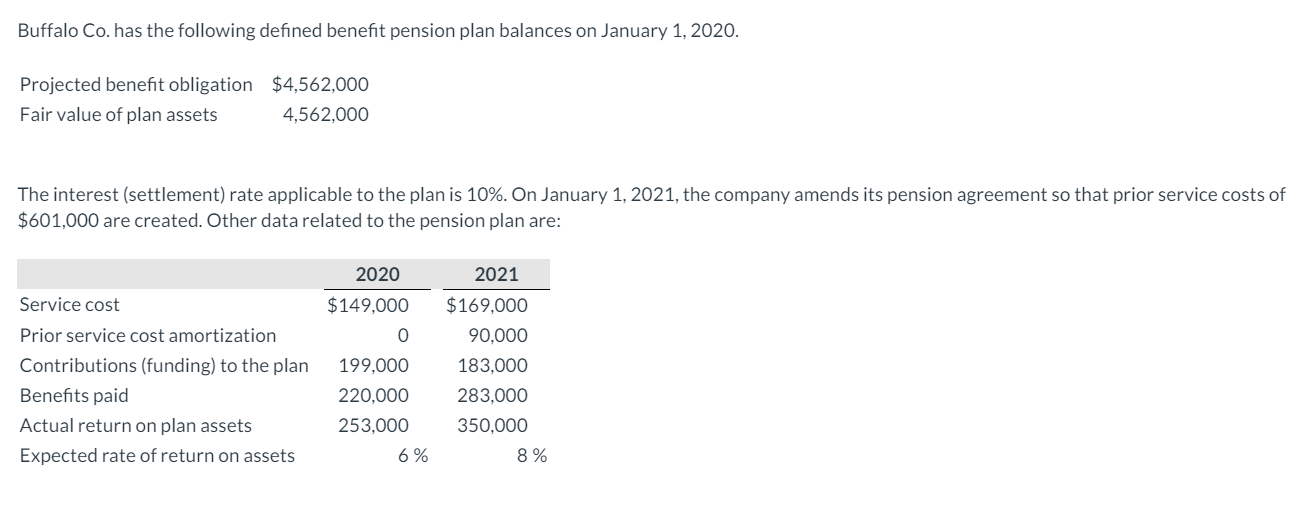

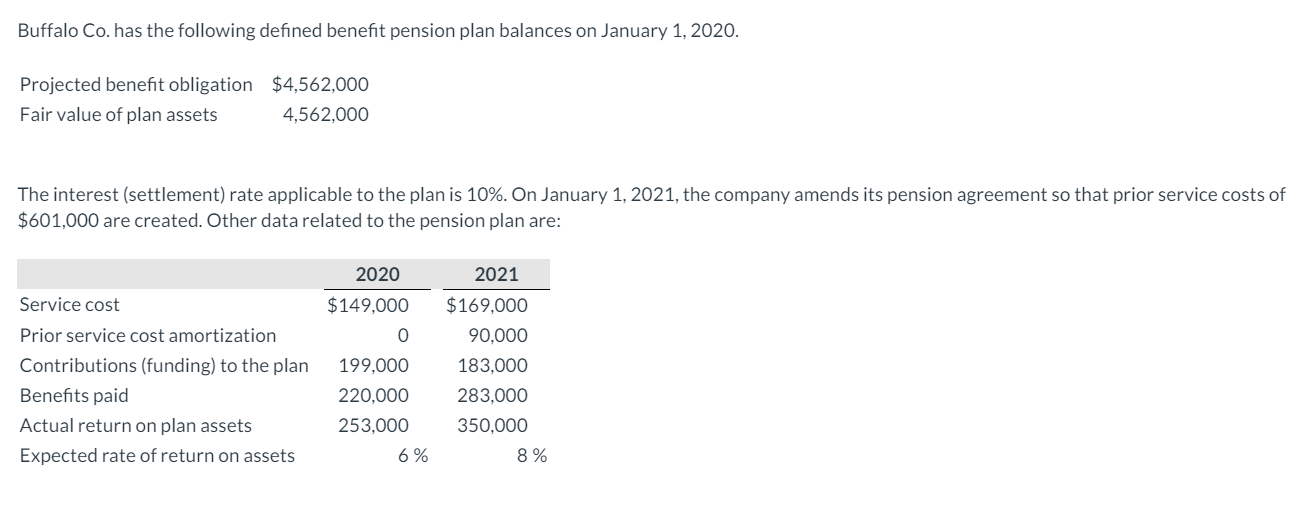

Buffalo Co. has the following defined benefit pension plan balances on January 1, 2020.

