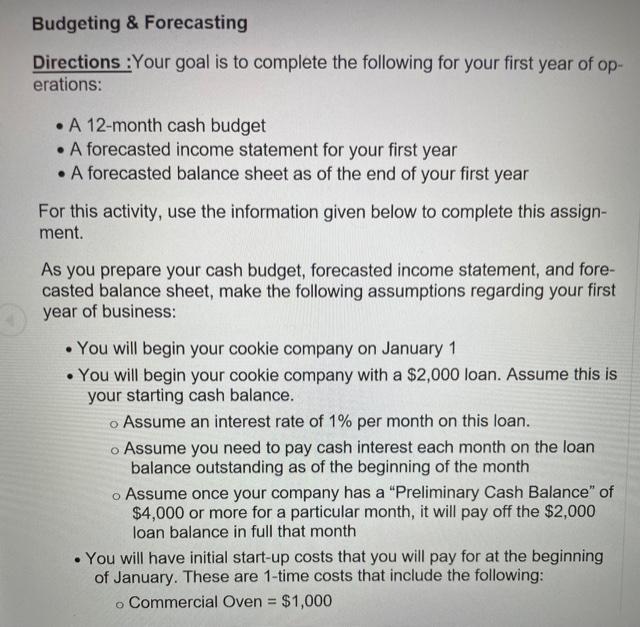

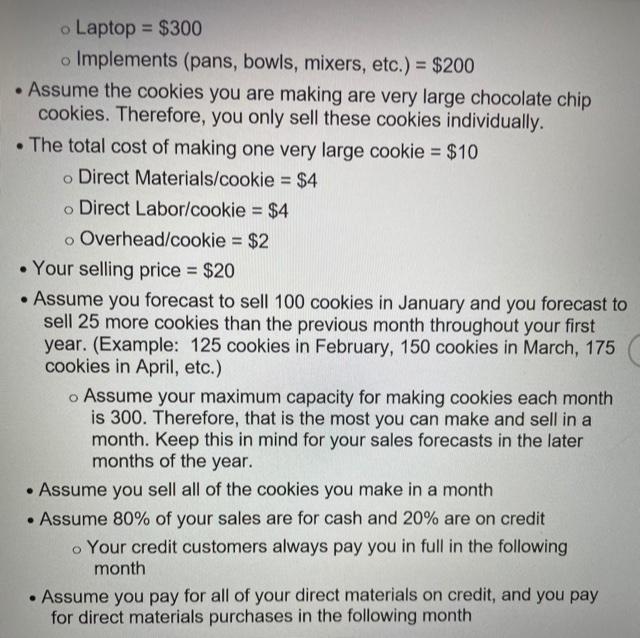

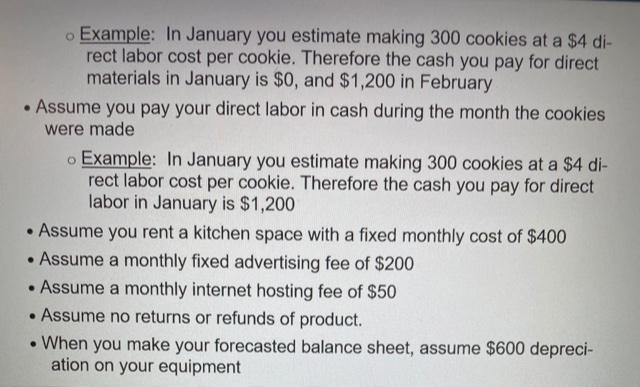

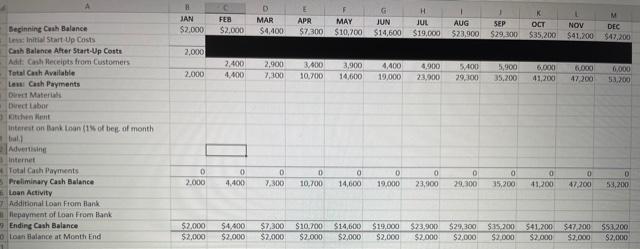

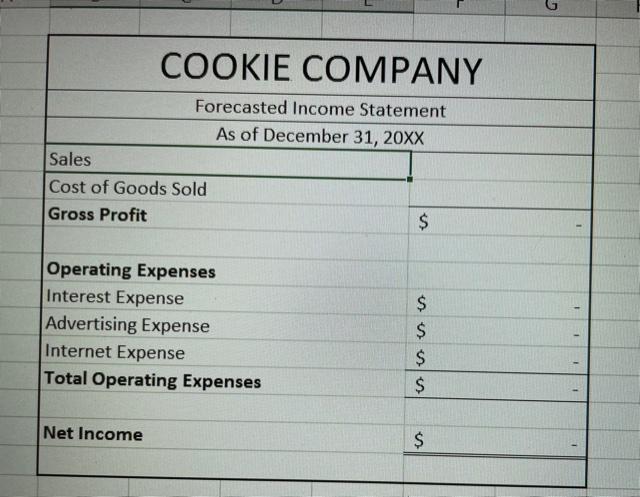

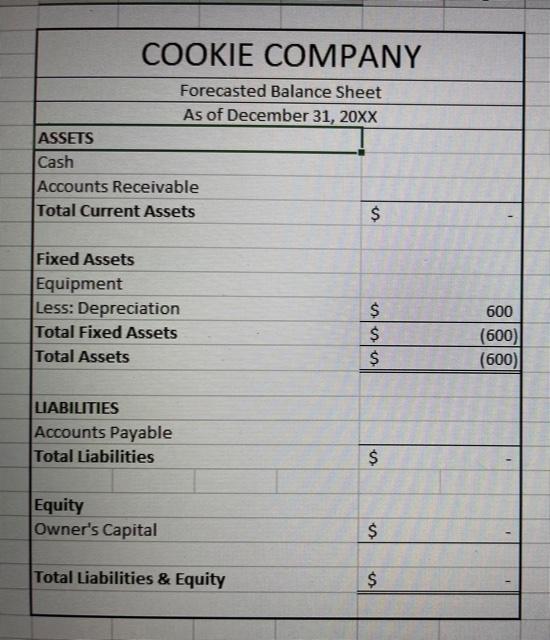

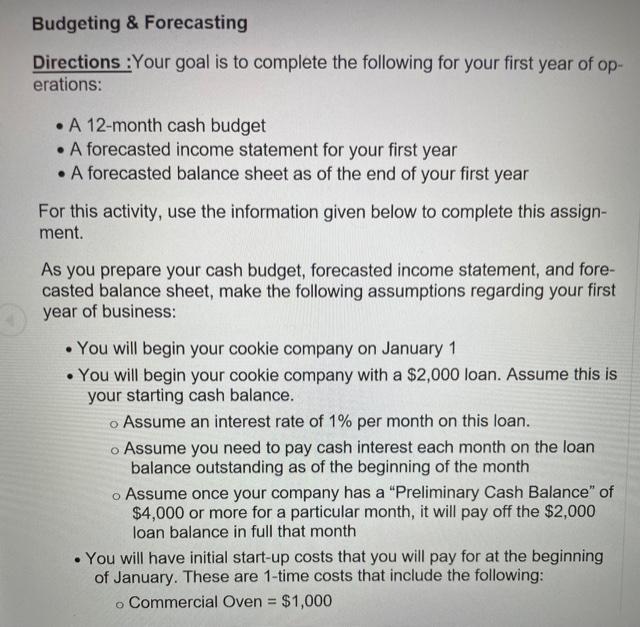

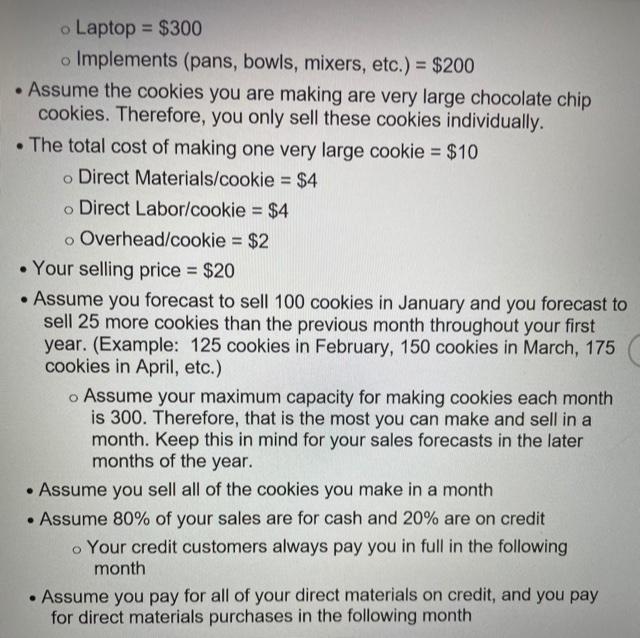

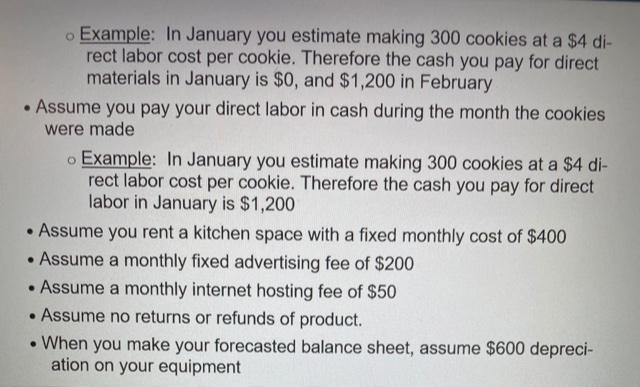

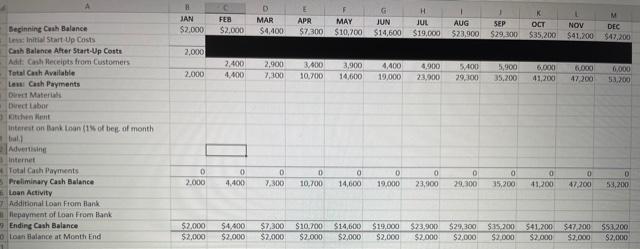

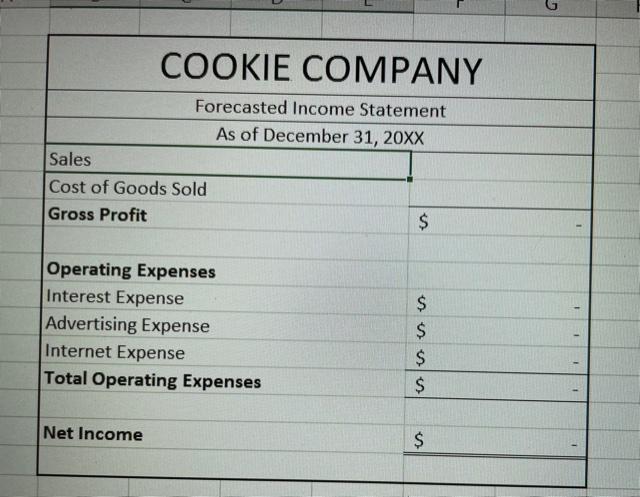

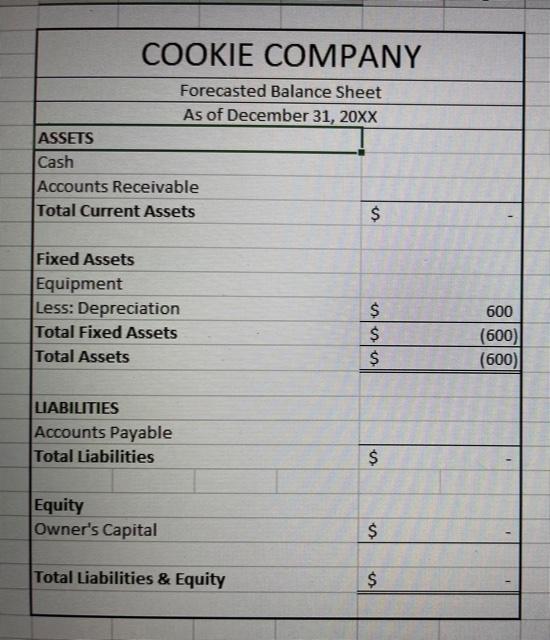

Budgeting & Forecasting Directions : Your goal is to complete the following for your first year of op- erations: A 12-month cash budget A forecasted income statement for your first year A forecasted balance sheet as of the end of your first year For this activity, use the information given below to complete this assign- ment. As you prepare your cash budget, forecasted income statement, and fore- casted balance sheet, make the following assumptions regarding your first year of business: You will begin your cookie company on January 1 You will begin your cookie company with a $2,000 loan. Assume this is your starting cash balance. o Assume an interest rate of 1% per month on this loan. o Assume you need to pay cash interest each month on the loan balance outstanding as of the beginning of the month . Assume once your company has a "Preliminary Cash Balance of $4,000 or more for a particular month, it will pay off the $2,000 loan balance in full that month . You will have initial start-up costs that you will pay for at the beginning of January. These are 1-time costs that include the following: o Commercial Oven = $1,000 O o Laptop = $300 o Implements (pans, bowls, mixers, etc.) = $200 Assume the cookies you are making are very large chocolate chip cookies. Therefore, you only sell these cookies individually. The total cost of making one very large cookie = $10 Direct Materials/cookie = $4 - Direct Labor/cookie = $4 o Overhead/cookie = $2 Your selling price = $20 Assume you forecast to sell 100 cookies in January and you forecast to sell 25 more cookies than the previous month throughout your first year. (Example: 125 cookies in February, 150 cookies in March, 175 cookies in April, etc.) o Assume your maximum capacity for making cookies each month is 300. Therefore, that is the most you can make and sell in a month. Keep this in mind for your sales forecasts in the later months of the year. Assume you sell all of the cookies you make in a month Assume 80% of your sales are for cash and 20% are on credit Your credit customers always pay you in full in the following month Assume you pay for all of your direct materials on credit, and you pay for direct materials purchases in the following month . O . Example: In January you estimate making 300 cookies at a $4 di- rect labor cost per cookie. Therefore the cash you pay for direct materials in January is $0, and $1,200 in February Assume you pay your direct labor in cash during the month the cookies were made . Example: In January you estimate making 300 cookies at a $4 di- rect labor cost per cookie. Therefore the cash you pay for direct labor in January is $1,200 Assume you rent a kitchen space with a fixed monthly cost of $400 Assume a monthly fixed advertising fee of $200 Assume a monthly internet hosting fee of $50 Assume no returns or refunds of product. When you make your forecasted balance sheet, assume $600 depreci- ation on your equipment JAN $2.000 FEB $2,000 0 MAR $4,400 APR MAY $7,300 $10,700 G JUN $14,600 H JUL $19,000 AUG $23,000 SEP $29,300 OCT $35,200 NOV $41,200 M DEC $47,200 2.000 2.400 4.400 2,900 7,300 2.000 3400 10.700 3,900 14,600 4,400 19.000 4.900 23,900 5400 29 100 5,900 35.200 6.000 41,200 6000 47200 0.000 53.100 Beginning Cash Balance te: Inital Start Up Costs Cash