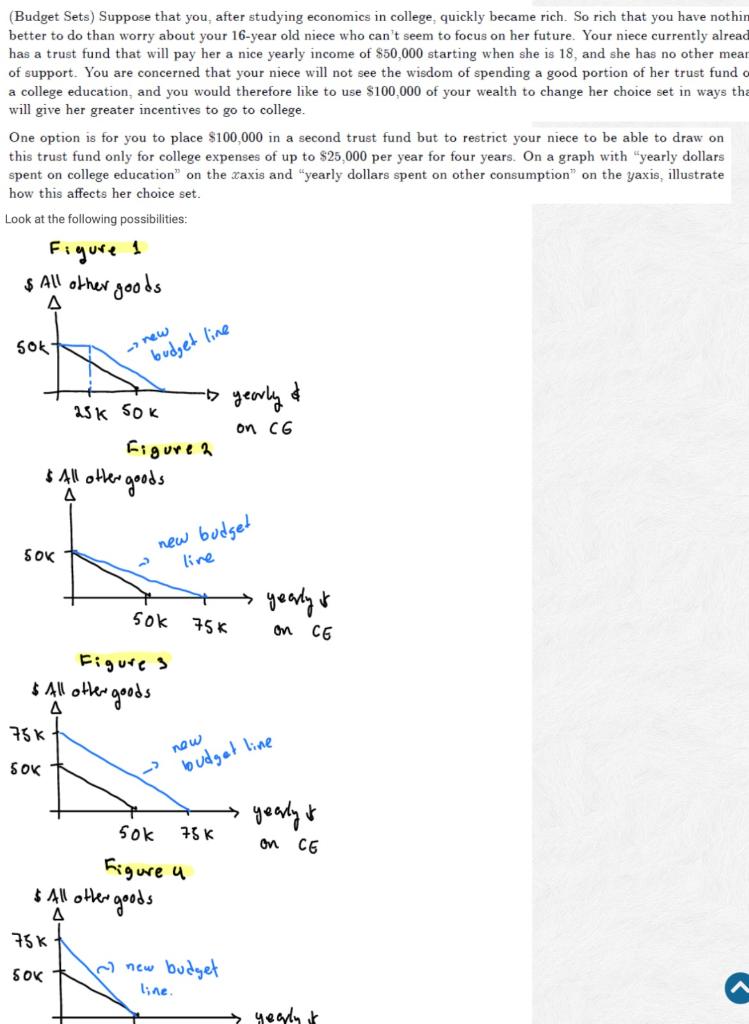

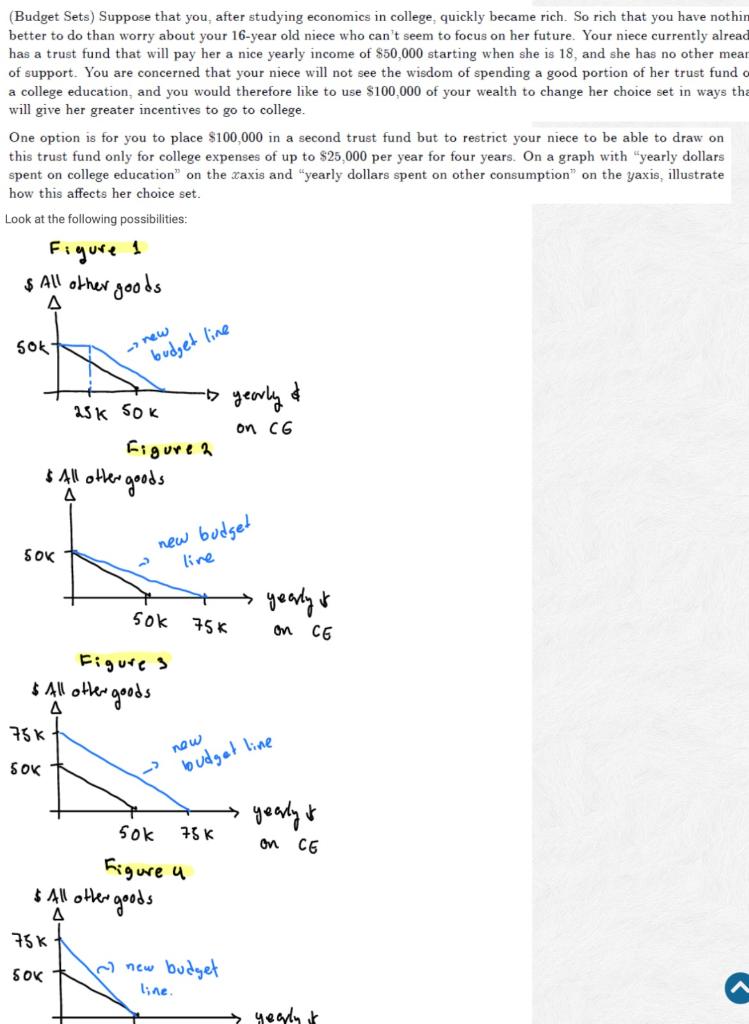

(Budget Sets) Suppose that you after studying economics in college, quickly became rich. So rich that you have nothin better to do than worry about your 16-year old niece who can't seem to focus on her future. Your niece currently alread has a trust fund that will pay her a nice yearly income of $50,000 starting when she is 18, and she has no other mear of support. You are concerned that your niece will not see the wisdom of spending a good portion of her trust fundo a college education, and you would therefore like to use $100,000 of your wealth to change her choice set in ways tha will give her greater incentives to go to college. One option is for you to place $100,000 in a second trust fund but to restrict your niece to be able to draw on this trust fund only for college expenses of up to $25,000 per year for four years. On a graph with "yearly dollars spent on college education on the xaxis and "yearly dollars spent on other consumption on the yaxis, illustrate how this affects her choice set. Look at the following possibilities: F Figure 1 & All other A 'goods SOK new budget line - yearly & 25k sok on CG Figure a & All other ter goods A new budget SOK live yearly is sok 75K on CE Figures & All other A 75K other goods new SOK > budget line yearly is sok 75 K on CE Figure a & All other goods 75K SOK ~ new budget line. (Budget Sets) Suppose that you after studying economics in college, quickly became rich. So rich that you have nothin better to do than worry about your 16-year old niece who can't seem to focus on her future. Your niece currently alread has a trust fund that will pay her a nice yearly income of $50,000 starting when she is 18, and she has no other mear of support. You are concerned that your niece will not see the wisdom of spending a good portion of her trust fundo a college education, and you would therefore like to use $100,000 of your wealth to change her choice set in ways tha will give her greater incentives to go to college. One option is for you to place $100,000 in a second trust fund but to restrict your niece to be able to draw on this trust fund only for college expenses of up to $25,000 per year for four years. On a graph with "yearly dollars spent on college education on the xaxis and "yearly dollars spent on other consumption on the yaxis, illustrate how this affects her choice set. Look at the following possibilities: F Figure 1 & All other A 'goods SOK new budget line - yearly & 25k sok on CG Figure a & All other ter goods A new budget SOK live yearly is sok 75K on CE Figures & All other A 75K other goods new SOK > budget line yearly is sok 75 K on CE Figure a & All other goods 75K SOK ~ new budget line