Question

BUILD-UP METHOD SIMULATION Assignment: Prepare a capitalization rate and company specific risk using the buildup method based on the information below. Please justify any judgments

BUILD-UP METHOD SIMULATION

Assignment: Prepare a capitalization rate and company specific risk using the buildup method based on the information below. Please justify any judgments with facts and evidence.

Risk Free Rate ____________

Equity Risk Premium ____________

Size Premium ___________

Specific Company Risk ____________

After-Tax Discount Rate ____________

Growth Rate ____________

After-Tax Capitalization Rate _____________

Simulation Facts:

Risk-Free Rate A safe rate or the amount that any investor would receive for a risk-free investment. A U.S. Treasury bond with approximately 20 years remaining to maturity is the typical benchmark. The rate of return for these types of bonds on or around December 31, 20XX (2.47%).

An equity risk premium that represents the additional premium an investor is receiving for the risk of investing in corporate equities over risk-free investments located in the Duff & Phelps, 20XX Valuation Handbook (7.00%).

A small company risk premium that represents the beta-adjusted size premium as illustrated in the 10th deciles of Duff & Phelps Key Variables in Estimating the Cost of Capital located in Duff & Phelps, 20XX Valuation Handbook (11.98%)

A Company-specific risk premium is added to the discount rate. The premium is comprised of various factors such as company performance, management, future expectations and, the size of the company. In this valuation analysts judgment, an additional ____ premium should be added to the discount rate.

Use the following subject company characteristics in your determination of Company-Specific Risk range 1%-10%

- Business revenue growth company management has outperformed inflation.

- Companys financial risk. Debt-free firms have a much lower risk of financial failure than heavily leveraged businesses. The subject company has moderate debt levels.

- Operational risks. Consider the difficulty and costs associated with growing your business.

Subject company is need of technology upgrades and retraining staff.

- Business profitability Is in line with industry peers.

- Customer concentration. The subject company relies on a few large customers for most of its income.

- Product concentration. The subject company has a diverse product mix 7. Market concentration. The subject company sells into a market that is limited.

- Competitive position. A company has a well-protected market niche but is exposed to large, well-funded competitors.

- Quality of management team. The subject company has experienced business managers

- Quality of staff. Staff is made of long-term employees.

Growth rate considerations select a, b, or c. Justify your decision: a: The 5-year average rate of inflation in the United States (1.31%).

Year Revenue

- $9,378,517

- $9,821,595

- $10,229,991

- $10,495,261

- $11,088,018

b: Average Annual Growth Rate c: Compound Growth

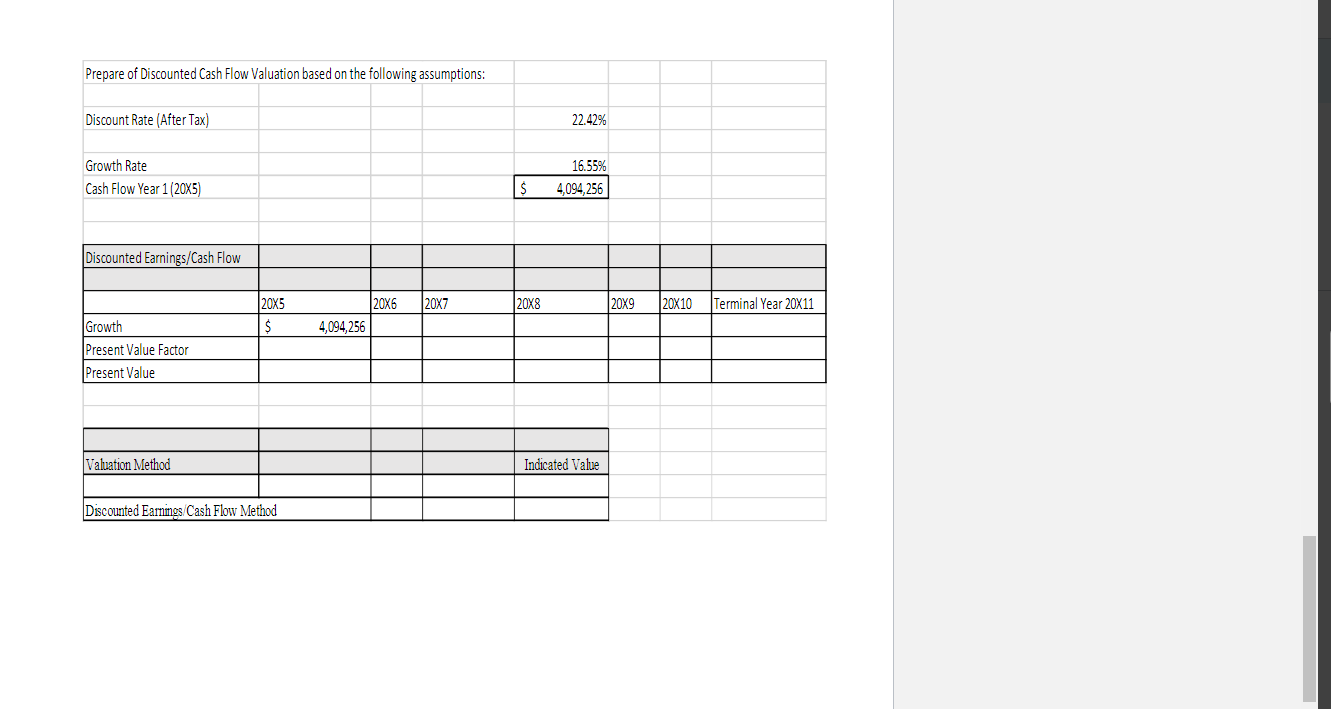

c: Compound Growth d: The discounted cash flow  method is directly related to capitalization of cash flow/earnings method.

method is directly related to capitalization of cash flow/earnings method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started