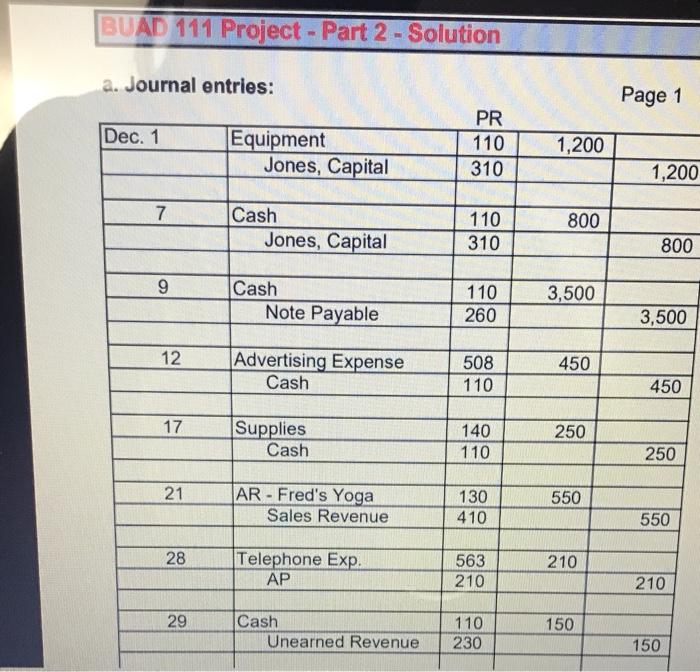

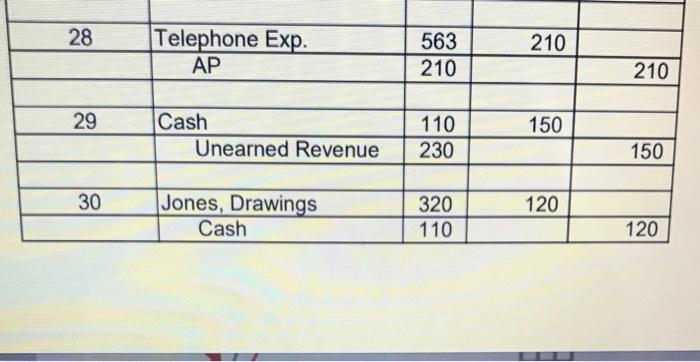

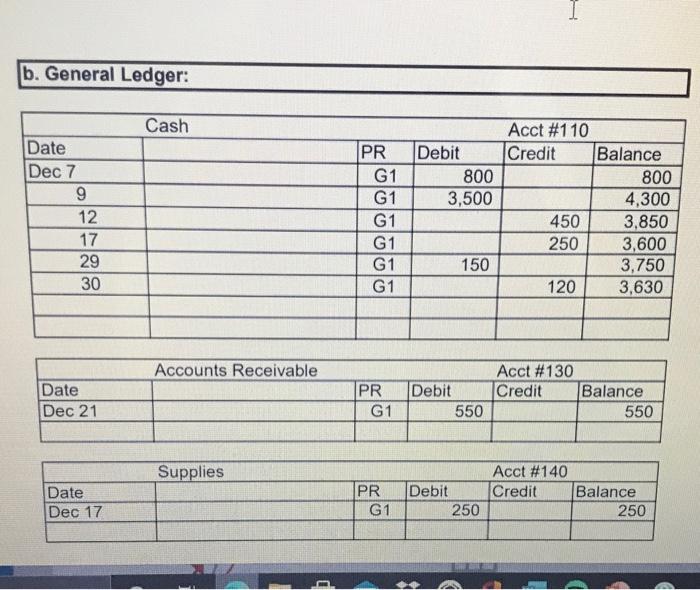

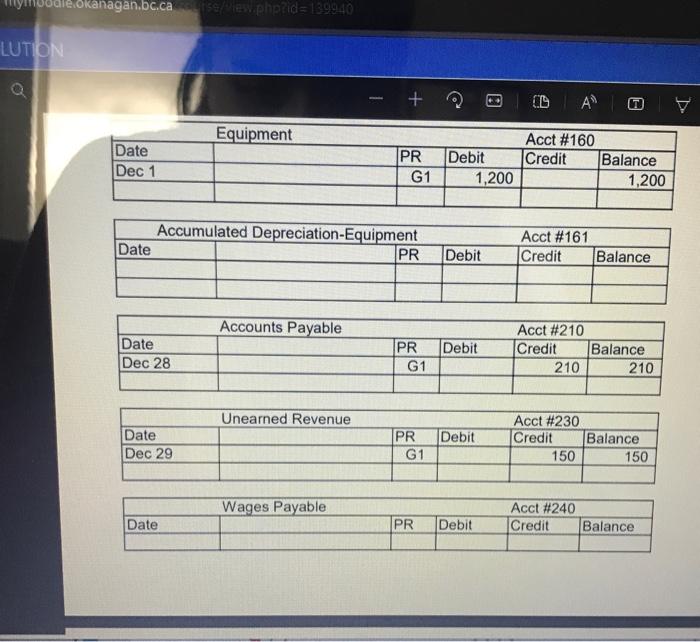

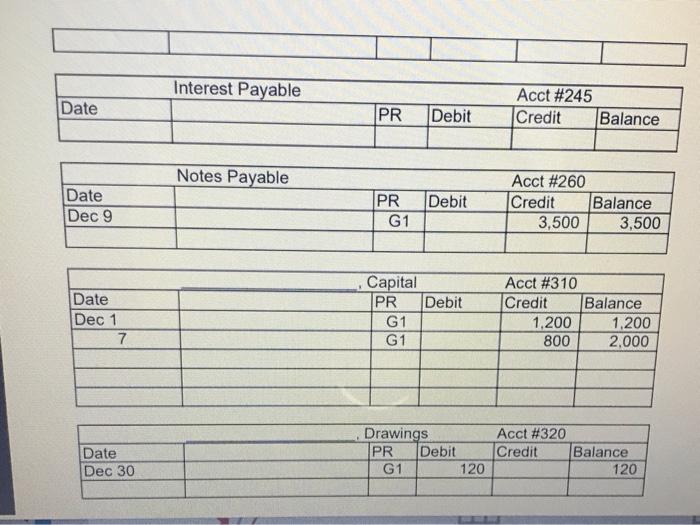

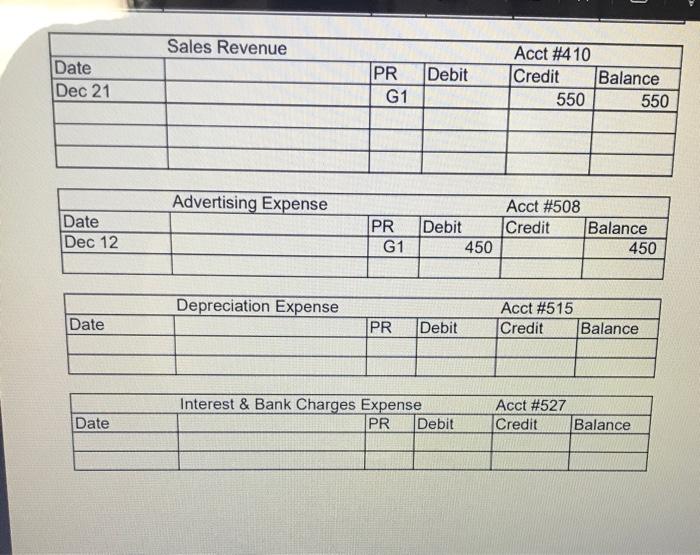

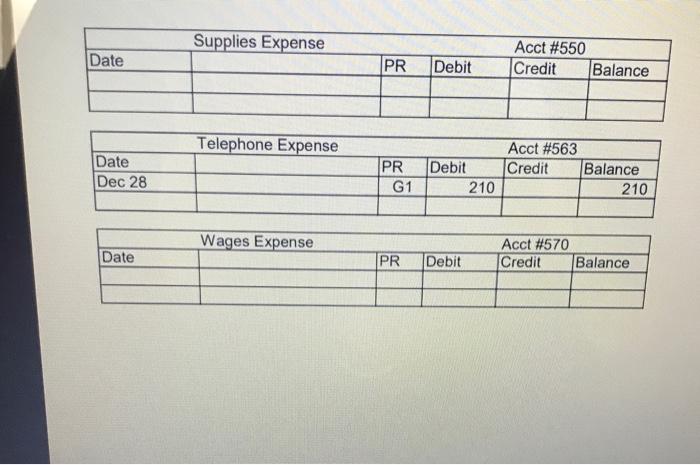

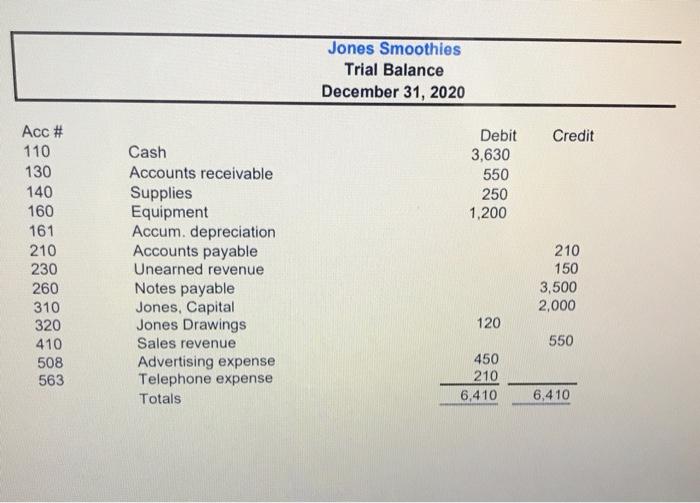

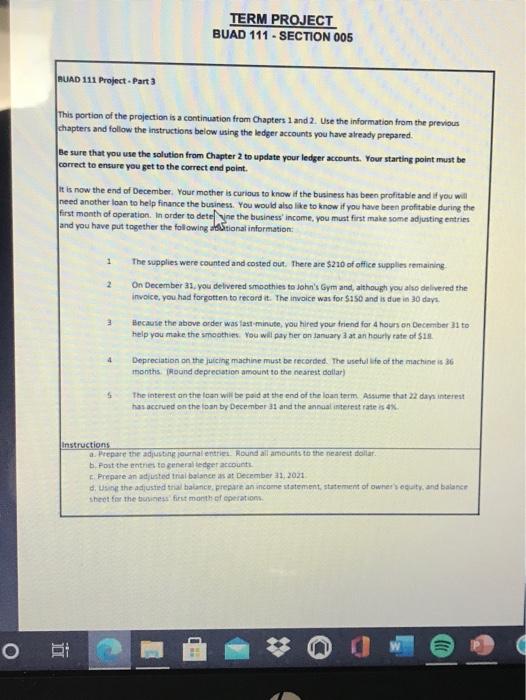

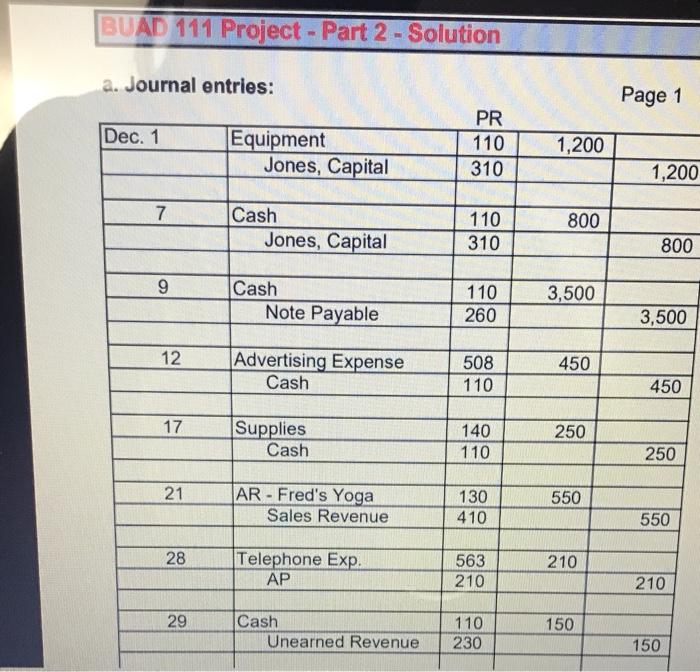

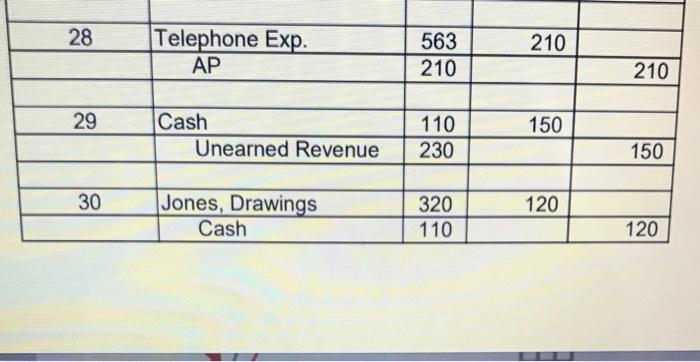

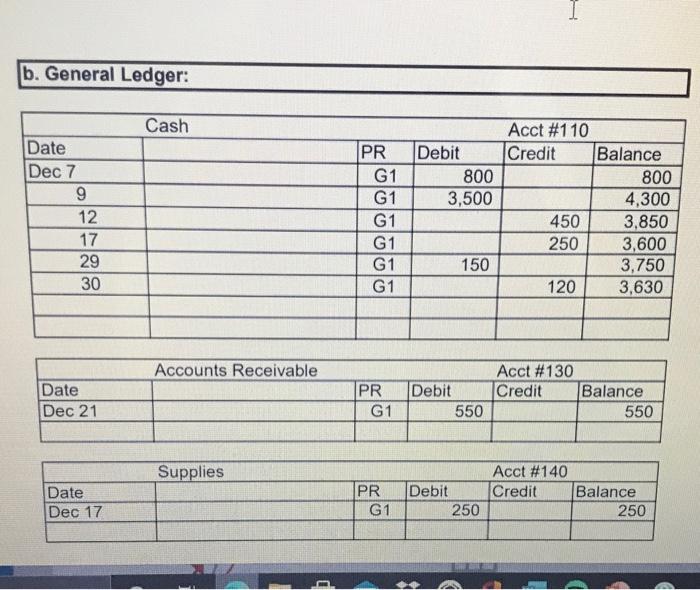

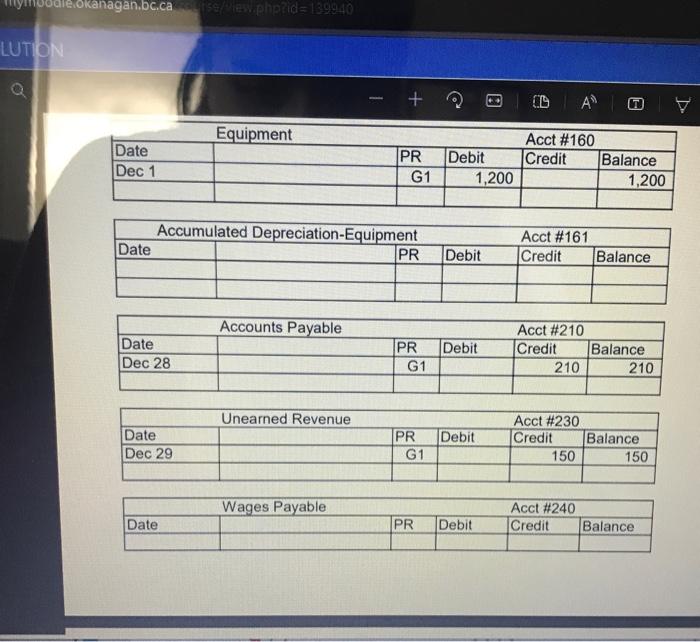

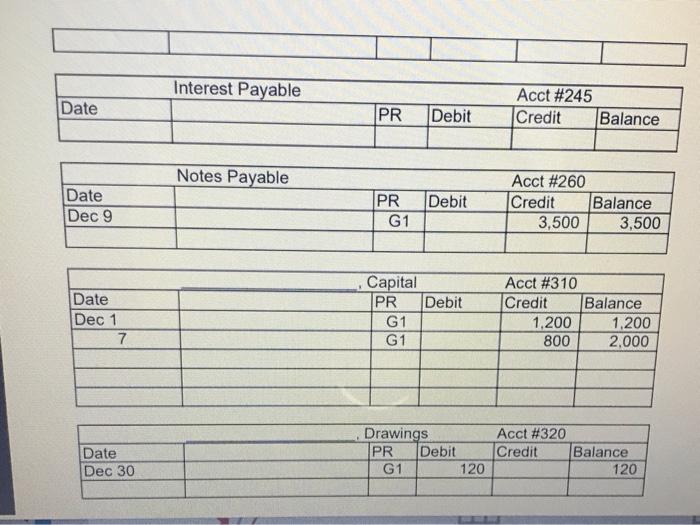

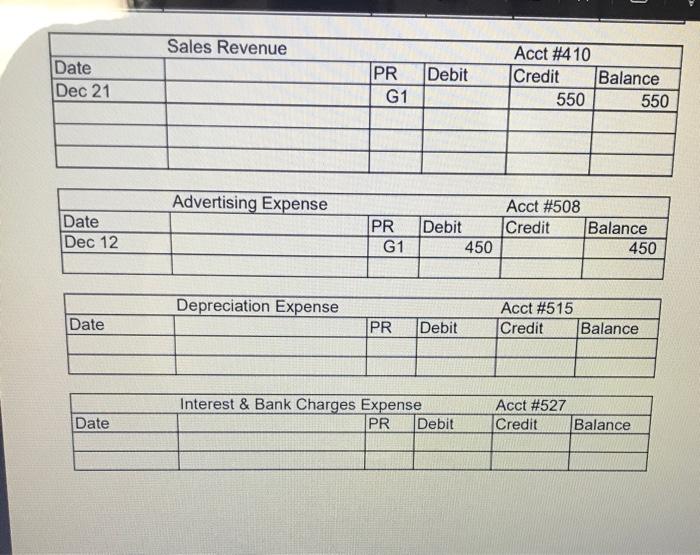

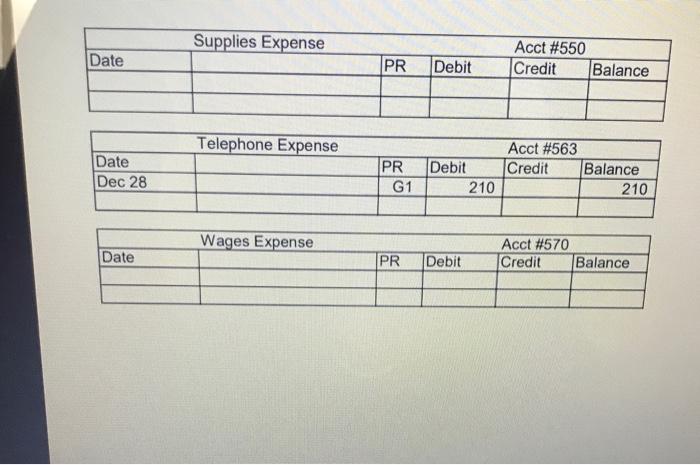

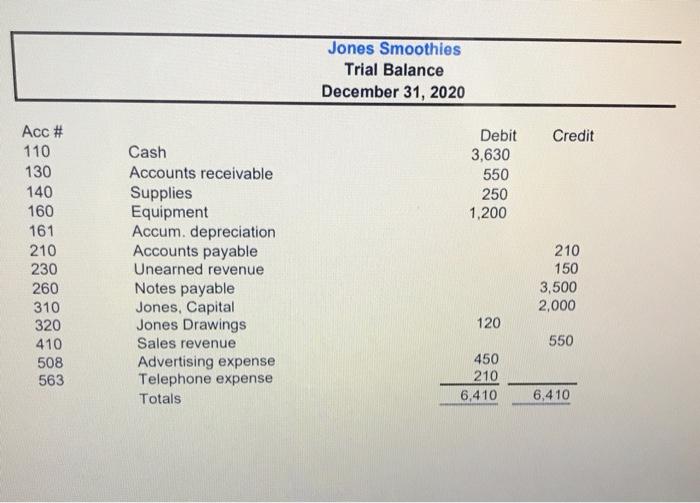

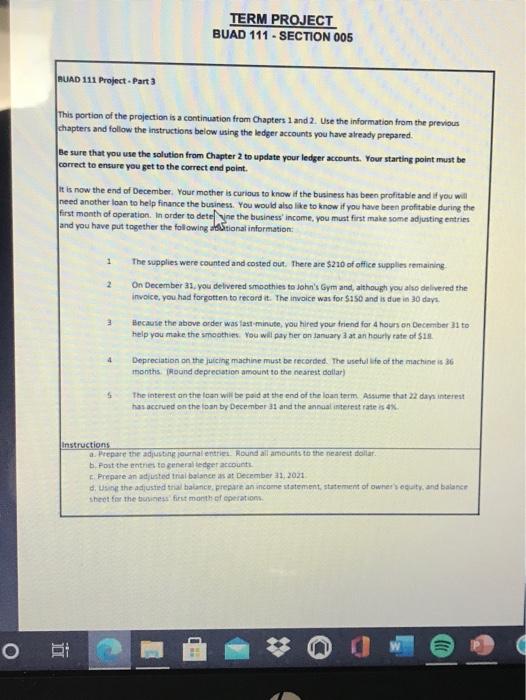

