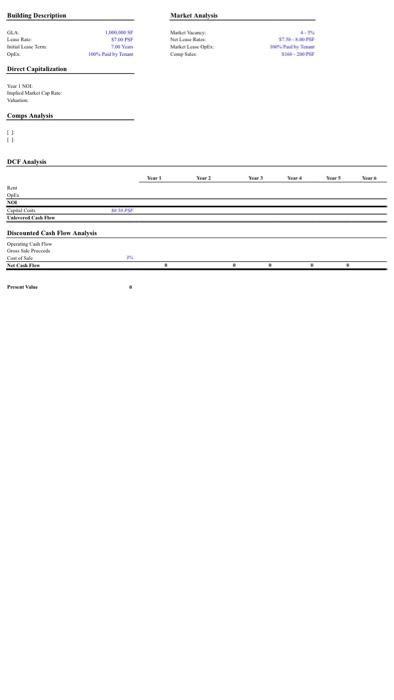

Building Description Market Analysis Direct Capitalizati Comps Analysis 8 DKCFA bar! Ver Year Ola Discounted Cashew Analysis Gold Get of Sale rather 1. React: A loan with an 80% loan to value ratio is preferable to a loan with a 50% loan to value ratio. 2. React: When evaluating the attractiveness of an investment, you should mainly focus on your equity IRR because it tells you the return you will realize on your invested money. 3. React: If a buyer of a property says that they purchased it for a 9% cap rate, while the seller of the same property says they sold it for an 8% cap rate, one of them must be lying. 4. React: A loan with a 7% interest rate is more attractive than a loan with 7.5% interest rate as long as both loans are of the same length and the same amortization schedule. 5. React: Debt service coverage (DSCR) is the most important metric when considering the sizing of a commercial mortgage. 6. Wal-Mart has approached you with the opportunity to enter a sale lease-back transaction with them on a one million square foot warehouse that they have recently developed. In typical Wal-Mart fashion, they have given you a "take it or leave it" final offer. The terms are: Purchase Price: $165 million Facility Size 1,000,000 SF Lease Term 7 years Rent S7 PSF NNN Operating Expenses Wal-Mart (tenant) pays all operating expenses, utilities, and property taxes (owner pays none) Renewal Options 7-year extension at $8 per ft a second 7 year extension at $9.50 per ft a third 7 year extension at $11.50 per ft. All at Wal-Mart's choice (i.c. it's Wal-Mart's option). Wal-Mart pays all operating expenses, utilities, property taxes, and capital expenditures undertaken during all lease renewal periods. You know the market and feel that the location is good, and that the warehouse market is in good supply/demand balance. Vacancy rates are 4% - 5% in quality facilities, while net rents in the market are running about $7.50 - $8 PSF (1.c. a slight oth WM Vahusika metric when considering the sizing of a commercial mortgage. 6. Wal-Mart has approached you with the opportunity to enter a sale lease-back transaction with them on a one million square foot warehouse that they have recently developed. In typical Wal-Mart fashion, they have given you a "take it, or leave it" final offer. The terms are: Purchase Price: $165 million Facility Size 1,000,000 SF Lease Term 7 years Rent S7 PSF NNN Operating Expenses Wal-Mart (tenant) pays all operating expenses, utilities, and property taxes (owner pays none) Renewal Options 7-year extension at $8 per ft a second 7 year extension at $9.50 per ft a third 7 year extension at $11.50 per A. All at Wal-Mart's choice (i.c. it's Wal-Mart's option). Wal-Mart pays all operating expenses, utilities, property taxes, and capital expenditures undertaken during all lease renewal periods. You know the market and feel that the location is good, and that the warehouse market is in good supply/demand balance. Vacancy rates are 4% - 5% in quality facilities, while net rents in the market are running about $7.50 - $8 PSF (i.e. a slight premium to the Wal-Mart lease). You have recently seen comparable sales that have traded in the range of S160 - $200 PSF. You also know that implied discount rates are currently at about a 3% premium to implied cap rates and capital costs are running at $0.50 PSF per annum. You know from your Real Estate Finance & Investments classes that you can value a building using a direct capitalization approach, a comps analysis and a DCF analysis. You also have a handy template that you've been using for these analyses which you will need to complete in order to come to a view on value. It's decision time...would you agree to pay the $150 million that Wal-Mart is asking? Why or why not? 1 1 React: A loan with an 80% loan to value ratio is preferable to a loan with a 50% loan to value ratio. 2. React: When evaluating the attractiveness of an investment, you should mainly focus on your equity IRR because it tells you the return you will realize on your invested money. 3. React: If a buyer of a property says that they purchased it for a 9% cap rate, while the seller of the same property says they sold it for an 8% cap rate, one of them must be lying. 4. React: A loan with a 7% Interest rate is more attractive than a loan with 7.5% interest rate as long as both loans are of the same length and the same amortization schedule. 5. React: Debt service coverage (SCR) is the most important metric when considering the sizing of a commercial mortgage 6. Wal-Mart has approached you with the opportunity to enter a sale lease back transaction with them on a one million square foot warehouse that they have recently developed. In typical Wal-Mart fashion, they have given you a "take it or leave it" final offer. The terms are Purchase Price: Facility Size Lease Term Rent Operating Expenses $165 million 1,000,000 SF 7 years $7 PSF NNN Wal-Mart (tenant) pays all operating expenses, utilities, and property taxes (owner pays none) 7-year extension at $8 peeft second year extension at $9.50 per ft a third 7 year extension at $1150 per ft- All at Wal Mart's choice (le. It's Wal Mart's option). Wal-Mart pays all operating expenses, utilities property taxes and capital expenditures undertaken during all lease renewal periods Renewal Options You know the market and feel that the location s good, and that the warehouse market is in good suppl/demand balance. Vacancy rates are 4% 5% quality facilities, while net rents in the market are running about $7.50 S8 PSE .. a slight premium to the Wal Man lease) You have recently seen comparable sales that have traded in the range of $160 - $200 PSF. You also know that implied discount rates are currently at about # 33 premium to implied top rates and capital costs are running at 50.50 PSF MacBook Pro Building Description Market Analysis Direct Capitalizati Comps Analysis 8 DKCFA bar! Ver Year Ola Discounted Cashew Analysis Gold Get of Sale rather 1. React: A loan with an 80% loan to value ratio is preferable to a loan with a 50% loan to value ratio. 