Question

Bucky Barnes, is obtaining a $300,000 U.S. ARM paid monthly with an amortization of 30 years and an interest rate of 6%. The adjustment

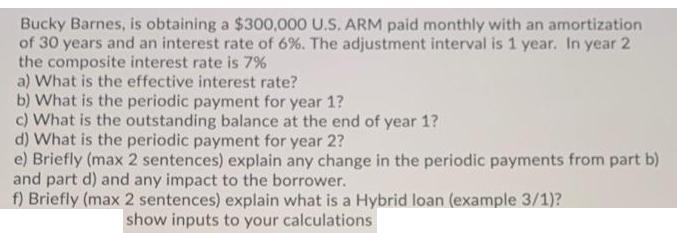

Bucky Barnes, is obtaining a $300,000 U.S. ARM paid monthly with an amortization of 30 years and an interest rate of 6%. The adjustment interval is 1 year. In year 2 the composite interest rate is 7% a) What is the effective interest rate? b) What is the periodic payment for year 1? c) What is the outstanding balance at the end of year 1? d) What is the periodic payment for year 2? e) Briefly (max 2 sentences) explain any change in the periodic payments from part b) and part d) and any impact to the borrower. f) Briefly (max 2 sentences) explain what is a Hybrid loan (example 3/1)? show inputs to your calculations

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a To find the effective interest rate we can use the formula Effective Interest Rate 1 Annual Intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical financial management

Authors: William r. Lasher

5th Edition

0324422636, 978-0324422634

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App