Question

BTY Enterprises was established some three years ago to manufacture leather covers for laptops. The turnover for the last financial year increased and was in

BTY Enterprises was established some three years ago to manufacture leather covers for laptops. The turnover for the last financial year increased and was in the range of 2 million Kwacha. The daily management of BTY Enterprises rested in Betty and Golibaba. Golibaba was the sales and marketing director whereas Betty was the production manager. Both of these directors were proficient in their areas of expertise and did not find any justification for employing a full-time Finance Manager.

They however decided to engage an individual consultant, named Lio, to review the finances of the enterprise. Lio first started by touring the premises to families herself of the company surrounding and the offices and was very impressed with what she saw. While she was touring the premises, she kept on writing short notes on her newly acquired iPad. However, before he could finalize her report, she was asked to proceed urgently to Italy to pursue a Ph.D. and fearing that she might forfeit the Scholarship she was given by the Italian Government through the Ministry of Foreign Affairs, she decided to just hand over the i-pad to Golibaba with the following notes:

i. Obtain Statement of Financial Affairs! (As below)

ii. Worried about investment? Need to determine whether there was any policy regarding investment and explore available options1.

iii. Determine working capital

iv. Took Many Stock balances. v. Liquidity to be investigated. vi. Debtor’s policy?

Golibaba then approached another consultant, Quicker and Partners consultants for advice and you are the Director of Quicker and Partners ltd asked to report on BTY Enterprises.

REQUIRED:

You are required to prepare a report for BTY Enterprises which:

i. Examines the liquidity of the Company.

ii. Discusses the management of working capital of BTY enterprises.

iii. Recommends improvements that can be made to financial management.

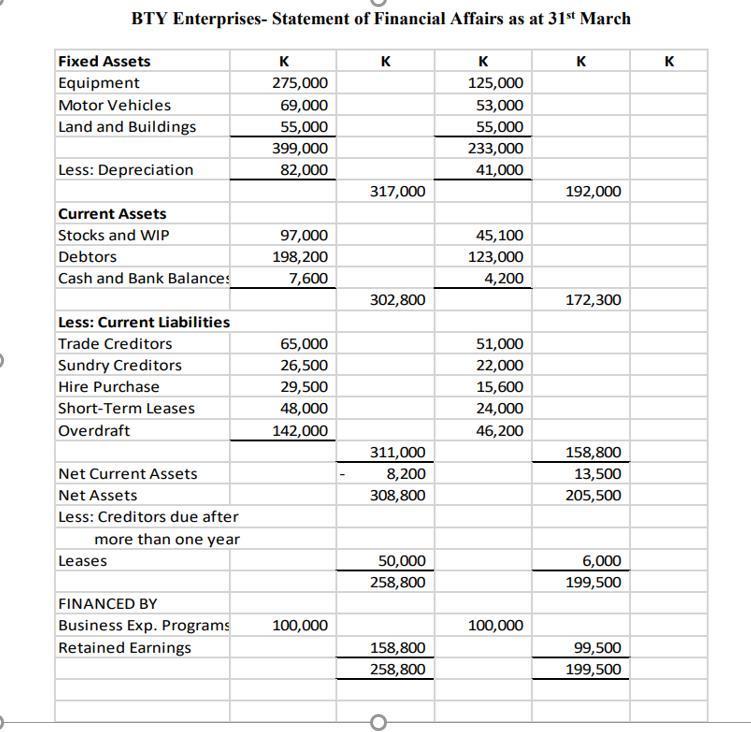

BTY Enterprises- Statement of Financial Affairs as at 31st March Fixed Assets Equipment Motor Vehicles Land and Buildings Less: Depreciation Current Assets Stocks and WIP Debtors Cash and Bank Balances Less: Current Liabilities Trade Creditors Sundry Creditors Hire Purchase Short-Term Leases Overdraft Net Current Assets Net Assets Less: Creditors due after more than one year Leases FINANCED BY Business Exp. Programs Retained Earnings 275,000 69,000 55,000 399,000 82,000 97,000 198,200 7,600 65,000 26,500 29,500 48,000 142,000 100,000 317,000 302,800 311,000 8,200 308,800 50,000 258,800 158,800 258,800 125,000 53,000 55,000 233,000 41,000 45,100 123,000 4,200 51,000 22,000 15,600 24,000 46,200 100,000 192,000 172,300 158,800 13,500 205,500 6,000 199,500 99,500 199,500 K

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

iliquidity The companys liquidity position is strong with current assets exceeding current liabilities This gives the company the ability to pay its shortterm obligations as they come due However the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started