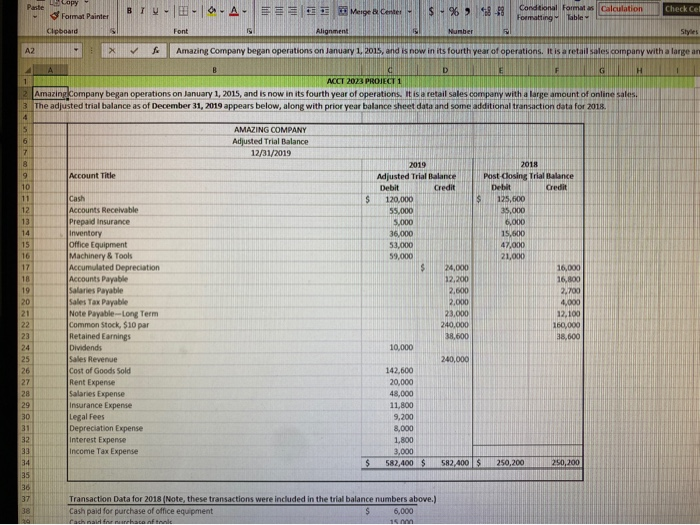

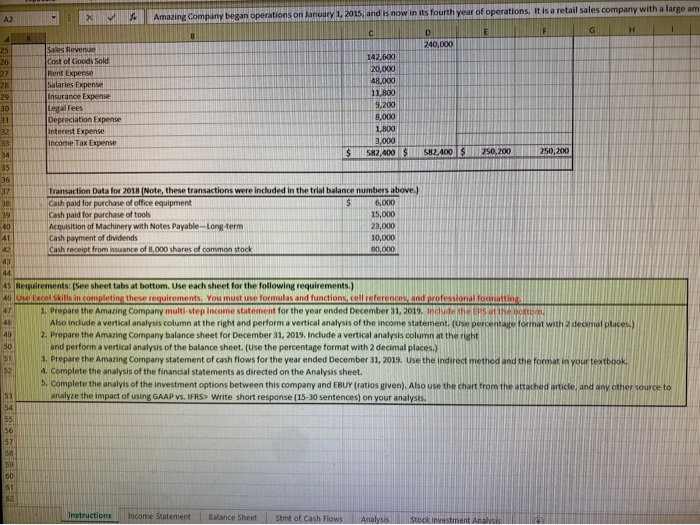

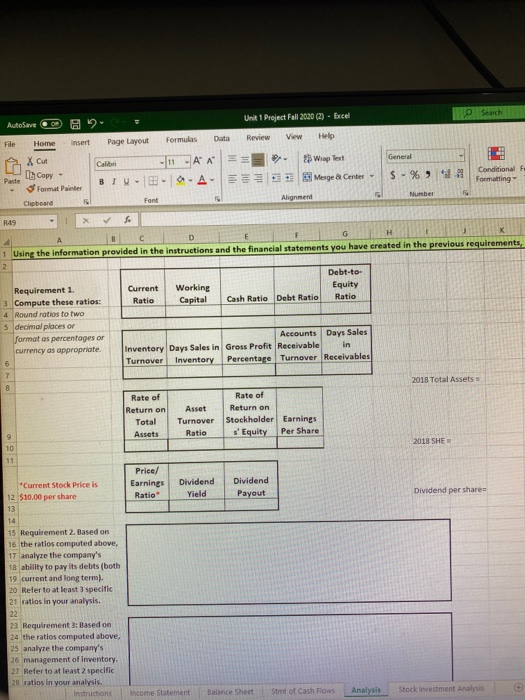

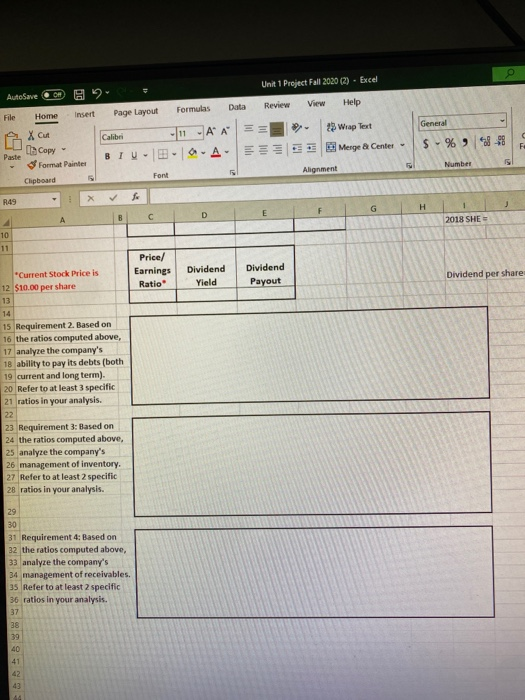

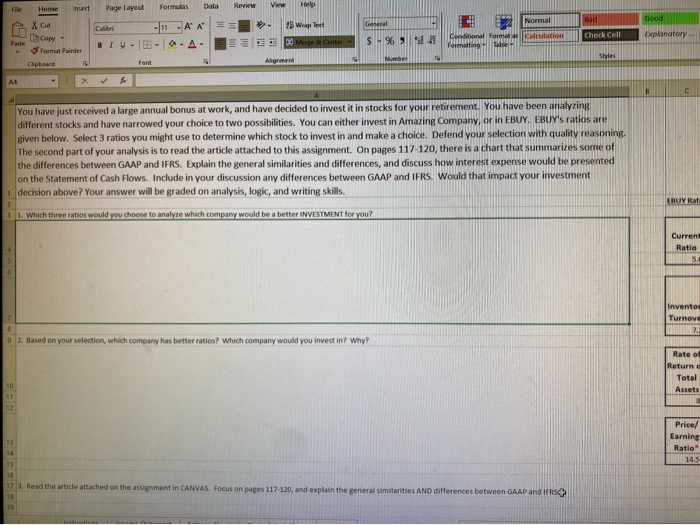

BTU-0-0-A 31 Meigta Center $ -% 48-58 Paste py Format Painter Cleboard S Conditional Formats Calculation Formatting Table Check Cel Font 19 Alignment Number D AZ > Amazing Company began operations on January 1, 2015, and is now in its fourth year of operations. It is a retail sales company with a large an B E F H AOCT 2023 PROIECT 1 2. Amazing company began operations on January 1, 2015, and is now in its fourth year of operations. It is a retail sales company with a large amount of online sales. 3. The adjusted trial balance as of December 31, 2019 appears below, along with prior year balance sheet data and some additional transaction data for 2018. 1 4 5 6 AMAZING COMPANY Adjusted Trial Balance 12/31/2019 7 9 Account Title $ 10 11 12 13 2019 Adjusted Trial Balance Debit Credit 120,000 55.000 5.000 36,000 53,000 59.000 $ 24,00 12,200 14 15 16 2018 Post Closing Trial Balance Debit Credit $ 125,000 35.000 6,000 15,600 47.000 21,000 16,000 16,800 2.700 4,000 12.100 160,000 38,000 Cash Accounts Receivable Prepaid insurance Inventory office Equipment Machinery & Tools Accumulated Depreciation Accounts Payable Salaries Payable Sales Tax Payable Note Payable--Long Term Common stock, $10 par Retained Earnings Dividends Sales Revenue Cost of Goods Sold Rent Expense Salaries Expense Insurance Expense Legal Fees Depreciation Expense Interest Expense Income Tax Expense 2.000 23.000 240,000 38,600 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 10,000 240,000 142,600 20,000 48,000 11,800 9,200 8,000 1,800 3,000 582,400 $ $ 582,400 250,200 250,200 35 30 30 Transaction Data for 2018 (Note, these transactions were included in the trial balance numbers above.) Cash paid for purchase of office equipment 6,000 rach maidin maten 16 A2 X Amazing Company began operations on January 1, 2015, and is now in its fourth year of operations. It is a retail sales company with a large am E F G c H 1 B D 240,000 25 26 27 28 29 30 31 12 33 34 35 36 37 38 39 40 41 42 Sales Revenge Cost of Goods Sold Rent Expense Salaries Expense Insurance Expense Legal Fees Depreciation Expense Interest Expense Income Tax Expense 142,600 20.000 48.000 11,800 9.200 8.000 1.800 3,000 $ 582,000 $ SH2.400 $ 250,200 250,200 Transaction Data for 2018 (Note, these transactions were included in the trial balance numbers above.) Cath paid for purchase of office equipment $ 6,000 Cash paid for purchase of tools 15,000 Acquisition of Machinery with Notes Payable-long-term 23,000 Cash payment of dividends 10,000 Cash receipt from issuance of 8,000 shares of common stock 30,000 43 44 45 Requirements: (See sheet tabs at bottom. Use each sheet for the following requirements.) 46 Use Lace Skills in completing these requirements. You must use formulas and functions, cell references. cind professional tomaattina 1. Prepare the Amazing Company multi-step income statement for the year ended December 31, 2019. Indude the Eps at the bottom Also include a vertical analysis column at the right and perform a vertical analysis of the income statement. (Use percentage format with 2 decimal places.) 