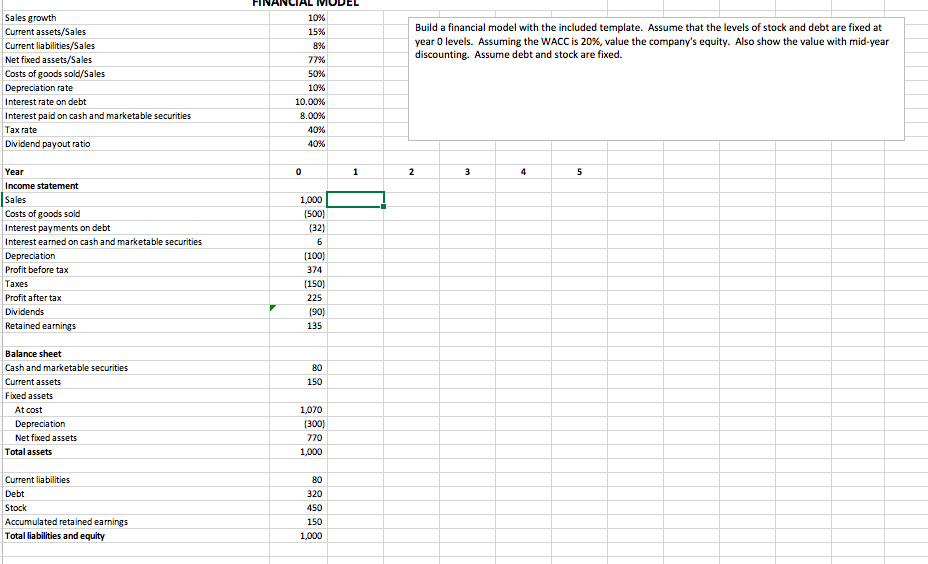

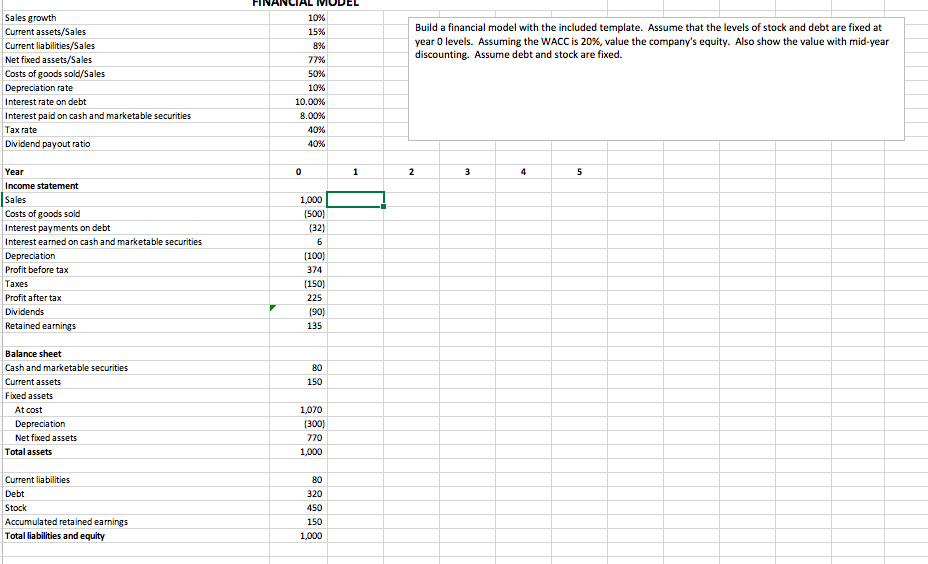

Build a financial model with the included template. Assume that the levels of stock and debt are fixed at year O levels. Assuming the WACC is 20%, value the company's equity. Also show the value with mid-year discounting. Assume debt and stock are fixed. Sales growth Current assets/Sales Current liabilities/Sales Net fixed assets/Sales Costs of goods sold/Sales Depreciation rate Interest rate on debt Interest paid on cash and marketable securities Tax rate Dividend payout ratio IVIC 10% 15% 8% 77% 50% 10% 10.00% 8.00% 40% 40% 0 1 2 3 4 5 Year Income statement Sales Costs of goods sold Interest payments on debt Interest earned on cash and marketable securities Depreciation Profit before tax Taxes Profit after tax Dividends Retained earnings 1,000 (500) (32) 6 (100) 374 (150) 225 (90) 135 80 150 Balance sheet Cash and marketable securities Current assets Fixed assets At cost Depreciation Net fixed assets Total assets 1,070 (300) 770 1,000 80 320 Current liabilities Debt Stock Accumulated retained earnings Total liabilities and equity 450 150 1,000 Build a financial model with the included template. Assume that the levels of stock and debt are fixed at year O levels. Assuming the WACC is 20%, value the company's equity. Also show the value with mid-year discounting. Assume debt and stock are fixed. Sales growth Current assets/Sales Current liabilities/Sales Net fixed assets/Sales Costs of goods sold/Sales Depreciation rate Interest rate on debt Interest paid on cash and marketable securities Tax rate Dividend payout ratio IVIC 10% 15% 8% 77% 50% 10% 10.00% 8.00% 40% 40% 0 1 2 3 4 5 Year Income statement Sales Costs of goods sold Interest payments on debt Interest earned on cash and marketable securities Depreciation Profit before tax Taxes Profit after tax Dividends Retained earnings 1,000 (500) (32) 6 (100) 374 (150) 225 (90) 135 80 150 Balance sheet Cash and marketable securities Current assets Fixed assets At cost Depreciation Net fixed assets Total assets 1,070 (300) 770 1,000 80 320 Current liabilities Debt Stock Accumulated retained earnings Total liabilities and equity 450 150 1,000