Question

Budget Problem: Better Plants, Inc. manufactures small biodegradable seedling starter trays. Josie Chase, owner, wants you to prepare the 2013 master budget for the company.

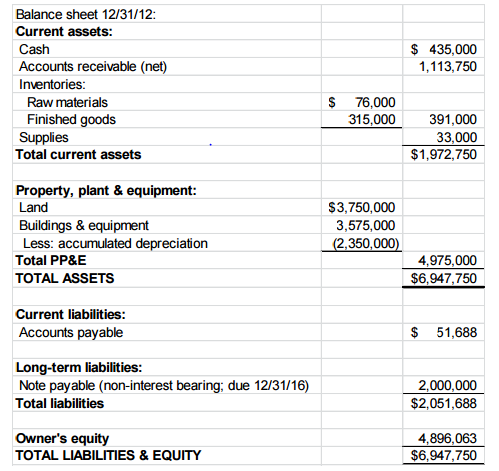

Budget Problem: Better Plants, Inc. manufactures small biodegradable seedling starter trays. Josie Chase, owner, wants you to prepare the 2013 master budget for the company. The balance sheet at the end of 2012 follows:

Sales volume in Quarter 4 -2012 was 2,250,000 trays. Based on their research, the marketing department forecasts sales volume will be: 1,750,000 trays in Quarter 1 2013; 1,000,000 trays in Quarter 2 2013; 1,250,000 trays in Quarter 3 2013; and 2,000,000 trays in Quarter 4 2013. For Quarter 1 2014 and Quarter 2 2014 they forecast that 1,750,000 and 750,000 trays will be sold, respectively. To achieve the projected sales volume, Josie estimates a selling price of $2.75 per tray.

Based on previous estimates of sales fluctuations, the marketing department believes that the desired ending finished goods inventory each quarter should equal 15% of the following quarters sales quantity. The beginning finished goods inventory in 2013 should be calculated from the 2012 balance sheet. The accounting department estimates that the units in beginning finished goods will have an assigned cost of $1.20 per tray

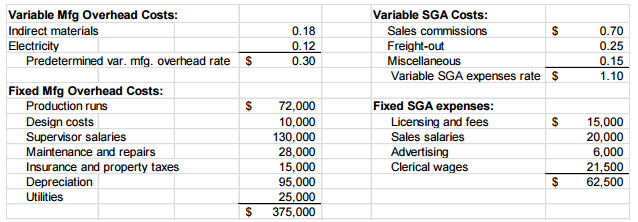

The trays are produced using a material purchased from a supplier for $.20 per ounce. It takes .5 ounces of material to produce one tray. To avoid material stock-outs, Josie maintains ending raw materials inventory equal to 20% of the following quarters production needs. Materials inventory at the beginning of 2013 should be calculated from the 2012 balance sheet. The cost of beginning materials inventory is expected to be $0.20 per ounce. Based on a study of the production processes, it takes 3 minutes to produce one tray. Direct labor workers are paid $12 per hour. The accounting department has gathered the following information about the remaining product and period costs. (For Manufacturing Costs: all variable rates are per unit produced, and all fixed rates are per quarter. For Selling, General, and Administrative Expenses (SGA): all variable rates are per unit of sales, and all fixed rates are per quarter).

Assume that there is no beginning or ending work-in-process inventories.

Cash information: Cash collections of sales revenue are 80% in the quarter of sale; 18% in the quarter following the sale; and 2% uncollectible. Better Plants recognizes bad debt expense on an accrual basis rather than the direct-write off method.

Materials purchased for production are the source of accounts payable. Purchases are paid 75% in the quarter of purchase; and 25% in the quarter following purchase. We pay all our debts.

At the beginning of Quarter 1 2013, Better Plants borrowed $100,000 from a local financial institution at an annual interest rate of 4%. Repayment of the loan will take place over the year with quarterly payments (at end of each quarter) of $25,000 principal plus accrued interest. The loan will be used to increase factory space and make improvements to the plant. The amounts spent will be as follows: $30,000 in Quarter 1 2013; $20,000 in Quarter 2 2013; $20,000 in Quarter 3 2013; and $25,000 in Quarter 4 2013.

Variable Mfg Overhead Costs: Variable SGA Costs: Indirect materials 0.18 Sales commissions $ 0.70 Electricity 0.12 Freight-out 0.25 Predetermined var. mfg. overhead rate $ 0.30 Miscellaneous 0.15 Variable SGA expenses rate $ 1.10 Fixed Mfg Overhead Costs: Production runs $ 72,000 Fixed SGA expenses: Design costs 10,000 Licensing and fees $ 15,000 Supervisor salaries 130,000 Sales salaries 20,000 Maintenance and repairs 28,000 Advertising 6,000 Insurance and property taxes 15,000 Clerical wages 21,500 Depreciation 95,000 $ 62,500 Utilities 25,000 $ 375,000

Required: Using Excel, prepare the master budget. Begin with the Balance Sheet 2012; include all operating budgets; include a cash budget; and end with the Balance Sheet 2013. You must prepare your own budget template and answers. Group work on Excel will not receive credit.

All inputs must be on the initial page of the workbook and all subsequent worksheets linked to the input page. Budgets that are not properly linked will not receive credit!

Each budget must be on a separate worksheet within the Excel workbook. Each worksheet tab must be labeled with the name of the budget.

Each budget must be properly formatted (title, labels, etc.).

Any worksheet cell that involves a calculation must include a formula.

Any worksheet cell that uses a value from another budget or table must include a cell reference.

Grading

Submit an Excel file to the Assignment drop-box through Canvas for grading. To evaluate your work, predetermined values on the initial input page of the budget will be changed. To receive full credit, the change must correctly flow through the related budgets.

Example 1 check figures: If the sales estimate in Quarter 1 - 2013 changes from 1,750,000 units to 3,000,000 units, to receive credit for the assignment, income for the year should change from $1,830,625 to $2,563,060.

Example 2 check figures: If Current Direct Materials Cost per ounce changes from $0.20 to $0.25, to receive credit for the assignment, income for the year should change from $1,830,625 to $1,705,356.

Example 3 check figures: If the revenue collection pattern changes percentages from 80/18/2 to 80/15/5, to receive credit for the assignment, income for the year should change from $1,830,625 to $1,335,625 and assets 12/31/13 from $8,773,938 to $8,278,937.

Balance sheet 12/31/12: Current assets: Cash Accounts receivable (net) $ 435,000 1,113,750 Raw materials $ 76,000 Finished goods Supplies Total current assets 315,000 391,000 33,000 $1,972,750 Property, plant & equipment: Land S3,750,000 3,575,000 350 Buildings &equipment Less: accumulated depreciation Total PP&E TOTAL ASSETS 4,975,000 $6.947.750 Current liabilities Accounts payable $ 51,688 Long-term liabilities: Note payable (non-interest bearing due 12/31/16) Total liabilities 2,000,000 $2,051,688 Owner's equity TOTAL LIABILITIES&EQUITY 4,896,063 $6,947,750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started