Question

Buc-EEs Holdings Inc. operates gas stations and general merchandise stores. Buc-EEs is considering an upstream vertical integration by taking over Marathon Petroleum Corp., an oil

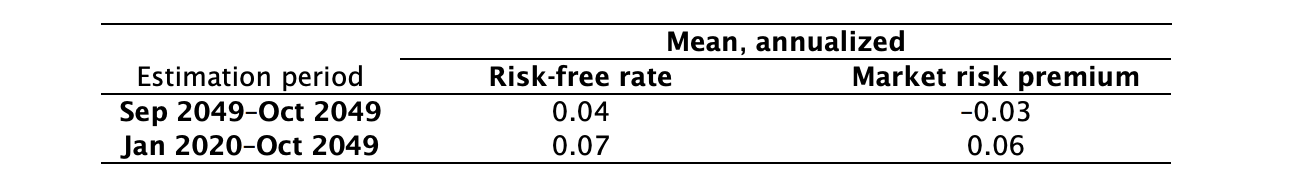

Buc-EEs Holdings Inc. operates gas stations and general merchandise stores. Buc-EEs is considering an upstream vertical integration by taking over Marathon Petroleum Corp., an oil refinery firm. You are the financial analyst of Buc-EEs and are asked to collect historical data on the risk-free rates and the market risk premiums. Your estimates as of November 2049 are summarized as follows:

B)

Suppose that the unlevered asset beta for the oil refining business is estimated at 1.30. Additionally, assume that Buc-EEs has a leverage ratio of 0.25 (equivalently a debt-to-equity ratio of 1/3), a debt beta of 0.1, and a marginal tax rate of 40%. Find the weighted average cost of capital (WACC) for the acquisition project. (Lecture notes pp.37-41) *In case you are unsure about your results in part (a), use 10% as both the risk-free rate and the market risk premium in your CAPM calculation.

\begin{tabular}{ccc} \hline & \multicolumn{2}{c}{ Mean, annualized } \\ \cline { 2 - 3 } Estimation period & Risk-free rate & Market risk premium \\ \hline Sep 2049-Oct 2049 & 0.04 & -0.03 \\ Jan 2020-Oct 2049 & 0.07 & 0.06 \\ \hline \end{tabular} \begin{tabular}{ccc} \hline & \multicolumn{2}{c}{ Mean, annualized } \\ \cline { 2 - 3 } Estimation period & Risk-free rate & Market risk premium \\ \hline Sep 2049-Oct 2049 & 0.04 & -0.03 \\ Jan 2020-Oct 2049 & 0.07 & 0.06 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started