Question

Building a Model - Marvel Renovations.xlsx Start with the partial model in the file attached. Marvel Pence, CEO of Marvels Renovations, a custom building and

Building a Model - Marvel Renovations.xlsx

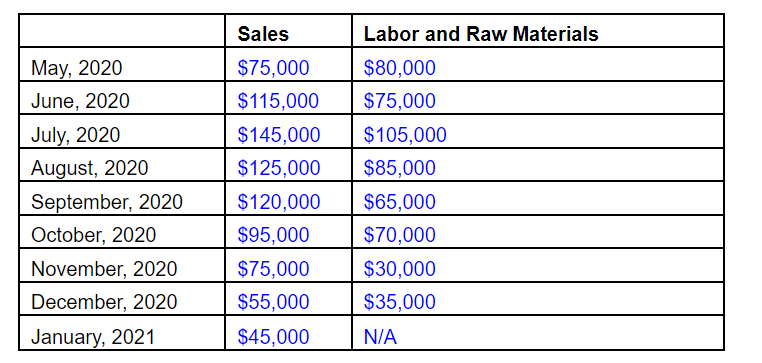

Start with the partial model in the file attached. Marvel Pence, CEO of Marvels Renovations, a custom building and repair company, is preparing documentation for a line of credit request from his commercial banker. Among the required documents is a detailed sales forecast for parts of 2020 and 2021:

Estimates obtained from the credit and collection department are as follows: collections within the month of sale, 20%; collections during the month following the sale, 60%; collections the second month following the sale, 25%. Payments for labor and raw materials are typically made during the month following the one in which these costs were incurred. Total costs for labor and raw materials are estimated for each month as shown in the table. General and administrative salaries will amount to approximately $25,000 a month; lease payments under long-term lease contracts will be $7,000 a month; depreciation charges will be $8,000 a month; miscellaneous expenses will be $5,000 a month; income tax payments of $30,000 will be due in both September and December; and a progress payment of $95,000 on a new office suite must be paid in October. Cash on hand on July 1 will amount to $70,000, and a minimum cash balance of $30,000 will be maintained throughout the cash budget period.

- Prepare a monthly cash budget for the last 6 months of 2020.

- Prepare an estimate of the required financing (or excess funds)that is, the amount of money Marvels Renovations will need to borrow (or will have available to invest)for each month during that period.

- Would the cash budget be accurate if inflows came in all during the month, but outflows were bunched early in the month?

- If its customers began to pay late, this would slow down collections and thus increase the required loan amount. Also, if sales dropped off, this would have an effect on the required loan. Do a sensitivity analysis that shows the effects of these two factors on the max loan requirement. Assume the purchases of labor and raw material also vary by the sales adjustment factor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started