Balance After Start-Up Costa Adit: Cash Receipts from Customers Total Cash Available Lena Cash Payments De Materia Direct Labor Kitchen Hunt interest on Bank Loan (1% ofbes of month ball Advertising Internet Total Cash Payments S Preliminary Cash Balance Loan Activity Additional loan From flank fepayment of Loan From Bank Ending Cash Balance Loan Balance at Month End 2.000 0 4,400 D 7.2010 0 10,700 0 14,600 0 19.000 0 29.300 0 35,200 23,000 0 41,200 0 47,200 D 53,200 52.000 52.000 $4,400 $2.000 $2,300 $2.000 $10.700 $2.000 $14,600 $2.000 $19.000 $23,000 $2.000 $2.000 $29,300 $15,200 $2.000 $2.000 541,200 $47,200 $2.000 $2.000 SS3200 $2.000 COOKIE COMPANY Forecasted Income Statement As of December 31, 20XX Sales Cost of Goods Sold Gross Profit $ - Operating Expenses Interest Expense Advertising Expense Internet Expense Total Operating Expenses - $ $ $ $ - - Net Income $ - COOKIE COMPANY Forecasted Balance Sheet As of December 31, 20XX ASSETS Cash Accounts Receivable Total Current Assets $ Fixed Assets Equipment Less: Depreciation Total Fixed Assets Total Assets $ $ $ 600 (600) (600) LIABILITIES Accounts Payable Total Liabilities $ Equity Owner's Capital $ - Total Liabilities & Equity $ $ - Budgeting & Forecasting Directions : Your goal is to complete the following for your first year of op- erations: A 12-month cash budget A forecasted income statement for your first year A forecasted balance sheet as of the end of your first year For this activity, use the information given below to complete this assign- ment. As you prepare your cash budget, forecasted income statement, and fore- casted balance sheet, make the following assumptions regarding your first year of business: You will begin your cookie company on January 1 You will begin your cookie company with a $2,000 loan. Assume this is your starting cash balance. o Assume an interest rate of 1% per month on this loan. o