building is 11 SW Curry St1, portland

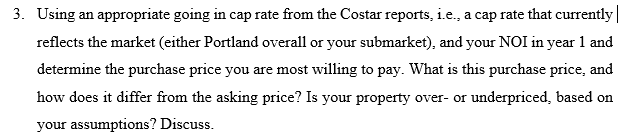

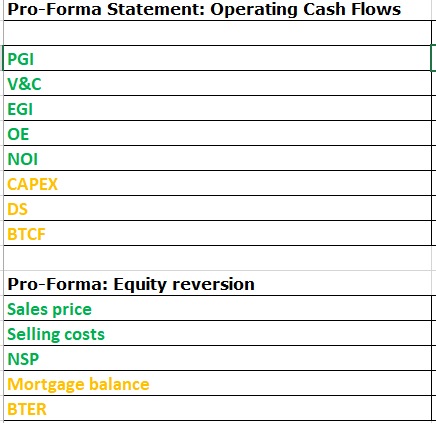

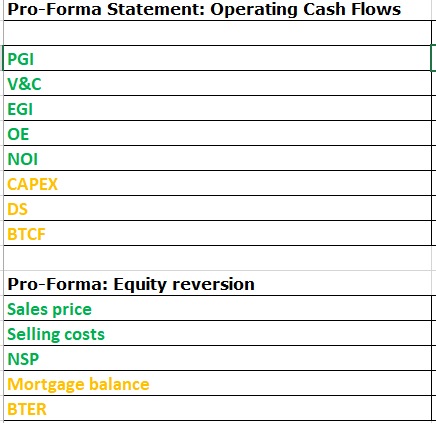

Part 2: Building Level Analysis (Work on after lecture on 10/14) In this second part, you develop pro-forma statements for operating and equity reversion cash flows at the building level based on your assumptions from part 1. Deliverables for part 2: Create pro-forma statements in Excel using the outline in D2L. Present the results of your analysis (i. e., the maximum purchase price you are willing to pay) and answer the question in this part in your report Word file from part 1. Submit your work as Word and Tasks: 1. Add your assumptions from part 1 as numbers into an input sheet in Excel. Make sure you state what number represents which input. For example, for the input rental rate 1- bedroom, your assumption (number) may be $1,200 per month. 2. Based on your assumptions about rental rates, rental rate growth. V&C, operating expenses, expense inflation, and going out cap rate, derive the NOI cash flows from year 1 to 10 and the sales price in year 10. Assume a 2% selling costs to obtain the net selling costs. Make sure all your calculations are linked to the input cells. 3. Using an appropriate going in cap rate from the Costar reports, i.e., a cap rate that currently reflects the market (either Portland overall or your submarket), and your NOI in year 1 and determine the purchase price you are most willing to pay. What is this purchase price, and how does it differ from the asking price? Is your property over- or underpriced, based on your assumptions? Discuss. Pro-Forma Statement: Operating Cash Flows PGI V&C EGI OE NOI CAPEX DS BTCF Pro-Forma: Equity reversion Sales price Selling costs NSP Mortgage balance BTER Part 2: Building Level Analysis (Work on after lecture on 10/14) In this second part, you develop pro-forma statements for operating and equity reversion cash flows at the building level based on your assumptions from part 1. Deliverables for part 2: Create pro-forma statements in Excel using the outline in D2L. Present the results of your analysis (i. e., the maximum purchase price you are willing to pay) and answer the question in this part in your report Word file from part 1. Submit your work as Word and Tasks: 1. Add your assumptions from part 1 as numbers into an input sheet in Excel. Make sure you state what number represents which input. For example, for the input rental rate 1- bedroom, your assumption (number) may be $1,200 per month. 2. Based on your assumptions about rental rates, rental rate growth. V&C, operating expenses, expense inflation, and going out cap rate, derive the NOI cash flows from year 1 to 10 and the sales price in year 10. Assume a 2% selling costs to obtain the net selling costs. Make sure all your calculations are linked to the input cells. 3. Using an appropriate going in cap rate from the Costar reports, i.e., a cap rate that currently reflects the market (either Portland overall or your submarket), and your NOI in year 1 and determine the purchase price you are most willing to pay. What is this purchase price, and how does it differ from the asking price? Is your property over- or underpriced, based on your assumptions? Discuss. Pro-Forma Statement: Operating Cash Flows PGI V&C EGI OE NOI CAPEX DS BTCF Pro-Forma: Equity reversion Sales price Selling costs NSP Mortgage balance BTER