Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Burgher Inc. experienced a tax loss in Yr 3. The company shows the following taxable income (loss) and tax rate for yr1 through yr3. There

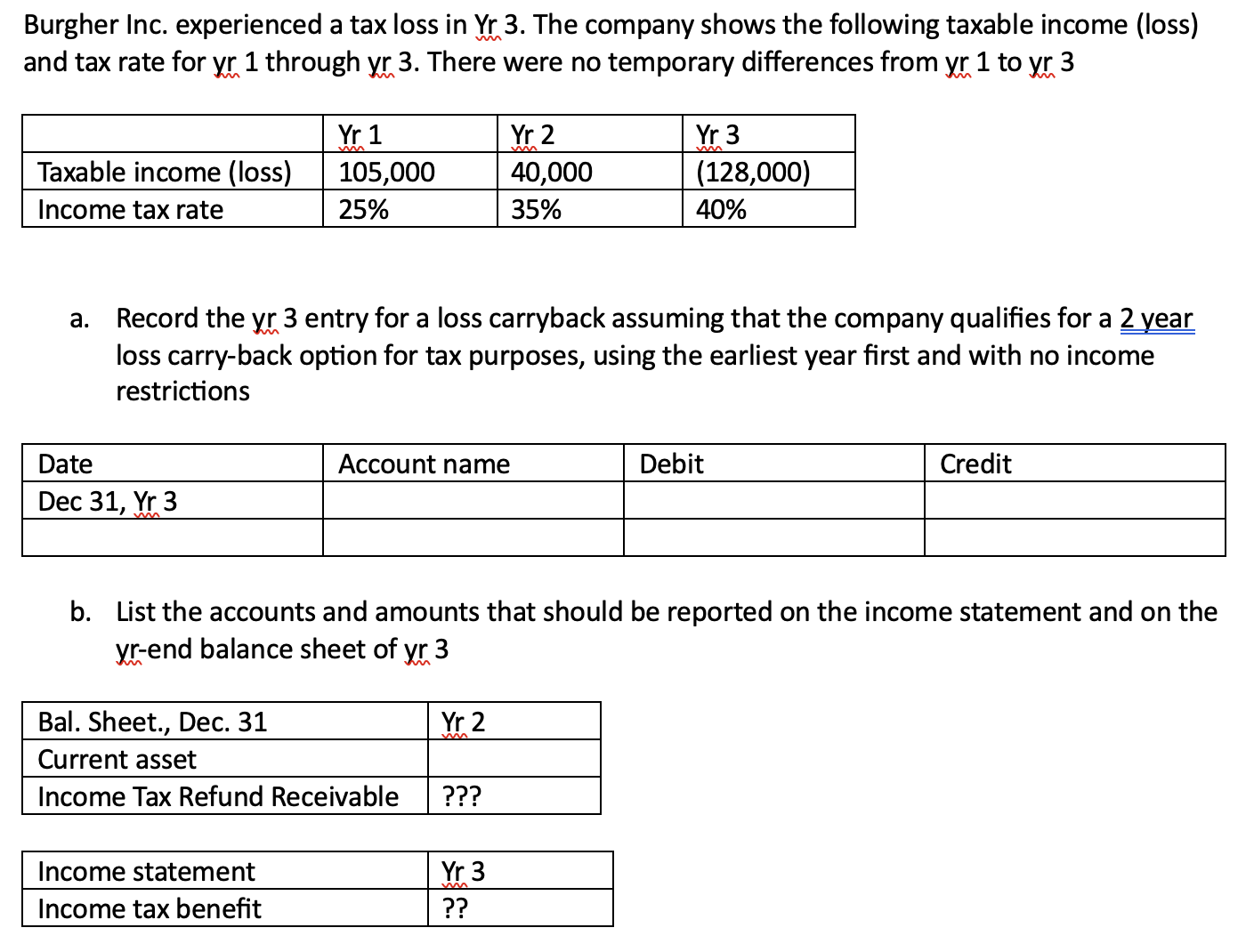

Burgher Inc. experienced a tax loss in Yr 3. The company shows the following taxable income (loss) and tax rate for yr1 through yr3. There were no temporary differences from yr1 to yr3 a. Record the yr 3 entry for a loss carryback assuming that the company qualifies for a 2 year loss carry-back option for tax purposes, using the earliest year first and with no income restrictions b. List the accounts and amounts that should be reported on the income statement and on the yr-end balance sheet of yr3

Burgher Inc. experienced a tax loss in Yr 3. The company shows the following taxable income (loss) and tax rate for yr1 through yr3. There were no temporary differences from yr1 to yr3 a. Record the yr 3 entry for a loss carryback assuming that the company qualifies for a 2 year loss carry-back option for tax purposes, using the earliest year first and with no income restrictions b. List the accounts and amounts that should be reported on the income statement and on the yr-end balance sheet of yr3 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started