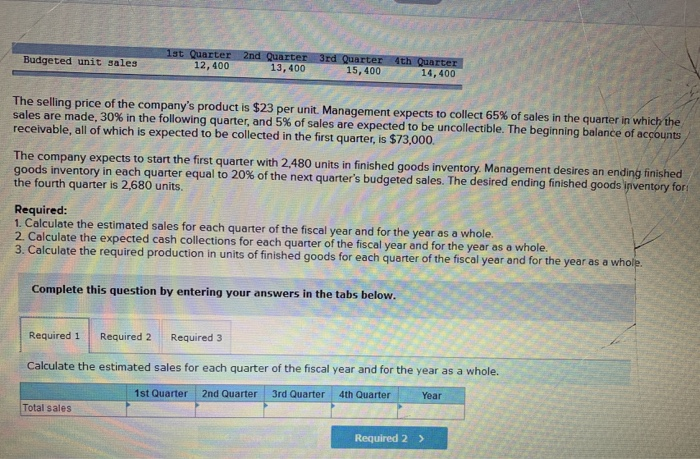

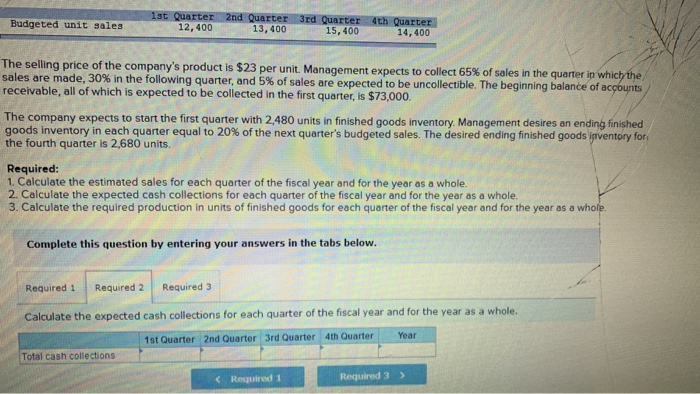

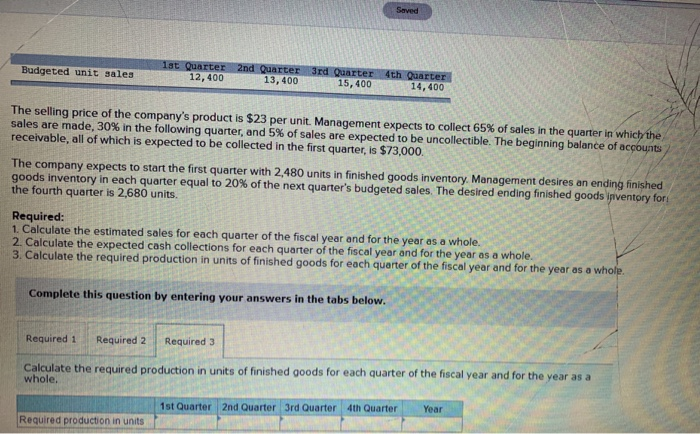

Budgeted unit sales 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 12,400 13,400 15,400 14,400 The selling price of the company's product is $23 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $73,000. The company expects to start the first quarter with 2.480 units in finished goods inventory Management desires an ending finished goods inventory in each quarter equal to 20% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 2,680 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total sales Required 2 > Budgeted unit sales 1st Quarter 12,400 2nd Quarter 3rd Quarter 4th Quarter 1 3,400 15,400 14,400 The selling price of the company's product is $23 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $73,000. The company expects to start the first quarter with 2.480 units in finished goods inventory Management desires an ending finished goods inventory in each quarter equal to 20% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 2,680 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total cash collections Seved Budgeted unit sales 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 12, 400 13,400 15,400 1 4, 400 The selling price of the company's product is $23 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $73,000. The company expects to start the first quarter with 2,480 units in finished goods inventory Management desires an ending finished goods inventory in each quarter equal to 20% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 2.680 units Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 the Geral year and for the year as a Calculate the required production in units of finished goods for each quarter of the fiscal year whole, 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Required production in units