BUAD 111 Project - Part 2 - Solution a. Journal entries: Page 1 Dec. 1 Equipment Jones, Capital PR 110 310 1,200 1,200 7 Cash Jones, Capital 800 110 310 800 9 Cash Note Payable 3,500 110 260 3,500 12 Advertising Expense Cash 450 508 110 450 17 Supplies Cash 250 140 110 250 21 AR - Fred's Yoga Sales Revenue 550 130 410 550 28 Telephone Exp. AP 563 210 210 210 29 Cash Unearned Revenue 150 110 230 150 28 Telephone Exp. 210 563 210 AP 210 29 150 Cash Unearned Revenue 110 230 150 30 120 Jones, Drawings Cash 320 110 120 b. General Ledger: Cash Date Dec 7 9 12 17 29 30 PR G1 G1 G1 G1 G1 G1 Acct #110 Debit Credit Balance 800 800 3,500 4,300 450 3,850 250 3,600 150 3,750 120 3,630 Accounts Receivable Date Dec 21 PR G1 Acct #130 Debit Credit Balance 550 550 Supplies Date Dec 17 PR G1 Acct #140 Debit Credit Balance 250 250 Bokanagan.bc.ca 158/lew.phprid=139940 LUTION A Do Equipment Date Dec 1 PR Acct #160 Debit Credit