Question

Building a Financial Model Your boss believes that company ABC is a good investment and he wants to buy some shares in this company -

Building a Financial Model

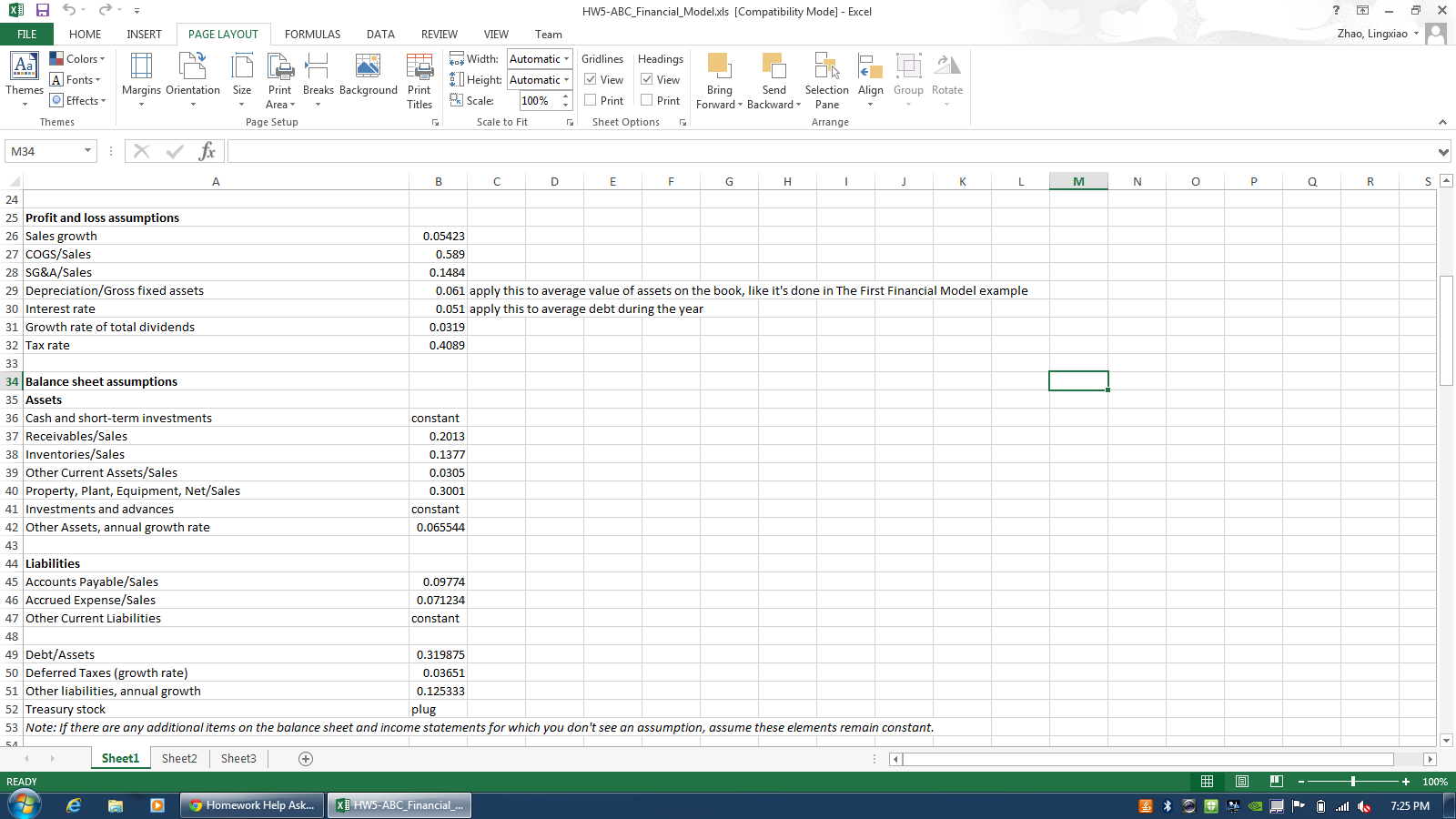