2. React: When evaluating the attractiveness of an investment, you should mainly focus on your equity IRR because it tells you the return you will realize on your invested money. 3. React: If a buyer of a property says that they purchased it for a 9% cap rate, while the seller of the same property says they sold it for an 8% cap rate, one of them must be lying. 4. React: A loan with a 7% interest rate is more attractive than a loan with 7.5% interest rate as long as both loans are of the same length and the same amortization schedule. 5. React: Debt service coverage (DSCR) is the most important metric when considering the sizing of a commercial mortgage. 6. Wal-Mart has approached you with the opportunity to enter a sale lease-back transaction with them on a one million square foot warehouse that they have recently developed. In typical Wal-Mart fashion, they have given you a "take it or leave it" final offer. The terms are: Purchase Price: $165 million Facility Size 1,000,000 SF Lease Term 7 years Rent S7 PSF NNN Operating Expenses Wal-Mart (tenant) pays all operating expenses, utilities, and property taxes (owner pays none) Renewal Options 7-year extension at $8 per ft a second 7 year extension at $9.50 per ft a third 7 year extension at $11.50 per ft. All at Wal-Mart's choice (i.c. it's Wal-Mart's option). Wal-Mart pays all operating expenses, utilities, property taxes, and capital expenditures undertaken during all lease renewal periods. You know the market and feel that the location is good, and that the warehouse market is in good supply/demand balance. Vacancy rates are 4% - 5% in quality facilities, while net rents in the market are running about $7.50 - $8 PSF (1.c. a slight oth WM Vahusika metric when considering the sizing of a commercial mortgage. 6. Wal-Mart has approached you with the opportunity to enter a sale lease-back transaction with them on a one million square foot warehouse that they have recently developed. In typical Wal-Mart fashion, they have given you a "take it, or leave it" final offer. The terms are: Purchase Price: $165 million Facility Size 1,000,000 SF Lease Term 7 years Rent S7 PSF NNN Operating Expenses Wal-Mart (tenant) pays all operating expenses, utilities, and property taxes (owner pays none) Renewal Options 7-year extension at $8 per ft a second 7 year extension at $9.50 per ft a third 7 year extension at $11.50 per A. All at Wal-Mart's choice (i.c. it's Wal-Mart's option). Wal-Mart pays all operating expenses, utilities, property taxes, and capital expenditures undertaken during all lease renewal periods. You know the market and feel that the location is good, and that the warehouse market is in good supply/demand balance. Vacancy rates are 4% - 5% in quality facilities, while net rents in the market are running about $7.50 - $8 PSF (i.e. a slight premium to the Wal-Mart lease). You have recently seen comparable sales that have traded in the range of S160 - $200 PSF. You also know that implied discount rates are currently at about a 3% premium to implied cap rates and capital costs are running at $0.50 PSF per annum. You know from your Real Estate Finance & Investments classes that you can value a building using a direct capitalization approach, a comps analysis and a DCF analysis. You also have a handy template that you've been using for these analyses which you will need to complete in order to come to a view on value. It's decision time...would you agree to pay the $150 million that Wal-Mart is asking? Why or why not? 1 1 React: A loan with an 80% loan to value ratio is preferable to a loan with a 50% loan to value ratio. 2. React: When evaluating the attractiveness of an investment, you should mainly focus on your equity IRR because it tells you the return you will realize on your invested money. 3. React: If a buyer of a property says that they purchased it for a 9% cap rate, while the seller of the same property says they sold it for an 8% cap rate, one of them must be lying. 4. React: A loan with a 7% Interest rate is more attractive than a loan with 7.5% interest rate as long as both loans are of the same length and the same amortization schedule. 5. React: Debt service coverage (SCR) is the most important metric when considering the sizing of a commercial mortgage 6. Wal-Mart has approached you with the opportunity to enter a sale lease back transaction with them on a one million square foot warehouse that they have recently developed. In typical Wal-Mart fashion, they have given you a "take it or leave it" final offer. The terms are Purchase Price: Facility Size Lease Term Rent Operating Expenses $165 million 1,000,000 SF 7 years $7 PSF NNN Wal-Mart (tenant) pays all operating expenses, utilities, and property taxes (owner pays none) 7-year extension at $8 peeft second year extension at $9.50 per ft a third 7 year extension at $1150 per ft- All at Wal Mart's choice (le. It's Wal Mart's option). Wal-Mart pays all operating expenses, utilities property taxes and capital expenditures undertaken during all lease renewal periods Renewal Options You know the market and feel that the location s good, and that the warehouse market is in good suppl/demand balance. Vacancy rates are 4% 5% quality facilities, while net rents in the market are running about $7.50 S8 PSE .. a slight premium to the Wal Man lease) You have recently seen comparable sales that have traded in the range of $160 - $200 PSF. You also know that implied discount rates are currently at about # 33 premium to implied top rates and capital costs are running at 50.50 PSF MacBook Pro