Assume you need to pay cash interest each month on the loan balance outstanding as of the beginning of the month . Assume once your company has a "Preliminary Cash Balance of $4,000 or more for a particular month, it will pay off the $2,000 loan balance in full that month . You will have initial start-up costs that you will pay for at the beginning of January. These are 1-time costs that include the following: o Commercial Oven = $1,000 O o Laptop = $300 o Implements (pans, bowls, mixers, etc.) = $200 Assume the cookies you are making are very large chocolate chip cookies. Therefore, you only sell these cookies individually. The total cost of making one very large cookie = $10 Direct Materials/cookie = $4 - Direct Labor/cookie = $4 o Overhead/cookie = $2 Your selling price = $20 Assume you forecast to sell 100 cookies in January and you forecast to sell 25 more cookies than the previous month throughout your first year. (Example: 125 cookies in February, 150 cookies in March, 175 cookies in April, etc.) o Assume your maximum capacity for making cookies each month is 300. Therefore, that is the most you can make and sell in a month. Keep this in mind for your sales forecasts in the later months of the year. Assume you sell all of the cookies you make in a month Assume 80% of your sales are for cash and 20% are on credit Your credit customers always pay you in full in the following month Assume you pay for all of your direct materials on credit, and you pay for direct materials purchases in the following month . O . Example: In January you estimate making 300 cookies at a $4 di- rect labor cost per cookie. Therefore the cash you pay for direct materials in January is $0, and $1,200 in February Assume you pay your direct labor in cash during the month the cookies were made . Example: In January you estimate making 300 cookies at a $4 di- rect labor cost per cookie. Therefore