Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Burlington Motor Carriers, a trucking company, is considering the installation of a two - way mobile satellite messaging service on its 2 , 0 0

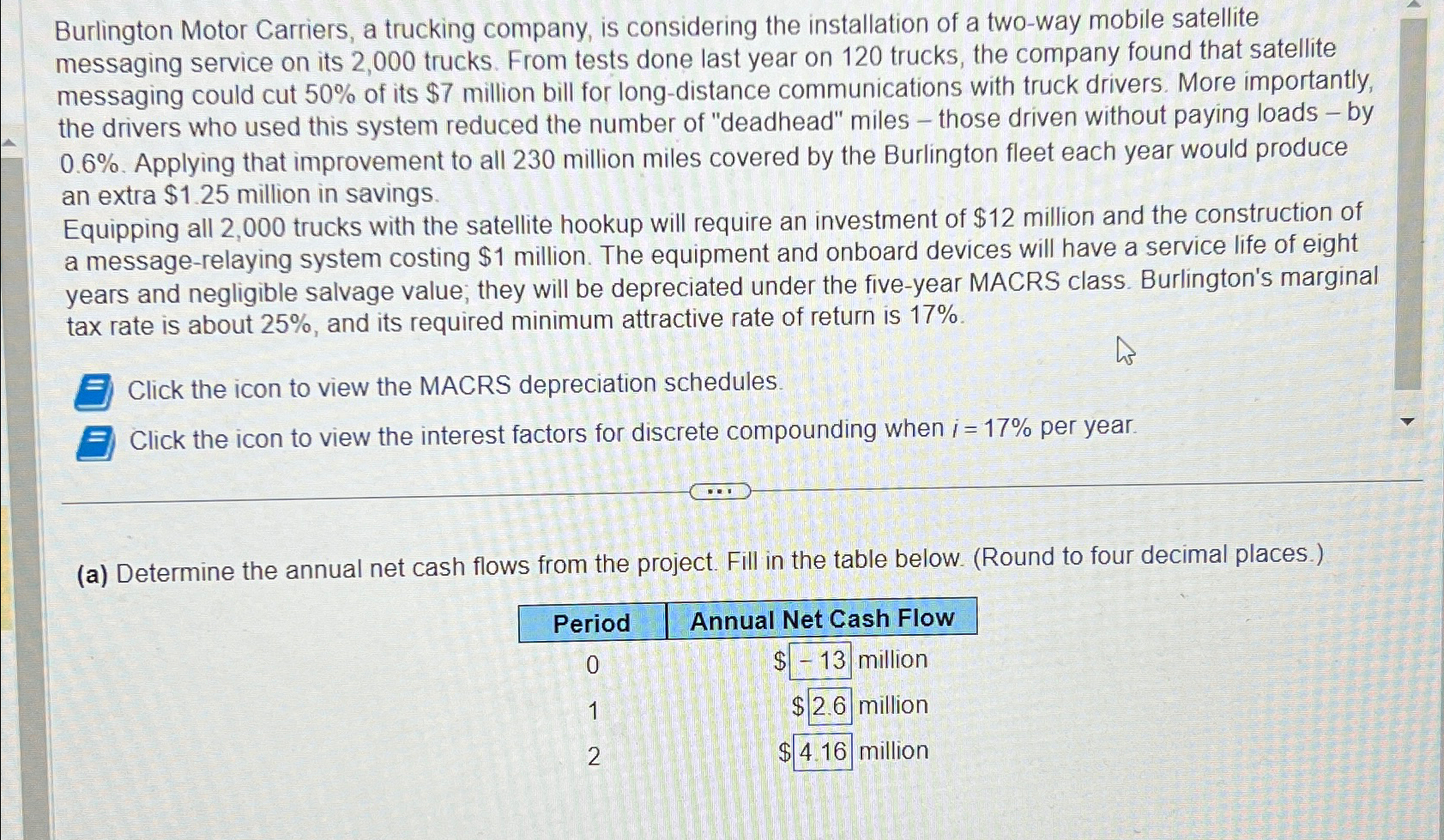

Burlington Motor Carriers, a trucking company, is considering the installation of a twoway mobile satellite messaging service on its trucks. From tests done last year on trucks, the company found that satellite messaging could cut of its $ million bill for longdistance communications with truck drivers. More importantly, the drivers who used this system reduced the number of "deadhead" miles those driven without paying loads by Applying that improvement to all million miles covered by the Burlington fleet each year would produce an extra $ million in savings.

Equipping all trucks with the satellite hookup will require an investment of $ million and the construction of a messagerelaying system costing $ million. The equipment and onboard devices will have a service life of eight years and negligible salvage value; they will be depreciated under the fiveyear MACRS class. Burlington's marginal tax rate is about and its required minimum attractive rate of return is

Click the icon to view the MACRS depreciation schedules.

Click the icon to view the interest factors for discrete compounding when per year.

a Determine the annual net cash flows from the project. Fill in the table below. Round to four decimal places.

tablePeriodAnnual Net Cash Flow million$ million$ million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started