2. Prepare the Amazing Company balance sheet for December 31, 2019. Include a vertical analysis column at the right 50 and perform a vertical analysis of the balance sheet. (Use the percentage format with 2 decimal places.) 3. Prepare the Amazing Company statement of cash flows for the year ended December 31, 2019. Use the indirect method and the format in your textbook. 4. Complete the analysis of the financial statements as directed on the Analysis sheet. 5. Complete the analyis of the investment options between this company and EBUY (ratios given). Also use the chart from the attached article, and any other source to analyze the impact of using GAAP VS. IFRS> Write short response (15-30 sentences) on your analysis. 54 55 56 57 52 15 50 60 61 62 Instructions Income Statement Balance Sheet Stmt of Cash Flows Analysis Stock investment Analysis O Search AutoSave Unit 1 Project Fall 2020 (2) - Excel A Data Review View File Formulas Help Home Insert Page Layout General Calibri $ %) Xun Copy- Paste Format Painter Clipboard Conditional F Formatting BIU- 2 Wrap Text AA-Mergea Center - Alignment Number Font R49 A D G H 1 Using the information provided in the instructions and the financial statements you have created in the previous requirements, 2 Debt-to- Requirement 1. Current Working Equity 3 Compute these ratios: Ratio Capital Cash Ratio Debt Ratio Ratio 4 Round ratios to two 5 decimal places or format as percentages or Accounts Days Sales currency as appropriate. Inventory Days Sales in Gross Profit Receivable in 6 Turnover Inventory Percentage Turnover Receivables 7 2018 Total Assets Rate of Rate of Return on Asset Return on Total Turnover Stockholder Earnings 9 Assets Ratio s' Equity Per Share 2018 SHE 8 10 Price/ Earnings Ratio Dividend Yield Dividend Payout Dividend per shares Current Stock Price is 12 $10.00 per share 13 14 15 Requirement 2. Based on 16 the ratios computed above, 17 analyze the company's 18 ability to pay its debts (both 19 current and long term). 20 Refer to at least 3 specific 21 ratios in your analysis. 22 23 Requirement 3: Based on 24 the ratios computed above, 25 analyze the company's 26 management of inventory. 27 Refer to at least 2 specific 28 ratios in your analysis. Instructions Income Statement Balance Sheet Strist of Cash Flows Analysis Stock investment Analysis Unit 1 Project Fall 2020 (2) - Excel AutoSave OH Data Review View Formulas Help File Home Insert Page Layout General Calibri A A 23 Wrap Text Merge a Center $ % 8-98 F X Cut In Copy Paste Format Painter Clipboard BIU -A- 5 Number Alignment Font X f R49 G H A B 2018 SHE 10 11 Price/ Earnings Ratio Dividend Yield Dividend Payout Dividend per share Current Stock Price is 12 $10.00 per share 13 14 15 Requirement 2. Based on 16 the ratios computed above, 17 analyze the company's 18 ability to pay its debts (both 19 current and long term). 20 Refer to at least 3 specific 21 ratios in your analysis. 22 23 Requirement 3: Based on 24 the ratios computed above, 25 analyze the company's 26 management of inventory. 27 Refer to at least 2 specific 28 ratios in your analysis. 29 30 31 Requirement 4: Based on 32 the ratios computed above, 33 analyze the company's 34 management of receivables. 35 Refer to at least 2 specific 36 ratios in your analysis. 