Answered step by step

Verified Expert Solution

Question

1 Approved Answer

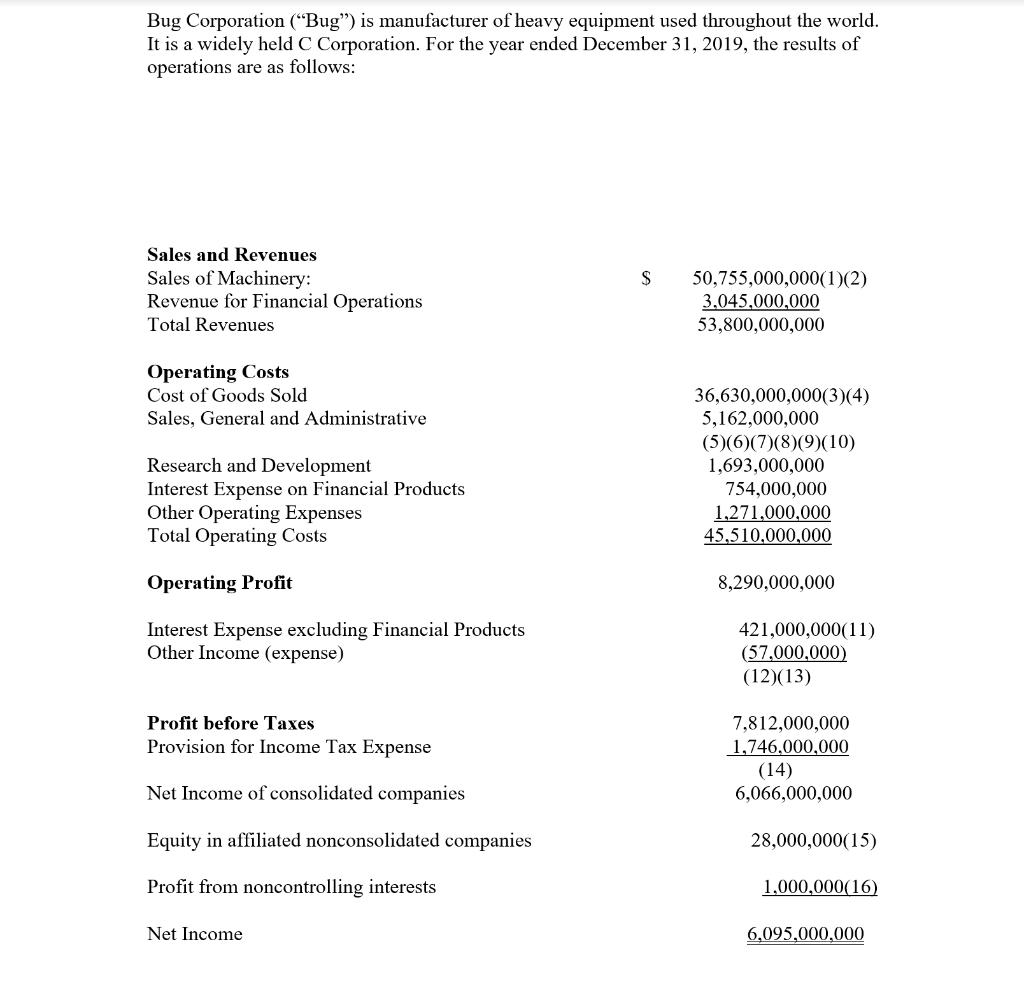

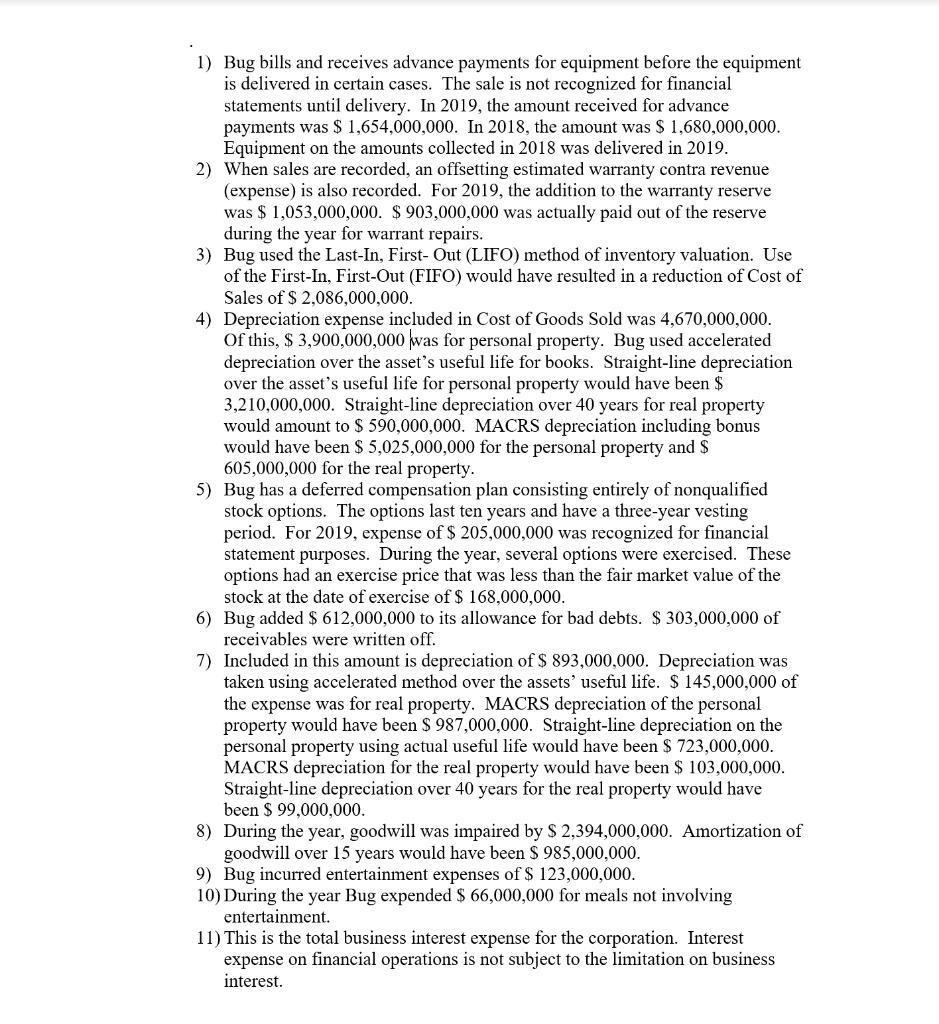

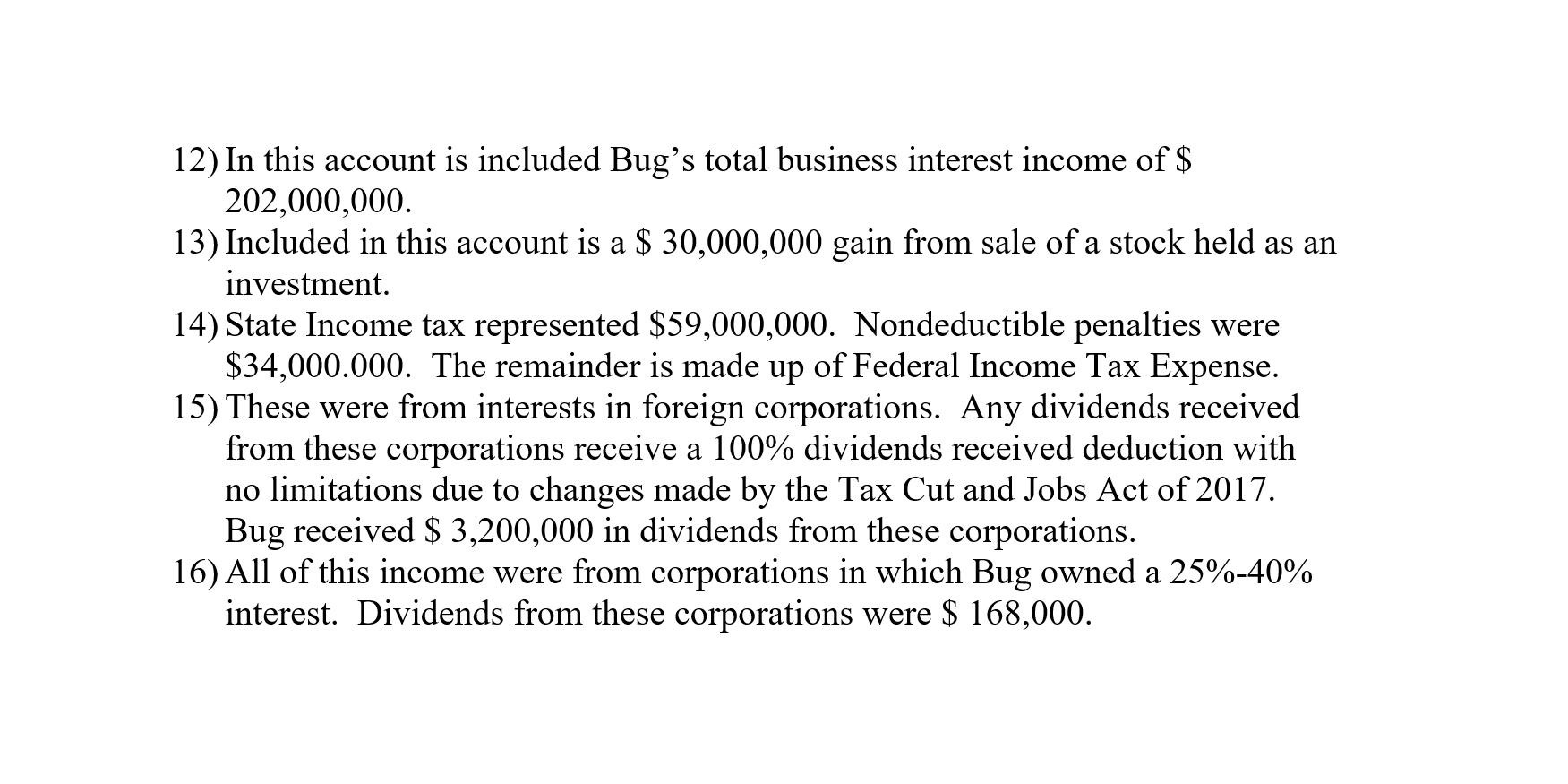

-Compute Bugs Federal Income Tax for the year ended December 31, 2019. Please show your calculation. -Compute Bugss Business Interest Deduction. Please show your calculation.

- -Compute Bug’s Federal Income Tax for the year ended December 31, 2019. Please show your calculation.

- -Compute Bugs’s Business Interest Deduction. Please show your calculation.

- -Compute Bugs’s Earnings and Profits for the year ended December 31, 2019. Please show your calculation.