Balance 1,200 1,200 G1 Accumulated Depreciation-Equipment Date PR Acct #161 Credit Balance Debit Accounts Payable Date Dec 28 Debit PR G1 Acct #210 Credit Balance 210 210 Unearned Revenue Date Dec 29 PR Debit G1 Acct #230 Credit Balance 150 150 Wages Payable Acct #240 Credit Balance Date PR Debit Interest Payable Date Acct #245 Credit Balance PR Debit Notes Payable Date Dec 9 PR Debit Acct #260 Credit Balance 3,500 3,500 G1 Date Dec 1 7 Capital PR Debit G1 G1 Acct #310 Credit Balance 1,200 1.200 800 2.000 Date Dec 30 Drawings Acct #320 PR Debit Credit Balance G1 120 120 Sales Revenue Date Dec 21 Debit PR G1 Acct #410 Credit Balance 550 550 Advertising Expense Date Dec 12 PR Acct #508 Debit Credit Balance 450 450 G1 Depreciation Expense Date Acct #515 Credit Balance PR Debit Interest & Bank Charges Expense PR Debit Acct #527 Credit Balance Date Supplies Expense Date Acct #550 Credit Balance PR Debit Telephone Expense Date Dec 28 PR G1 Acct #563 Debit Credit Balance 210 210 Wages Expense Date Acct #570 Credit Balance PR Debit Jones Smoothies Trial Balance December 31, 2020 Credit Debit 3,630 550 250 1,200 Acc # 110 130 140 160 161 210 230 260 310 320 410 508 563 Cash Accounts receivable Supplies Equipment Accum. depreciation Accounts payable Unearned revenue Notes payable Jones, Capital Jones Drawings Sales revenue Advertising expense Telephone expense Totals 210 150 3,500 2,000 120 550 450 210 6,410 6,410 TERM PROJECT BUAD 111 - SECTION 005 MUAD 111 Project - Part 3 This portion of the projection is a continuation from Chapters 1 and 2. Use the information from the previous chapters and follow the instructions below using the ledger accounts you have already