37 38 39 40 41 42 43 File Home Insert Help Bid Good Page Layout Formas Data Review V Colieri - AA == >> - 29 Wrap Text BTU -AA- LED Merge Center Font Alignment General SH% X Cut [Copy Paste Format Painter Clipboard Normal Conditional for alculation Formatting Check Cell Explanatory... DO Styles Numbel M X f You have just received a large annual bonus at work, and have decided to investit in stocks for your retirement. You have been analyzing different stocks and have narrowed your choice to two possibilities. You can either invest in Amazing Company, or in EBUY. EBUY's ratios are given below. Select 3 ratios you might use to determine which stock to invest in and make a choice. Defend your selection with quality reasoning. The second part of your analysis is to read the article attached to this assignment. On pages 117-120, there is a chart that summarizes some of the differences between GAAP and IFRS. Explain the general similarities and differences, and discuss how interest expense would be presented on the Statement of Cash Flows. Include in your discussion any differences between GAAP and IFRS. Would that impact your investment decision above? Your answer will be graded on analysis, logic, and writing skills. 1. Which three ratios would you choose to analyze which company would be a better INVESTMENT for you? ERUY Rat Current Ratio 5. Inventor Turnove 7. 9 2. Based on your selection, which company has better ratios? Which company would you invest in? Why? Rate of Return Total Assets 10 11 12 13 Price/ Earning Ratio" 14.5 14 15 16 17 3. Read the article attached on the assignment in CANVAS. Focus on pages 117.120, and explain the general similarities AND differences between GAAP and IFRS 19 BTU-0-0-A 31 Meigta Center $ -% 48-58 Paste py Format Painter Cleboard S Conditional Formats Calculation Formatting Table Check Cel Font 19 Alignment Number D AZ > Amazing Company began operations on January 1, 2015, and is now in its fourth year of operations. It is a retail sales company with a large an B E F H AOCT 2023 PROIECT 1 2. Amazing company began operations on January 1, 2015, and is now in its fourth year of operations. It is a retail sales company with a large amount of online sales. 3. The adjusted trial balance as of December 31, 2019 appears below, along with prior year balance sheet data and some additional transaction data for 2018. 1 4 5 6 AMAZING COMPANY Adjusted Trial Balance 12/31/2019 7 9 Account Title $ 10 11 12 13 2019 Adjusted Trial Balance Debit Credit 120,000 55.000 5.000 36,000 53,000 59.000 $ 24,00 12,200 14 15 16 2018 Post Closing Trial Balance Debit Credit $ 125,000 35.000 6,000 15,600 47.000 21,000 16,000 16,800 2.700 4,000 12.100 160,000 38,000 Cash Accounts Receivable Prepaid insurance Inventory office Equipment Machinery & Tools Accumulated Depreciation Accounts Payable Salaries Payable Sales Tax Payable Note Payable--Long Term Common stock, $10 par Retained Earnings Dividends Sales Revenue Cost of Goods Sold Rent Expense Salaries Expense Insurance Expense Legal Fees Depreciation Expense Interest Expense Income Tax Expense 2.000 23.000 240,000 38,600 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 10,000 240,000 142,600 20,000 48,000 11,800 9,200 8,000 1,800 3,000 