Projected benefit obligation $4,562,000

Fair value of plan assets 4,562,000

The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs of $601,000 are created. Other data related to the pension plan are:

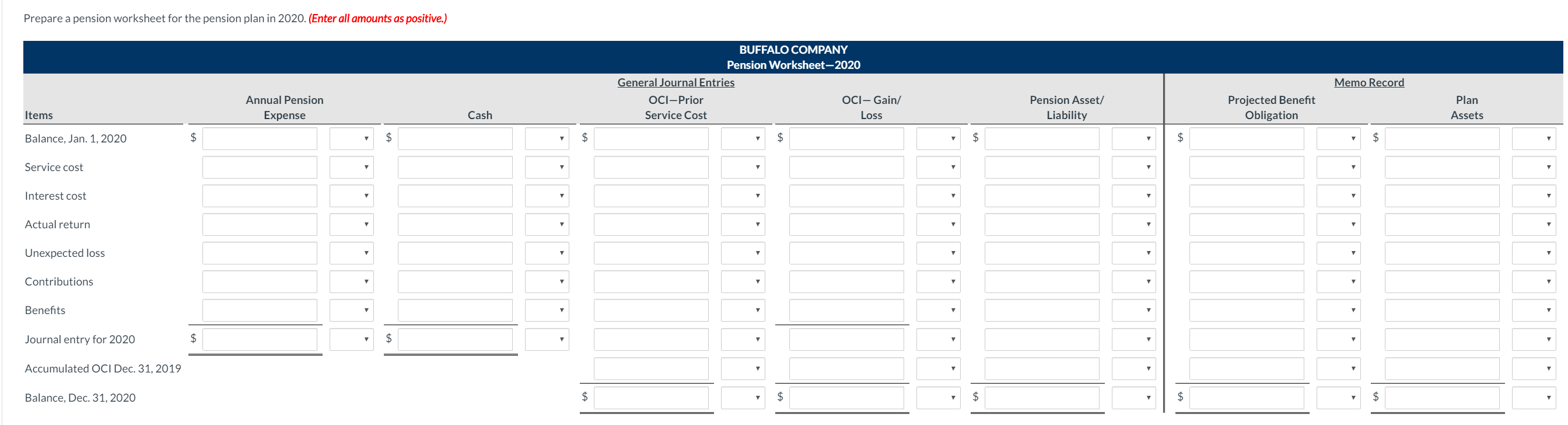

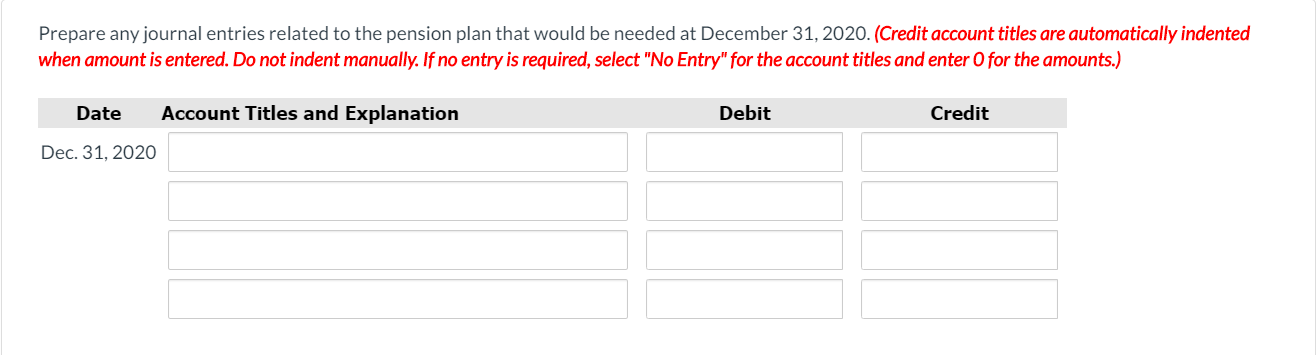

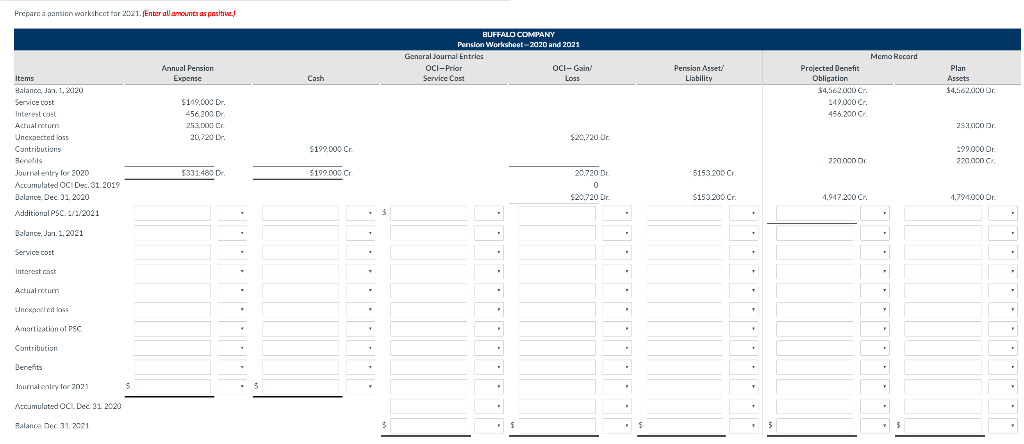

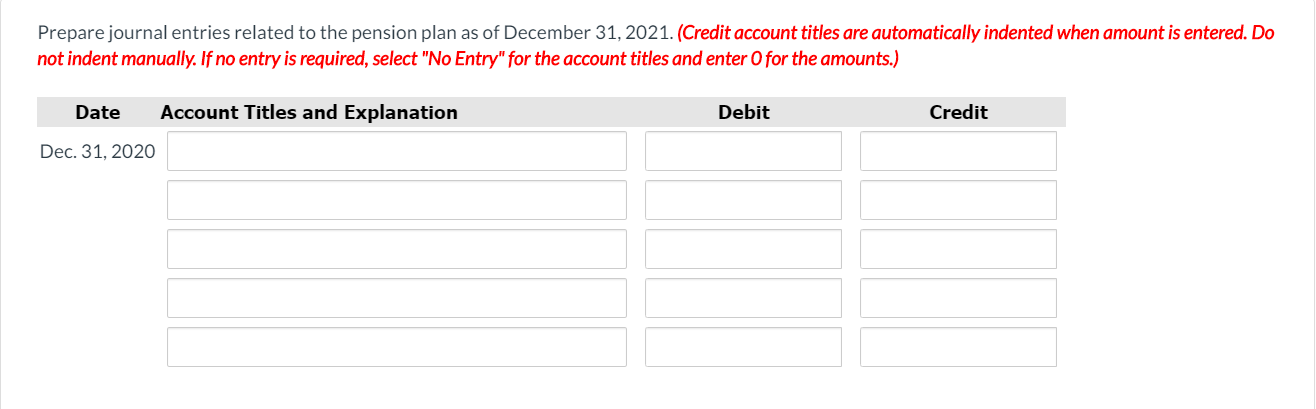

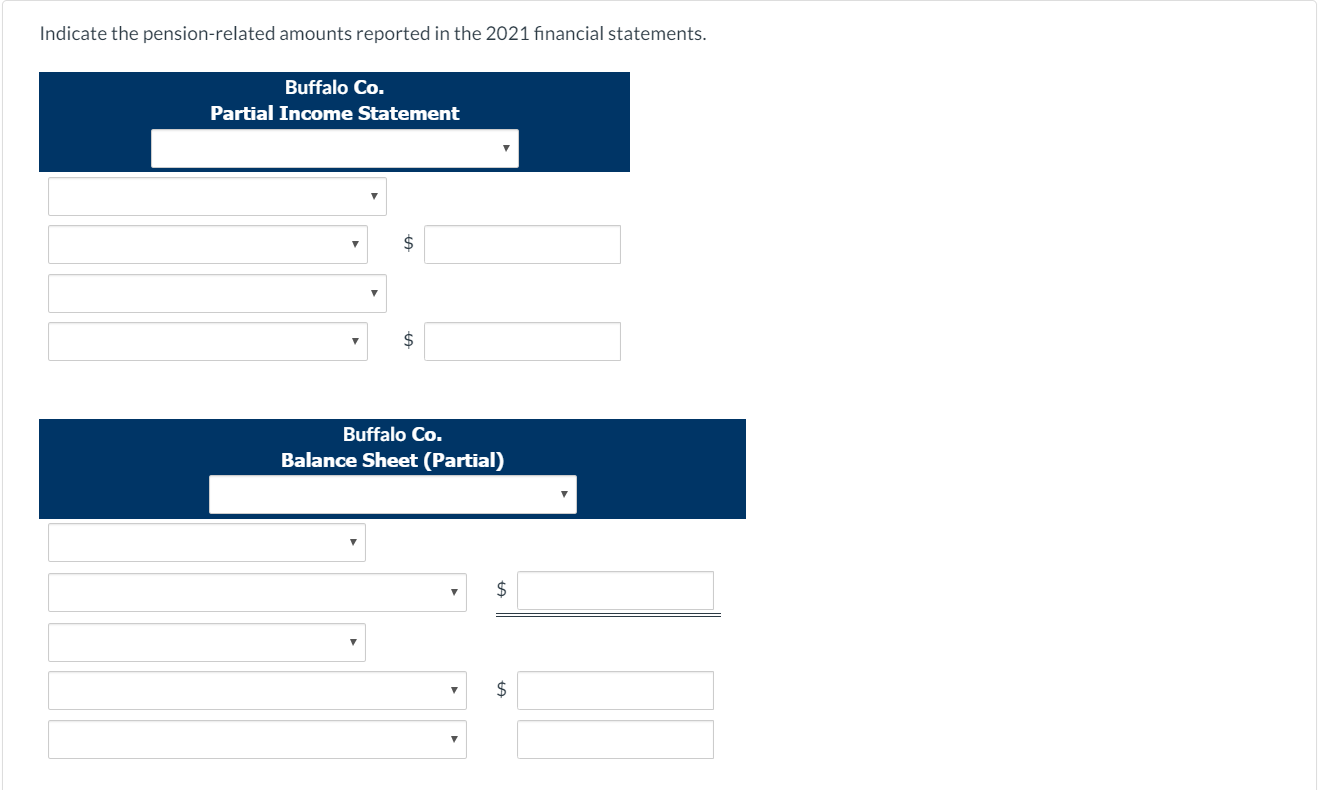

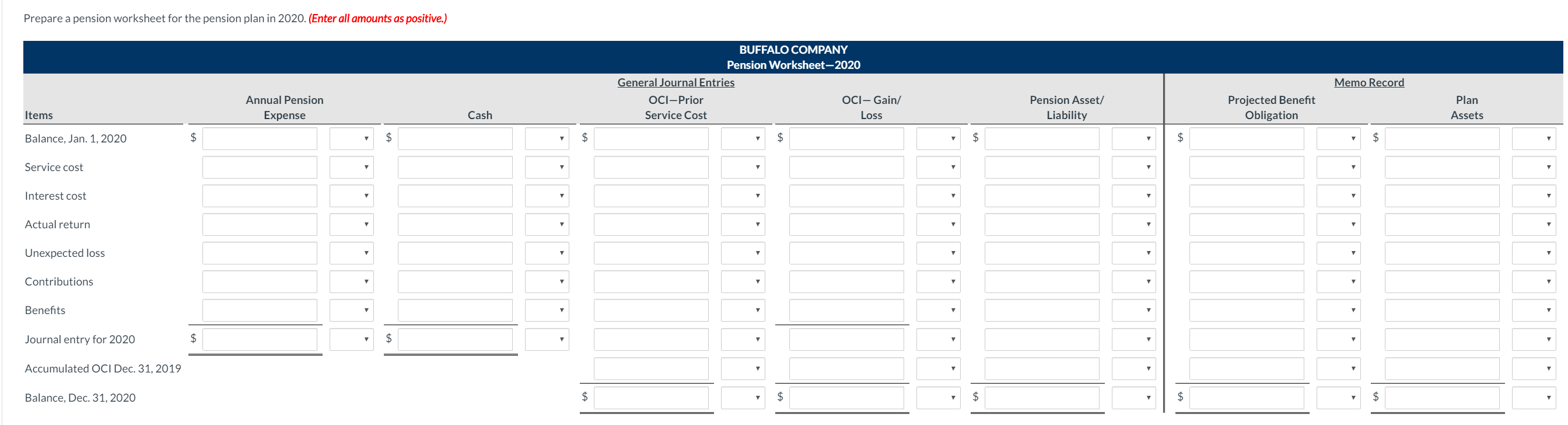

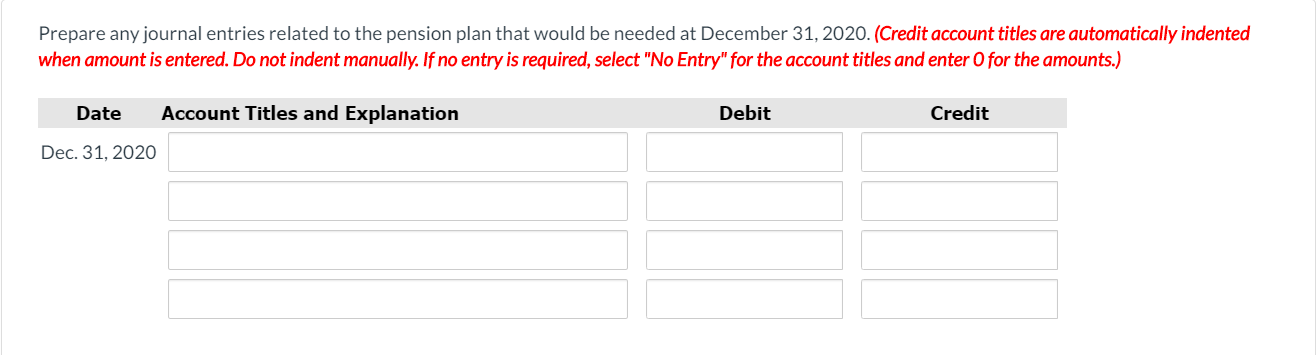

