Question

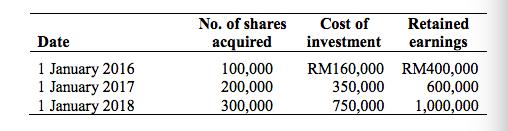

Burau Bhd (BB) has 1,000,000 ordinary shares issued at RM1.00 each. Andaman Bhd (AB) acquired interest in the equity shares of BB as follows: The

Burau Bhd (BB) has 1,000,000 ordinary shares issued at RM1.00 each. Andaman Bhd (AB) acquired interest in the equity shares of BB as follows:

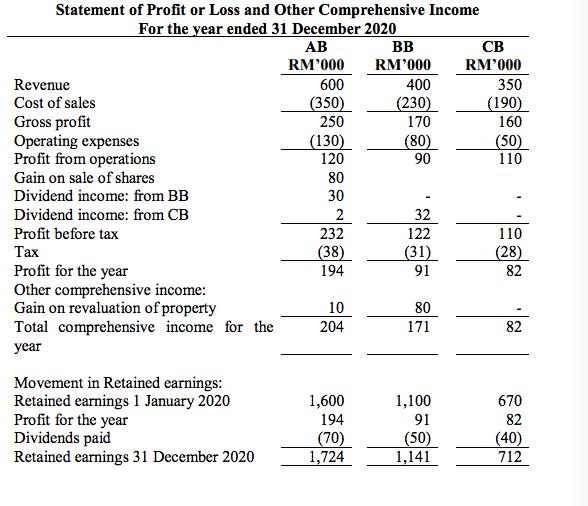

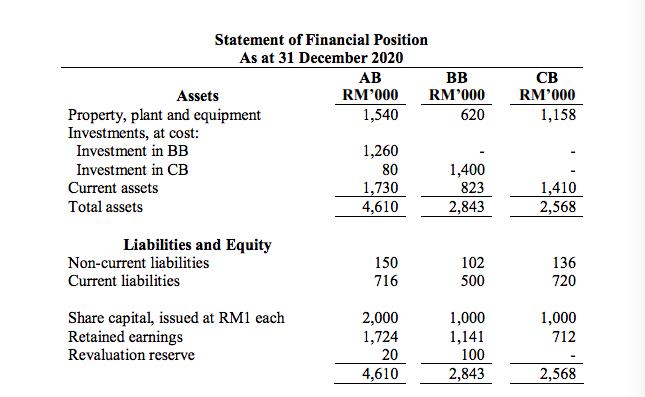

The price paid by AB for the acquisition on 1 January 2018 was representative of the fair value of BB. On 1 January 2016, AB also acquired 15% interest in Cenang Bhd (CB) for a consideration of RM240,000. CB has 1,000,000 ordinary shares issued at RM1.00 each. The retained earnings of CB on this date were RM600,000. The market price of CB’s shares on this date was RM1.60 per share. On 1 January 2019, BB acquired 80% interest in CB for a consideration of RM1,400,000 when the retained earnings of CB were RM650,000. The market price of CB’s shares on this date was RM1.75 per share. The financial statements of the three companies for the year ended 31 December 2020 were as follows:

Additional information:

1. On 1 January 2018, the net assets of BB were stated at fair value except for its building. The market value of the building was RM50,000 higher than its book value. No adjustment has been made for the value on this date. The building has a remaining useful life of 20 years. During 2020, the building was revalued to its market value. The revaluation has produced a revaluation surplus of RM80,000. Ignore real property gains tax.

2. On 1 January 2019, the net assets of CB were stated at fair value except for its freehold land. The land was recorded at its historical cost although the market value of the land was RM100,000 higher than the historical cost. No revaluation has been made to the value of the land.

3. For investment in BB, there was impairment loss of RM10,000 for goodwill for financial year ended 31 December 2020. No impairment loss in the prior years.

4. On 1 April 2020, AB sold two-third of its interest in CB for RM240,000.

5. AB manufactures machinery for sale to customers. During 2020, AB sold 5 machines to CB for RM200,000. The profit margin to AB was 40% on selling price. CB recorded the machines as its property, plant and equipment. The machines were depreciated at 20% per year. Full year depreciation was recorded in the year of purchase.

6. During 2020, BB sold inventories for RM30,000 to AB. As at 31 December 2020, RM9,000 remained in the ending inventories of AB. The corresponding intragroup sales and ending inventories for the 2019 financial year were RM45,000 and RM11,000, respectively. The profit margin to BB was 20% on selling price.

7. AB measures non-controlling interest at fair value. 8. Assume tax rate is 25%.

Compute the goodwill on consolidation for investments in BB and CB.

Date 1 January 2016 1 January 2017 1 January 2018 No. of shares acquired 100,000 200,000 300,000 Cost of Retained investment earnings RM160,000 RM400,000 350,000 600,000 750,000 1,000,000

Step by Step Solution

3.37 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER INTRODUCTION Section 287 of the Companies Act 2013 provides that holding company controls the composition of the Board of Directors or exercise...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started