the cash you pay for direct labor in January is $1,200 Assume you rent a kitchen space with a fixed monthly cost of $400 Assume a monthly fixed advertising fee of $200 Assume a monthly internet hosting fee of $50 Assume no returns or refunds of product. When you make your forecasted balance sheet, assume $600 depreci- ation on your equipment JAN $2.000 FEB $2,000 0 MAR $4,400 APR MAY $7,300 $10,700 G JUN $14,600 H JUL $19,000 AUG $23,000 SEP $29,300 OCT $35,200 NOV $41,200 M DEC $47,200 2.000 2.400 4.400 2,900 7,300 2.000 3400 10.700 3,900 14,600 4,400 19.000 4.900 23,900 5400 29 100 5,900 35.200 6.000 41,200 6000 47200 0.000 53.100 Beginning Cash Balance te: Inital Start Up Costs Cash Balance After Start-Up Costa Adit: Cash Receipts from Customers Total Cash Available Lena Cash Payments De Materia Direct Labor Kitchen Hunt interest on Bank Loan (1% ofbes of month ball Advertising Internet Total Cash Payments S Preliminary Cash Balance Loan Activity Additional loan From flank fepayment of Loan From Bank Ending Cash Balance Loan Balance at Month End 2.000 0 4,400 D 7.2010 0 10,700 0 14,600 0 19.000 0 29.300 0 35,200 23,000 0 41,200 0 47,200 D 53,200 52.000 52.000 $4,400 $2.000 $2,300 $2.000 $10.700 $2.000 $14,600 $2.000 $19.000 $23,000 $2.000 $2.000 $29,300 $15,200 $2.000 $2.000 541,200 $47,200 $2.000 $2.000 SS3200 $2.000 COOKIE COMPANY Forecasted Income Statement As of December 31, 20XX Sales Cost of Goods Sold Gross Profit $ - Operating Expenses Interest Expense Advertising Expense Internet Expense Total Operating Expenses - $ $ $ $ - - Net Income $ - COOKIE COMPANY Forecasted Balance Sheet As of December 31, 20XX ASSETS Cash Accounts Receivable Total Current Assets $ Fixed Assets Equipment Less: Depreciation Total Fixed Assets Total Assets $ $ $ 600 (600) (600) LIABILITIES Accounts Payable Total Liabilities $ Equity Owner's Capital $ - Total Liabilities & Equity $ $