Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Burkina Faso sold $165,000 of goods and accepted the customer's $165,000 8%, 1-year note receivable in exchange. Assuming 8% approximates the market rate of

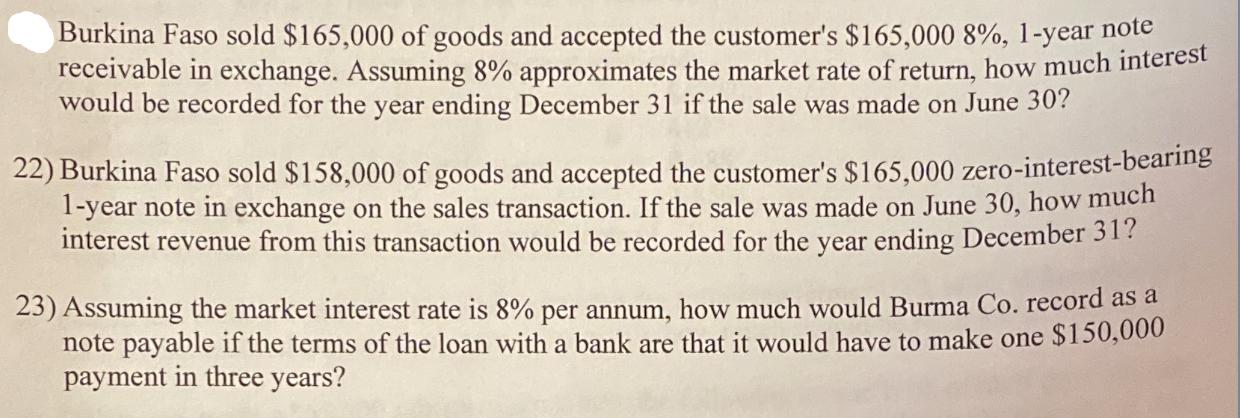

Burkina Faso sold $165,000 of goods and accepted the customer's $165,000 8%, 1-year note receivable in exchange. Assuming 8% approximates the market rate of return, how much interest would be recorded for the year ending December 31 if the sale was made on June 30? 22) Burkina Faso sold $158,000 of goods and accepted the customer's $165,000 zero-interest-bearing 1-year note in exchange on the sales transaction. If the sale was made on June 30, how much interest revenue from this transaction would be recorded for the year ending December 31? 23) Assuming the market interest rate is 8% per annum, how much would Burma Co. record as a note payable if the terms of the loan with a bank are that it would have to make one $150,000 payment in three years?

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

21 To calculate the interest recorded for the year ending December 31 we need to determine the inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started