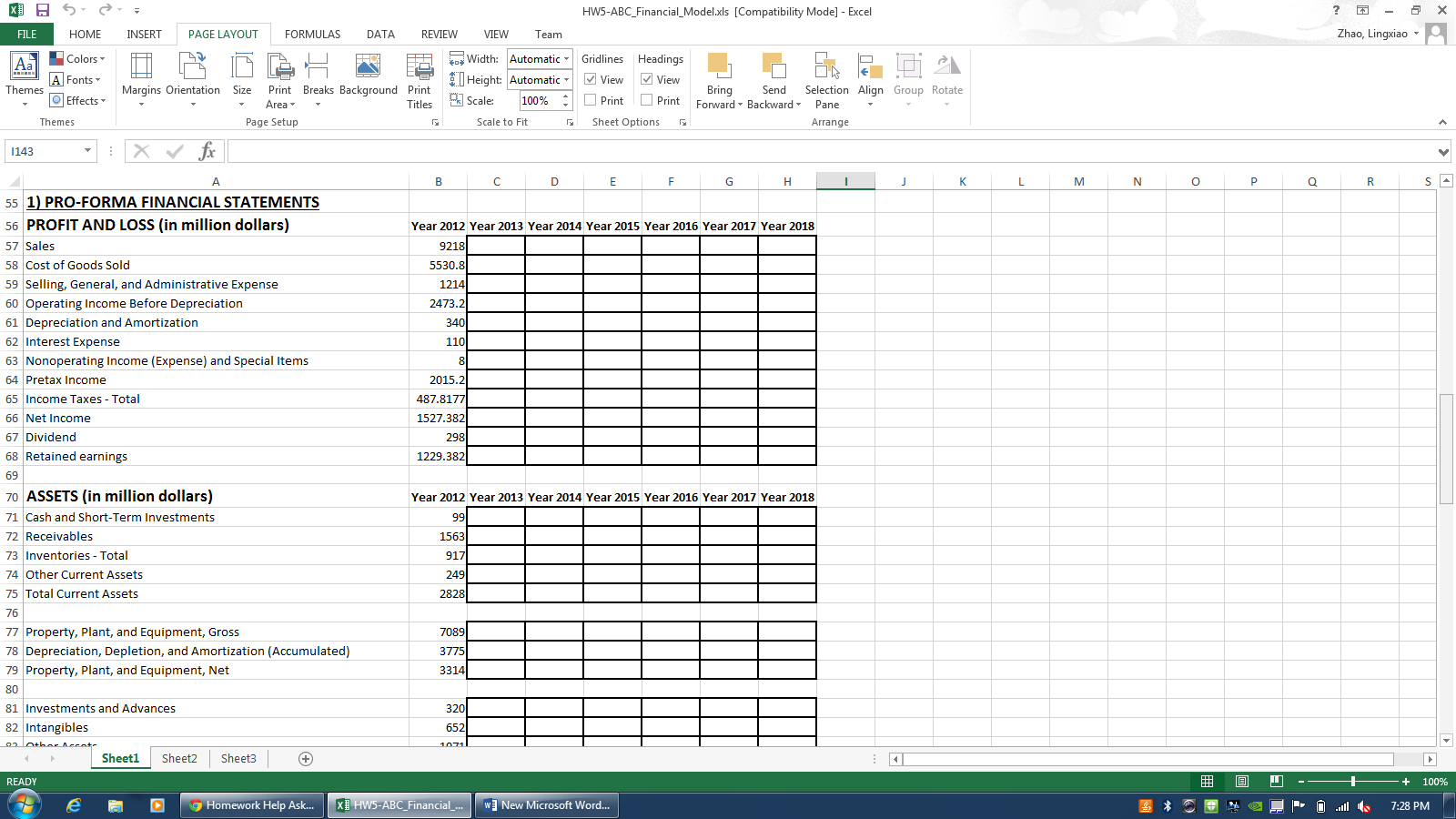

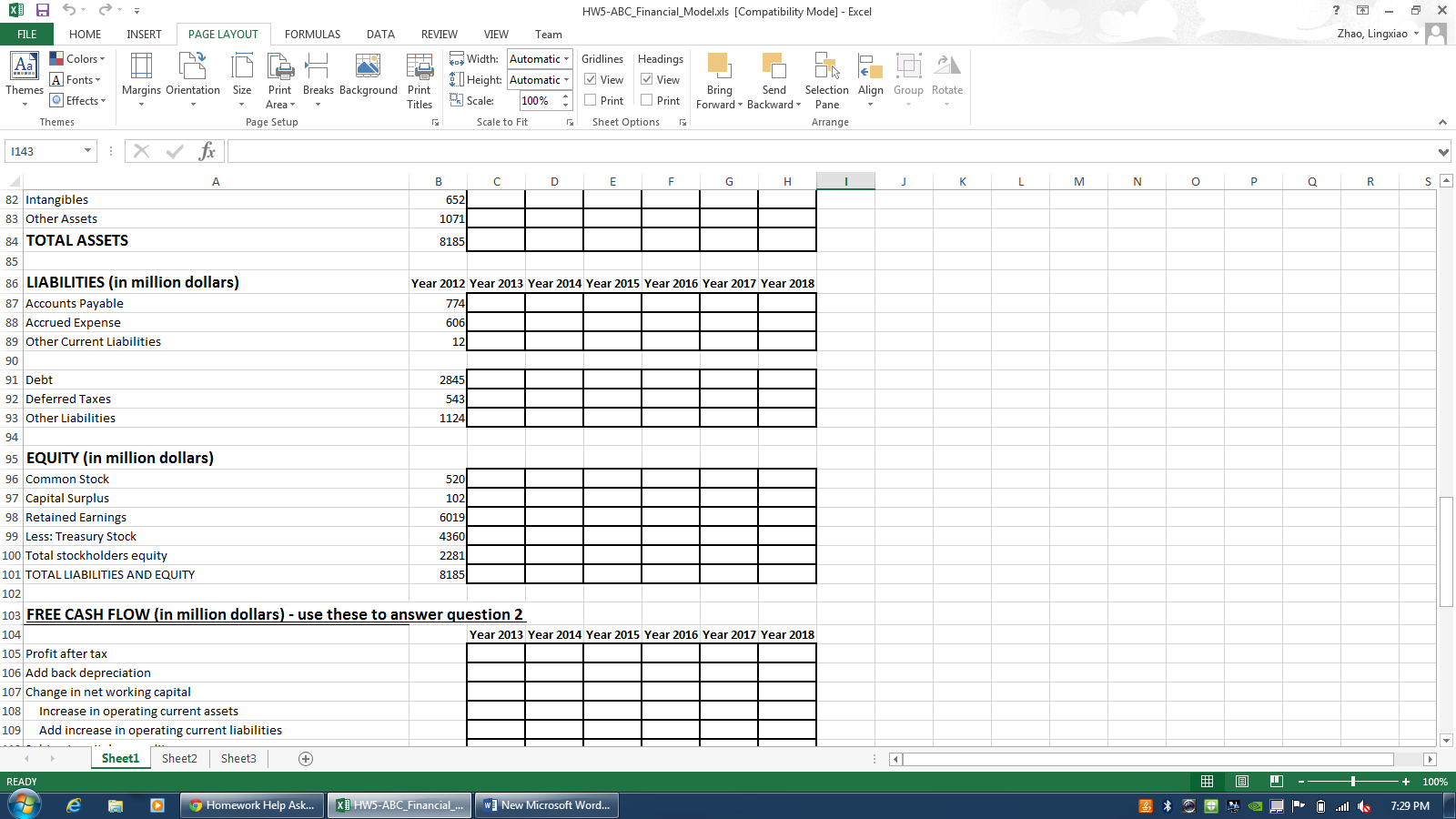

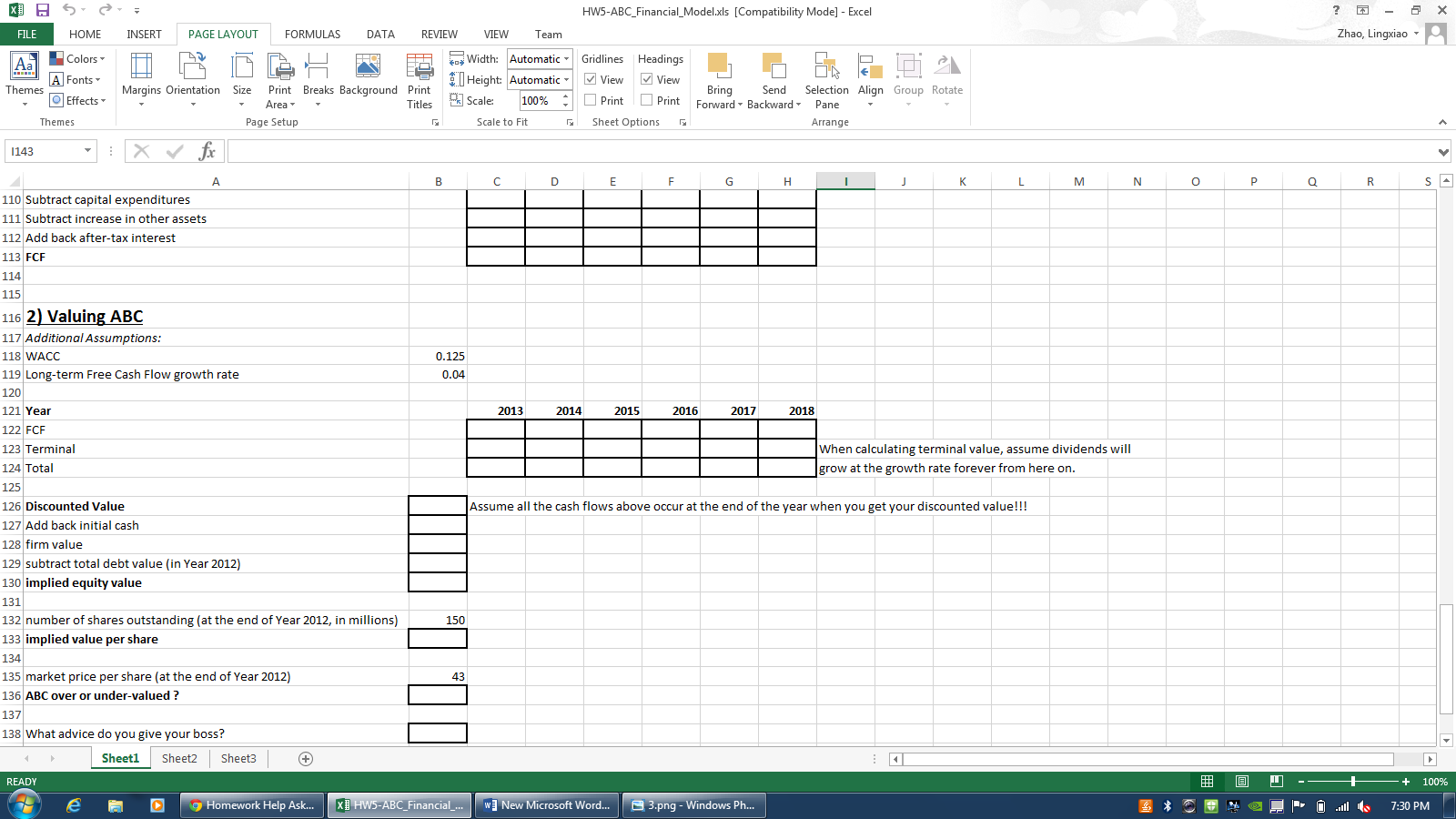

Your boss believes that company ABC is a good investment and he wants to buy some shares in this company - however, since he is new at this, he brings you the past 10 years financial statements for company ABC and asks you if it is a good idea to buy. In particular, he wants you to estimate whether the current price of their stock is reasonable, undervalued or overvalued. Based on the information given, you have synthesized the assumptions below. Use these to answer the following questions:

