Answered step by step

Verified Expert Solution

Question

1 Approved Answer

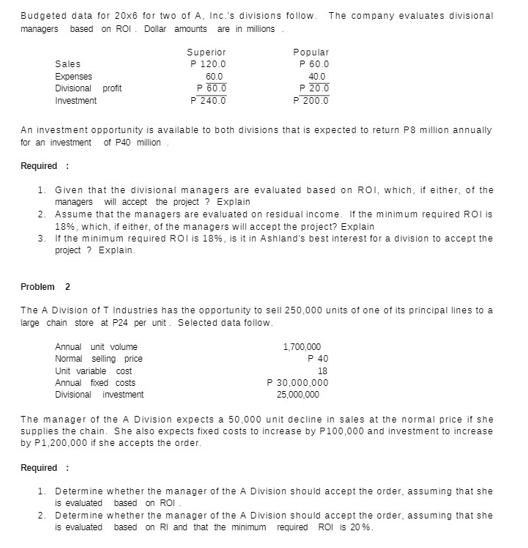

Budgeted data for 20x6 for two of A, Inc.'s divisions follow The company evaluates divisional managers based on ROI. Dollar amounts are in millions

Budgeted data for 20x6 for two of A, Inc.'s divisions follow The company evaluates divisional managers based on ROI. Dollar amounts are in millions Sales Expenses Divisional profit Investment Problem 2 Superior P 120.0 60.0 P 60.0 P 240.0 An investment opportunity is available to both divisions that is expected to return P8 million annually for an investment of P40 million Required: 1. Given that the divisional managers are evaluated based on ROI, which, if either, of the managers will accept the project ? Explain 2. Assume that the managers are evaluated on residual income. If the minimum required ROI is 18%, which, if either, of the managers will accept the project? Explain 3. If the minimum required ROI is 18%, is it in Ashland's best interest for a division to accept the project ? Explain. Popular P 60.0 40.0 P 20.0 P 200.0 Annual unit volume Normal selling price Unit variable cost Annual fixed costs Divisional investment The A Division of T Industries has the opportunity to sell 250,000 units of one of its principal lines to a large chain store at P24 per unit. Selected data follow. 1,700,000 P 40 18 P 30,000,000 25,000,000 The manager of the A Division expects a 50.000 unit decline in sales at the normal price if she supplies the chain. She also expects fixed costs to increase by P100,000 and investment to increase by P1,200,000 if she accepts the order. Required: 1. Determine whether the manager of the A Division should accept the order, assuming that she is evaluated based on ROI 2. Determine whether the manager of the A Division should accept the order, assuming that she is evaluated based on RI and that the minimum required ROI is 20%.

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 1 Return on Investment ROI Divisional Profitinvestment 100 ROI Superior 60240 100 25 ROI Popular 20200 100 10 Investment Opportunity ROI Popular 840 100 20 Since the ROI from the project 20 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started