582,400 $ $ 582,400 250,200 250,200 35 30 30 Transaction Data for 2018 (Note, these transactions were included in the trial balance numbers above.) Cash paid for purchase of office equipment 6,000 rach maidin maten 16 A2 X Amazing Company began operations on January 1, 2015, and is now in its fourth year of operations. It is a retail sales company with a large am E F G c H 1 B D 240,000 25 26 27 28 29 30 31 12 33 34 35 36 37 38 39 40 41 42 Sales Revenge Cost of Goods Sold Rent Expense Salaries Expense Insurance Expense Legal Fees Depreciation Expense Interest Expense Income Tax Expense 142,600 20.000 48.000 11,800 9.200 8.000 1.800 3,000 $ 582,000 $ SH2.400 $ 250,200 250,200 Transaction Data for 2018 (Note, these transactions were included in the trial balance numbers above.) Cath paid for purchase of office equipment $ 6,000 Cash paid for purchase of tools 15,000 Acquisition of Machinery with Notes Payable-long-term 23,000 Cash payment of dividends 10,000 Cash receipt from issuance of 8,000 shares of common stock 30,000 43 44 45 Requirements: (See sheet tabs at bottom. Use each sheet for the following requirements.) 46 Use Lace Skills in completing these requirements. You must use formulas and functions, cell references. cind professional tomaattina 1. Prepare the Amazing Company multi-step income statement for the year ended December 31, 2019. Indude the Eps at the bottom Also include a vertical analysis column at the right and perform a vertical analysis of the income statement. (Use percentage format with 2 decimal places.) 2. Prepare the Amazing Company balance sheet for December 31, 2019. Include a vertical analysis column at the right 50 and perform a vertical analysis of the balance sheet. (Use the percentage format with 2 decimal places.) 3. Prepare the Amazing Company statement of cash flows for the year ended December 31, 2019. Use the indirect method and the format in your textbook. 4. Complete the analysis of the financial statements as directed on the Analysis sheet. 5. Complete the analyis of the investment options between this company and EBUY (ratios given). Also use the chart from the attached article, and any other source to analyze the impact of using GAAP VS. IFRS> Write short response (15-30 sentences) on your analysis. 54 55 56 57 52 15 50 60 61 62 Instructions Income Statement Balance Sheet Stmt of Cash Flows Analysis Stock investment Analysis O Search AutoSave Unit 1 Project Fall 2020 (2) - Excel A Data Review View File Formulas Help Home Insert Page Layout General Calibri $ %) Xun Copy- Paste Format Painter Clipboard Conditional F Formatting BIU- 2 Wrap Text AA-Mergea Center - Alignment Number Font R49 A D G H 1 Using the information provided in the instructions and the financial statements you have created in the previous requirements, 2 Debt-to- Requirement 1. Current Working Equity 3 Compute these ratios: Ratio Capital Cash Ratio Debt Ratio Ratio 4 Round ratios to two 5 decimal places or format as percentages or Accounts Days Sales currency as appropriate. Inventory Days Sales in Gross Profit Receivable in 6 Turnover Inventory Percentage Turnover Receivables 7 2018 Total Assets Rate of Rate of Return on Asset Return on Total Turnover Stockholder Earnings 9 Assets Ratio s' Equity Per Share 2018 SHE 8 10 Price/ Earnings Ratio Dividend Yield Dividend Payout Dividend per shares Current Stock Price is 12 $10.00 per share 13 14 15 Requirement 2. Based on 16 the ratios computed above, 17 analyze the company's 18 ability to pay its debts (both 19 current and long term). 