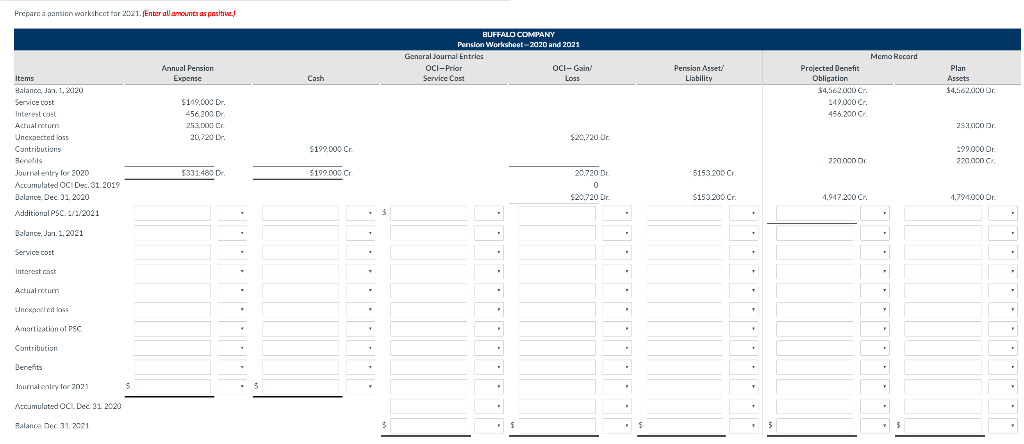

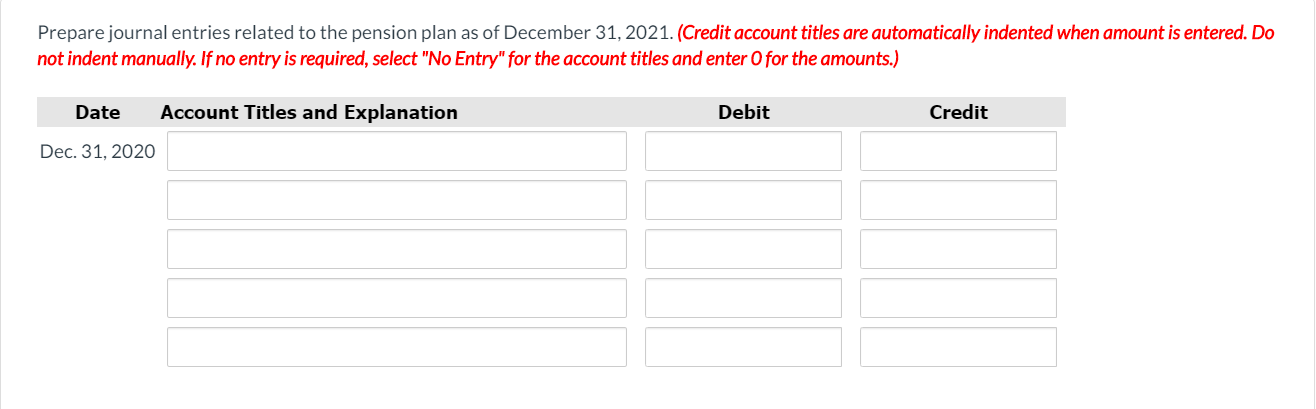

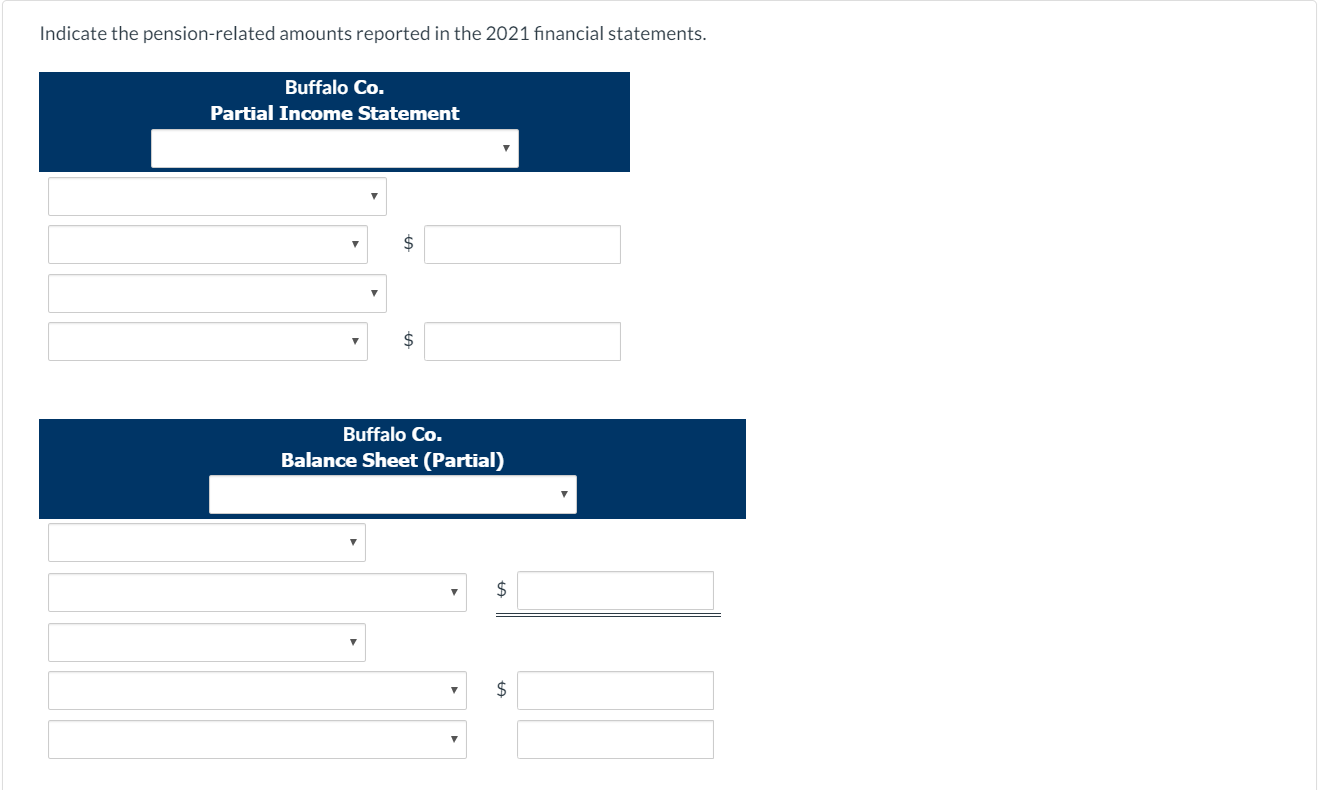

Buffalo Co. has the following defined benefit pension plan balances on January 1, 2020. Projected benefit obligation $4,562,000 Fair value of plan assets 4,562,000 The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs of $601,000 are created. Other data related to the pension plan are: Service cost Prior service cost amortization Contributions (funding) to the plan