Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Buffelhead's stock price is $192 and could halve or double in each six-month period. A one-year call option on Buffelhead has an exercise price of

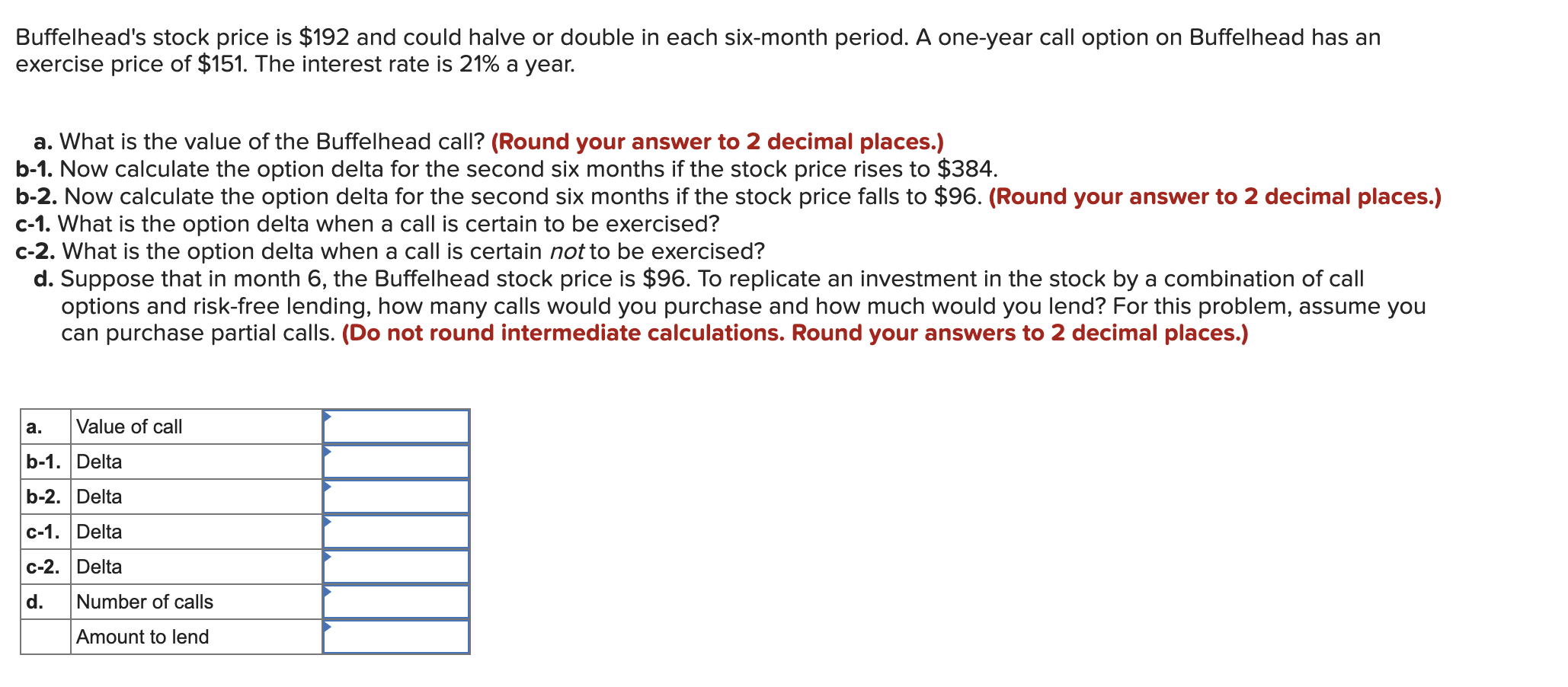

Buffelhead's stock price is $192 and could halve or double in each six-month period. A one-year call option on Buffelhead has an exercise price of $151. The interest rate is 21% a year. a. What is the value of the Buffelhead call? (Round your answer to 2 decimal places.) b-1. Now calculate the option delta for the second six months if the stock price rises to $384. b-2. Now calculate the option delta for the second six months if the stock price falls to $96. (Round your answer to 2 decimal places.) c-1. What is the option delta when a call is certain to be exercised? c-2. What is the option delta when a call is certain not to be exercised? d. Suppose that in month 6 , the Buffelhead stock price is $96. To replicate an investment in the stock by a combination of call options and risk-free lending, how many calls would you purchase and how much would you lend? For this problem, assume you can purchase partial calls. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Buffelhead's stock price is $192 and could halve or double in each six-month period. A one-year call option on Buffelhead has an exercise price of $151. The interest rate is 21% a year. a. What is the value of the Buffelhead call? (Round your answer to 2 decimal places.) b-1. Now calculate the option delta for the second six months if the stock price rises to $384. b-2. Now calculate the option delta for the second six months if the stock price falls to $96. (Round your answer to 2 decimal places.) c-1. What is the option delta when a call is certain to be exercised? c-2. What is the option delta when a call is certain not to be exercised? d. Suppose that in month 6 , the Buffelhead stock price is $96. To replicate an investment in the stock by a combination of call options and risk-free lending, how many calls would you purchase and how much would you lend? For this problem, assume you can purchase partial calls. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Buffelhead's stock price is $192 and could halve or double in each six-month period. A one-year call option on Buffelhead has an exercise price of $151. The interest rate is 21% a year. a. What is the value of the Buffelhead call? (Round your answer to 2 decimal places.) b-1. Now calculate the option delta for the second six months if the stock price rises to $384. b-2. Now calculate the option delta for the second six months if the stock price falls to $96. (Round your answer to 2 decimal places.) c-1. What is the option delta when a call is certain to be exercised? c-2. What is the option delta when a call is certain not to be exercised? d. Suppose that in month 6 , the Buffelhead stock price is $96. To replicate an investment in the stock by a combination of call options and risk-free lending, how many calls would you purchase and how much would you lend? For this problem, assume you can purchase partial calls. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Buffelhead's stock price is $192 and could halve or double in each six-month period. A one-year call option on Buffelhead has an exercise price of $151. The interest rate is 21% a year. a. What is the value of the Buffelhead call? (Round your answer to 2 decimal places.) b-1. Now calculate the option delta for the second six months if the stock price rises to $384. b-2. Now calculate the option delta for the second six months if the stock price falls to $96. (Round your answer to 2 decimal places.) c-1. What is the option delta when a call is certain to be exercised? c-2. What is the option delta when a call is certain not to be exercised? d. Suppose that in month 6 , the Buffelhead stock price is $96. To replicate an investment in the stock by a combination of call options and risk-free lending, how many calls would you purchase and how much would you lend? For this problem, assume you can purchase partial calls. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started