20 Refer to at least 3 specific 21 ratios in your analysis. 22 23 Requirement 3: Based on 24 the ratios computed above, 25 analyze the company's 26 management of inventory. 27 Refer to at least 2 specific 28 ratios in your analysis. Instructions Income Statement Balance Sheet Strist of Cash Flows Analysis Stock investment Analysis Unit 1 Project Fall 2020 (2) - Excel AutoSave OH Data Review View Formulas Help File Home Insert Page Layout General Calibri A A 23 Wrap Text Merge a Center $ % 8-98 F X Cut In Copy Paste Format Painter Clipboard BIU -A- 5 Number Alignment Font X f R49 G H A B 2018 SHE 10 11 Price/ Earnings Ratio Dividend Yield Dividend Payout Dividend per share Current Stock Price is 12 $10.00 per share 13 14 15 Requirement 2. Based on 16 the ratios computed above, 17 analyze the company's 18 ability to pay its debts (both 19 current and long term). 20 Refer to at least 3 specific 21 ratios in your analysis. 22 23 Requirement 3: Based on 24 the ratios computed above, 25 analyze the company's 26 management of inventory. 27 Refer to at least 2 specific 28 ratios in your analysis. 29 30 31 Requirement 4: Based on 32 the ratios computed above, 33 analyze the company's 34 management of receivables. 35 Refer to at least 2 specific 36 ratios in your analysis. 37 38 39 40 41 42 43 File Home Insert Help Bid Good Page Layout Formas Data Review V Colieri - AA == >> - 29 Wrap Text BTU -AA- LED Merge Center Font Alignment General SH% X Cut [Copy Paste Format Painter Clipboard Normal Conditional for alculation Formatting Check Cell Explanatory... DO Styles Numbel M X f You have just received a large annual bonus at work, and have decided to investit in stocks for your retirement. You have been analyzing different stocks and have narrowed your choice to two possibilities. You can either invest in Amazing Company, or in EBUY. EBUY's ratios are given below. Select 3 ratios you might use to determine which stock to invest in and make a choice. Defend your selection with quality reasoning. The second part of your analysis is to read the article attached to this assignment. On pages 117-120, there is a chart that summarizes some of the differences between GAAP and IFRS. Explain the general similarities and differences, and discuss how interest expense would be presented on the Statement of Cash Flows. Include in your discussion any differences between GAAP and IFRS. Would that impact your investment decision above? Your answer will be graded on analysis, logic, and writing skills. 1. Which three ratios would you choose to analyze which company would be a better INVESTMENT for you? ERUY Rat Current Ratio 5. Inventor Turnove 7. 9 2. Based on your selection, which company has better ratios? Which company would you invest in? Why? Rate of Return Total Assets 10 11 12 13 Price/ Earning Ratio" 14.5 14 15 16 17 3. Read the article attached on the assignment in CANVAS. Focus on pages 117.120, and explain the general similarities AND differences between GAAP and IFRS 19