Benefits paid Actual return on plan assets Expected rate of return on assets 2020 $149,000 0 199,000 220,000 253,000 6% 2021 $169,000 90,000 183,000 283,000 350,000 8 % Prepare a pension worksheet for the pension plan in 2020. (Enter all amounts as positive.) BUFFALO COMPANY Pension Worksheet-2020 General Journal Entries OCI-Prior OCI- Gain/ Service Cost Loss Memo Record Annual Pension Expense Pension Asset/ Liability Projected Benefit Obligation Plan Assets Items Cash Balance, Jan. 1, 2020 Service cost Interest cost Actual return Unexpected loss Contributions Benefits Journal entry for 2020 $ $ Accumulated OCI Dec. 31, 2019 Balance, Dec. 31, 2020 Prepare any journal entries related to the pension plan that would be needed at December 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020 Prepare a pension worksheet for 2021. (Enter all amounts as positive. BUFFALO COMPANY Pension Worksheet-2020 and 2021 General Journal Entries OCI-Prior OCI-Gain/ Service Cost Loss Plan Annual Pension Expense Pension Asset/ Liability Cash Momo Record Projected Benefit Obligation $4,562.000 6 149.000 Cr. 456.2006 Items Balance, Jan. 1, 2020 Service cost Interest cost Actualmctum Unexpected loss Contributions Assets $4,562.000 Dr. $149,000 Dr. 456200 Dr. 253,000 C 20,720 Dr. 252000 Dr $20,720 Dr. $199.000 Cr 199.000 DI 220.000 220,000 DI $331.480 Dr $199.000 20.720 DI $153 200 Cr. Journal entry for 2020 Accumulated OCI Dec.31.2012 Balance, Dec 31, 2020 Additional PSC. 1/1/2021 $20.720 Dr. $150 200 Cr. 4.947.200 Cr. 4.791000 Dr. Balance, Jan 1, 2021 Service cost Interest cast Actual nctum Unexpected Amortization of PSC Contribution Benefits Jumalantry for 2021 S Accumulated OC Dec 31, 2020 Balance, Dec 31, 2021 Prepare journal entries related to the pension plan as of December 31, 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020 Indicate the pension-related amounts reported in the 2021 financial statements. Buffalo Co. Partial Income Statement Buffalo Co. Balance Sheet (Partial)