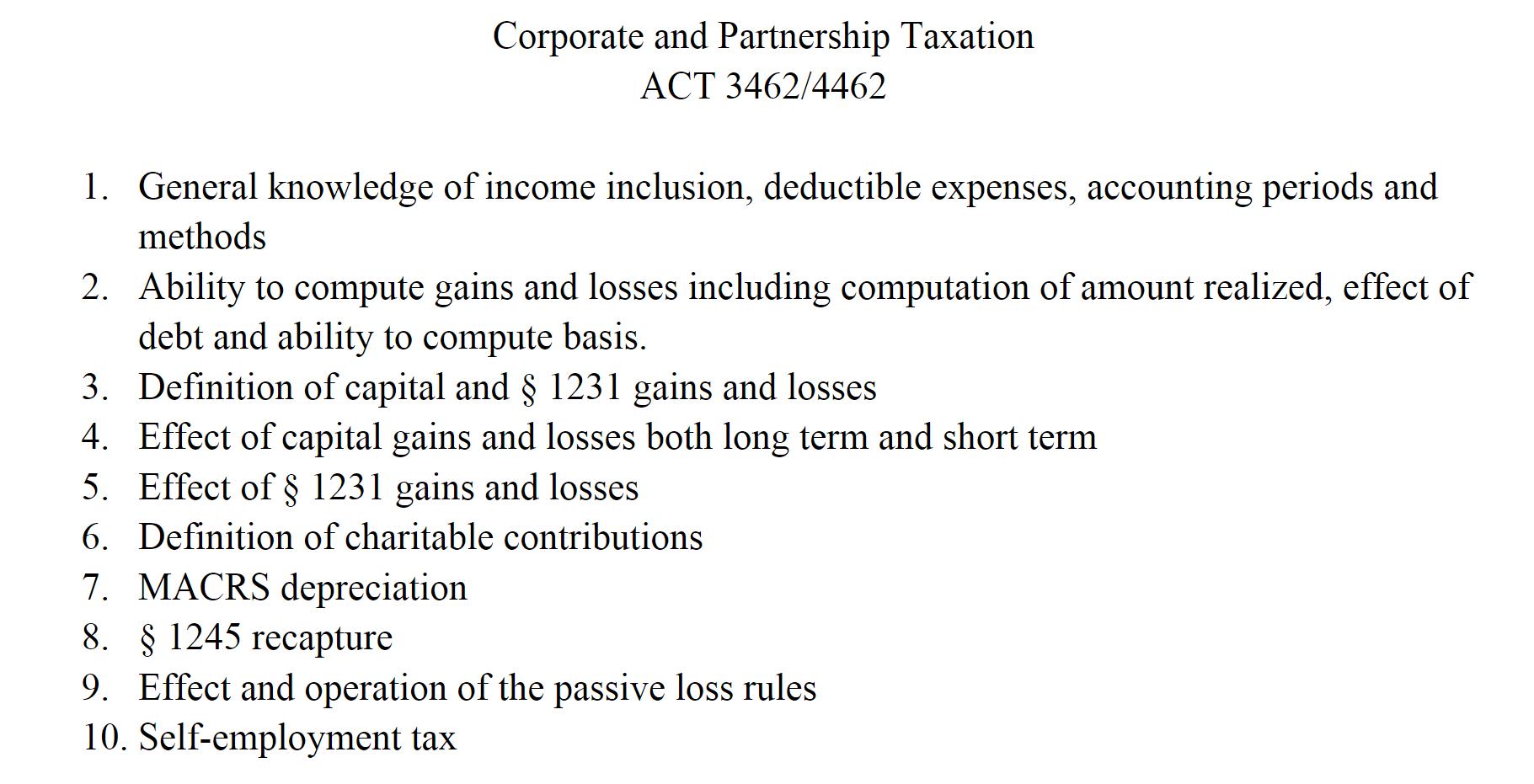

Corporate and Partnership Taxation ACT 3462/4462 1. General knowledge of income inclusion, deductible expenses, accounting periods and methods 2. Ability to compute gains and losses including computation of amount realized, effect of debt and ability to compute basis. 3. Definition of capital and 1231 gains and losses 4. Effect of capital gains and losses both long term and short term 5. Effect of 1231 gains and losses 6. Definition of charitable contributions 7. MACRS depreciation 8. 1245 recapture 9. Effect and operation of the passive loss rules 10. Self-employment tax

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Total Revenues 53800000000 Operating Costs 45510000000 Operating Profit 8290000000 Interest Expens...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started