prepared. Be sure that you use the solution from Chapter 2 to update your ledger accounts. Your starting point must be correct to ensure you get to the correct end point. it is now the end of December. Your mother is curious to know if the business has been profitable and if you will need another loan to help finance the business. You would also like to know if you have been profitable during the first month of operation. In order to dete ne the business income, you must first make some adjusting entries and you have put together the following ustionat information: 1 2 The supplies were counted and costed out. There are $220 of office supplies remaining On December 31, you delvered smoothies to John's Gym and, although you also delivered the invoice, you had forgotten to record it. The invoice was for S150 and is due in 30 days 3 Because the above order was last minute, you hired your friend for 4 hours on December 31 to help you make the smoothies. You will pay her on January at an hourly rate of 18 4 Depreciation on the juicing machine must be recorded. The useful life of the machine is 36 months Round depreciation amount to the nearest dollar) 1 The interest on the loan will be paid at the end of the loan term Assume that 22 days interest has accrund on the fan by December 31 and the annual interest rate sex Instructions a. Prepare the adjusting journal entries Round all amounts to the nearest solar b. Post the entes to generatedger accounts Prepare an adjusted trial balance as December 31, 2021 d. Use the adjusted trial balance, prepare an income statement statement of owner's guity, and balance Sheet for the bass first month of operations O BI