Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Budgetary Planning and Standard Costing 1. All of Gaylord Boutique's sales are on account. In the past, 20% of the amounts charged have been

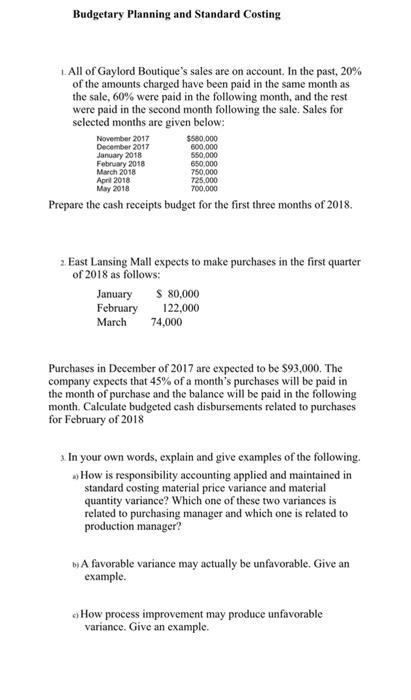

Budgetary Planning and Standard Costing 1. All of Gaylord Boutique's sales are on account. In the past, 20% of the amounts charged have been paid in the same month as the sale, 60% were paid in the following month, and the rest were paid in the second month following the sale. Sales for selected months are given below: November 2017 December 2017 January 2018 February 2018 March 2018 April 2018 May 2018 $580,000 600.000 550,000 725,000 700,000 Prepare the cash receipts budget for the first three months of 2018. January February March 650,000 750,000 2. East Lansing Mall expects to make purchases in the first quarter of 2018 as follows: 74,000 $ 80,000 122,000 Purchases in December of 2017 are expected to be $93,000. The company expects that 45% of a month's purchases will be paid in the month of purchase and the balance will be paid in the following month. Calculate budgeted cash disbursements related to purchases for February of 2018 3. In your own words, explain and give examples of the following. How is responsibility accounting applied and maintained in standard costing material price variance and material quantity variance? Which one of these two variances is related to purchasing manager and which one is related to production manager? b) A favorable variance may actually be unfavorable. Give an example. How process improvement may produce unfavorable variance. Give an example.

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Solution GAYLORDS BOUTIQUES Cash Receipt Budget for first three Month 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started