1) Build pro-forma Balance Sheets and Income Statements for the next 6 years

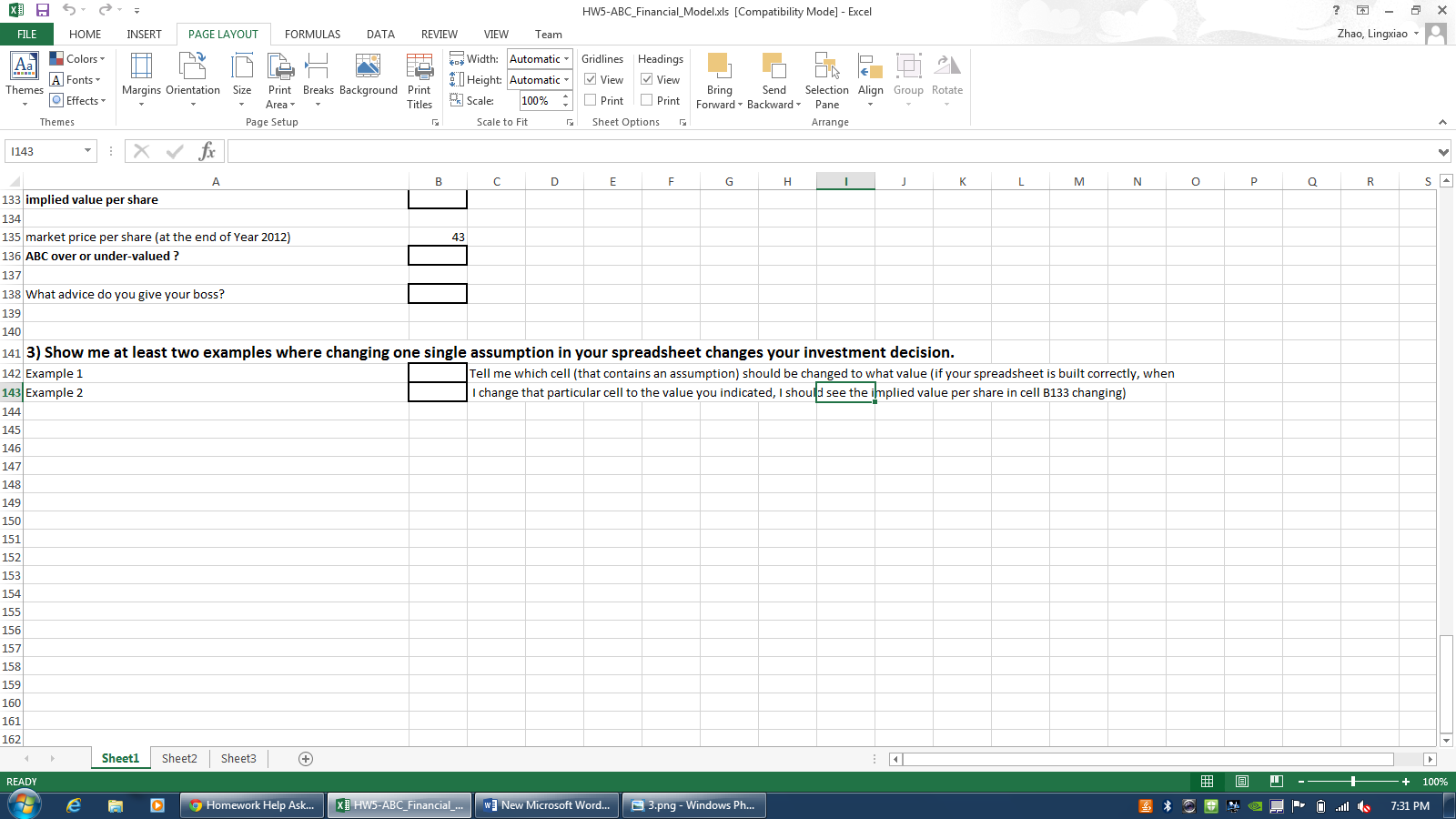

2) Is the company overvalued or undervalued according to your assumptions? What advice would you give your boss?

3) Show me at least two examples where changing one single assumption in your spreadsheet changes your investment decision.

Note: This case closely matches the First Financial model example posted on the website. Use that as an example if you get stuck.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started