Question

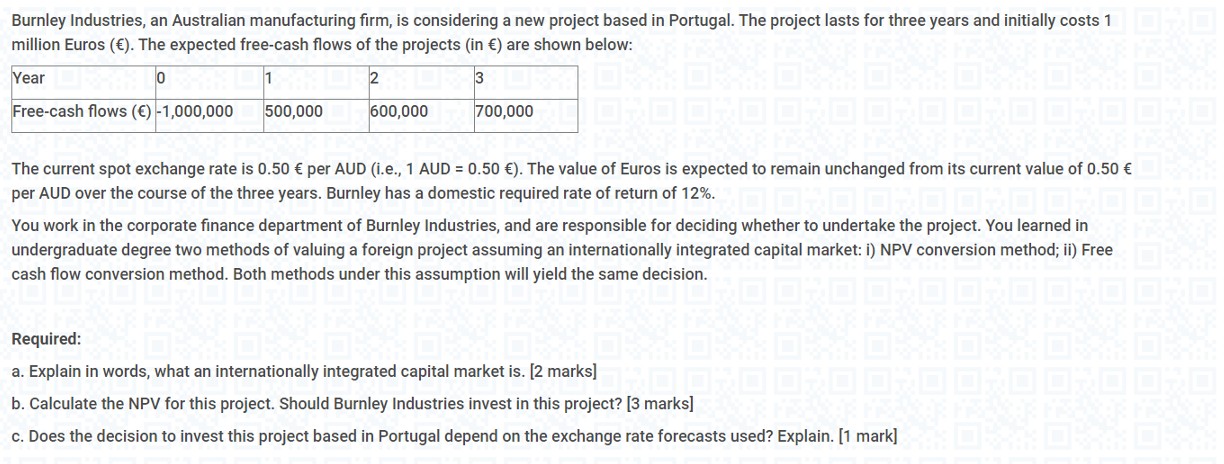

Burnley Industries, an Australian manufacturing firm, is considering a new project based in Portugal. The project lasts for three years and initially costs 1 million

Burnley Industries, an Australian manufacturing firm, is considering a new project based in Portugal. The project lasts for three years and initially costs 1\ million Euros (

). The expected free-cash flows of the projects (in

) are shown below:\ The current spot exchange rate is

0.50per AUD (i.e., 1 AUD

=0.50). The value of Euros is expected to remain unchanged from its current value of

0.50\ per AUD over the course of the three years. Burnley has a domestic required rate of return of

12%.\ You work in the corporate finance department of Burnley Industries, and are responsible for deciding whether to undertake the project. You learned in\ undergraduate degree two methods of valuing a foreign project assuming an internationally integrated capital market: i) NPV conversion method; ii) Free\ cash flow conversion method. Both methods under this assumption will yield the same decision.\ Required:\ a. Explain in words, what an internationally integrated capital market is. [2 marks]\ b. Calculate the NPV for this project. Should Burnley Industries invest in this project? [3 marks]\ c. Does the decision to invest this project based in Portugal depend on the exchange rate forecasts used? Explain. [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started