Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Build a Bridge Inc. prepares its financial statements in accordance with IFRS. The company started work on a contract in May 2023 to build

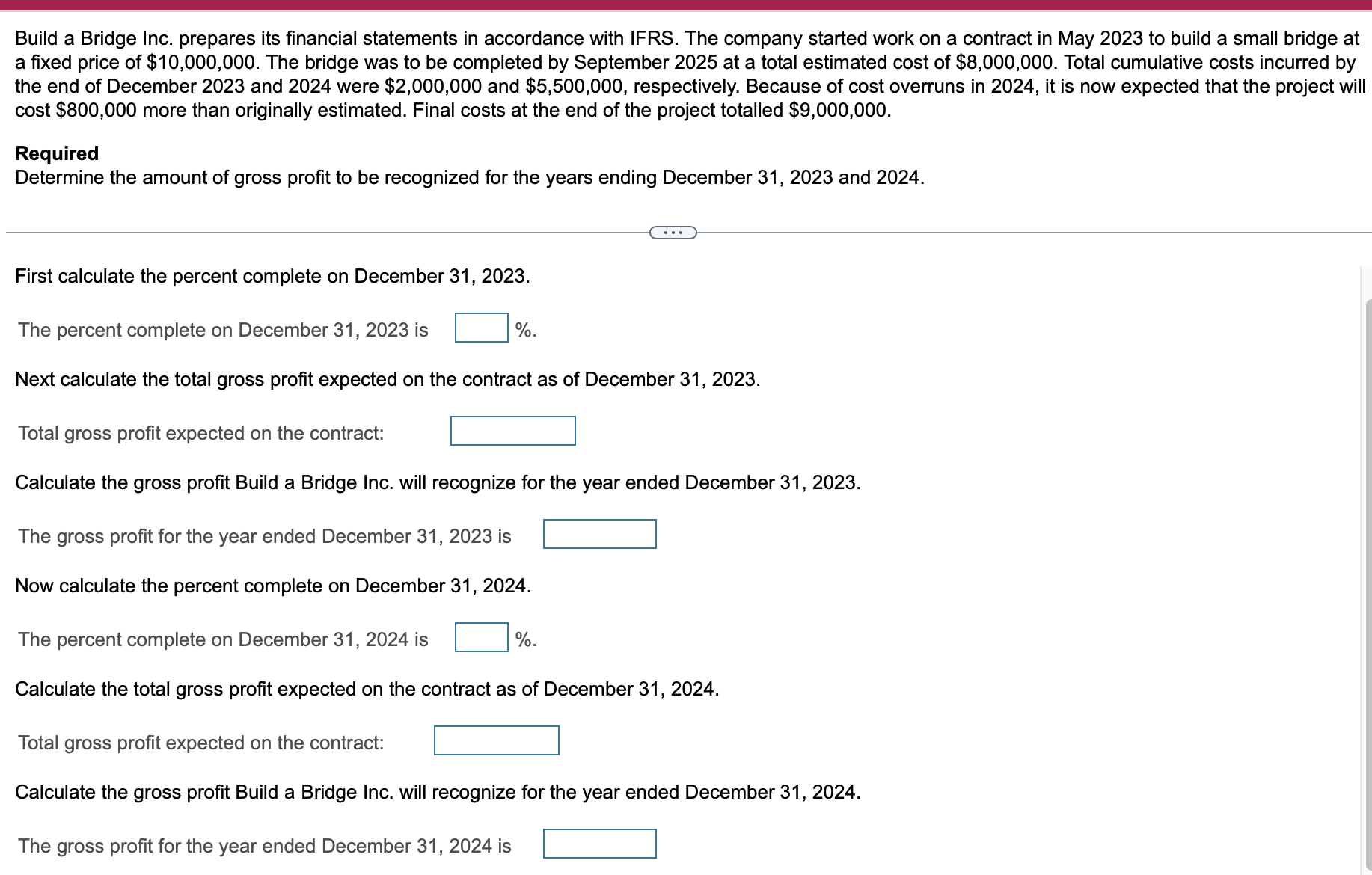

Build a Bridge Inc. prepares its financial statements in accordance with IFRS. The company started work on a contract in May 2023 to build a small bridge at a fixed price of $10,000,000. The bridge was to be completed by September 2025 at a total estimated cost of $8,000,000. Total cumulative costs incurred by the end of December 2023 and 2024 were $2,000,000 and $5,500,000, respectively. Because of cost overruns in 2024, it is now expected that the project will cost $800,000 more than originally estimated. Final costs at the end of the project totalled $9,000,000. Required Determine the amount of gross profit to be recognized for the years ending December 31, 2023 and 2024. First calculate the percent complete on December 31, 2023. The percent complete on December 31, 2023 is %. Next calculate the total gross profit expected on the contract as of December 31, 2023. Total gross profit expected on the contract: Calculate the gross profit Build a Bridge Inc. will recognize for the year ended December 31, 2023. The gross profit for the year ended December 31, 2023 is Now calculate the percent complete on December 31, 2024. The percent complete on December 31, 2024 is %. Calculate the total gross profit expected on the contract as of December 31, 2024. Total gross profit expected on the contract: Calculate the gross profit Build a Bridge Inc. will recognize for the year ended December 31, 2024. The gross profit for the year ended December 31, 2024 is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the amount of gross profit to be recognized for the years ending December 31 2023 and 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started