Question

Burt & Cameron, a Halifax accounting firm, has just taken on the audit of NorthJet, a small airline providing private charter service that began operations

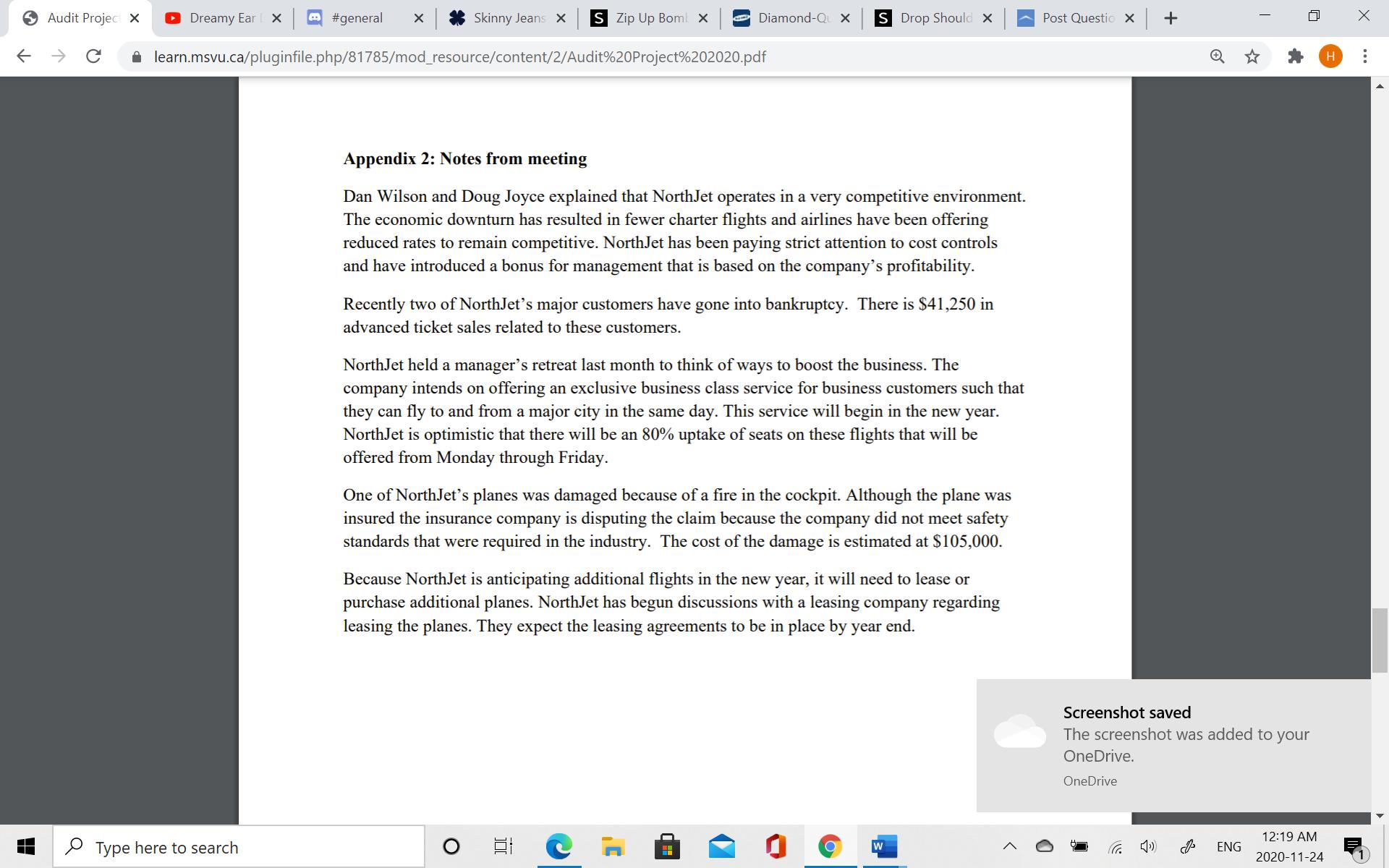

Burt & Cameron, a Halifax accounting firm, has just taken on the audit of NorthJet, a small airline providing private charter service that began operations in 2009. The airline is owned by Wilson and Doug Joyce. The previous auditor has resigned because of poor health. You are an audit senior with Burt & Cameron and have been asked to work on the audit. Northgate uses rented facilities at Halifax International airport. It has purchased three of its airplanes and is leasing six other planes. It employs six pilots full time and has a database of pilots that can be called if additional flights are required at any given time. Northgate has done well since it began operations, but Burt and Cameron are concerned about the profit for the first six months of this year. In addition, two of NorthJet’s planes have been grounded because of faulty electrical connections. The warranty has expired on these planes. You held an audit planning meeting with Dan Wilson, Doug Joyce, and Kyle Burt, the partner. You were provided with the interim financial statements for the first six months of the current year along with the prior year audited statements (Appendix 1). Your notes for the meeting are in appendix 2.A junior accountant from your office has done work on the accounts receivables and property plant and equipment. The work done is documented in Appendix 3.

Evaluate the audit work done by the audit junior on the accounts receivable and property plant and equipment and outline additional procedures that should be performed by the audit team on future work in this area. Clearly identify why more procedures are needed. Make use of headings, sub-headings and bullets points for these.

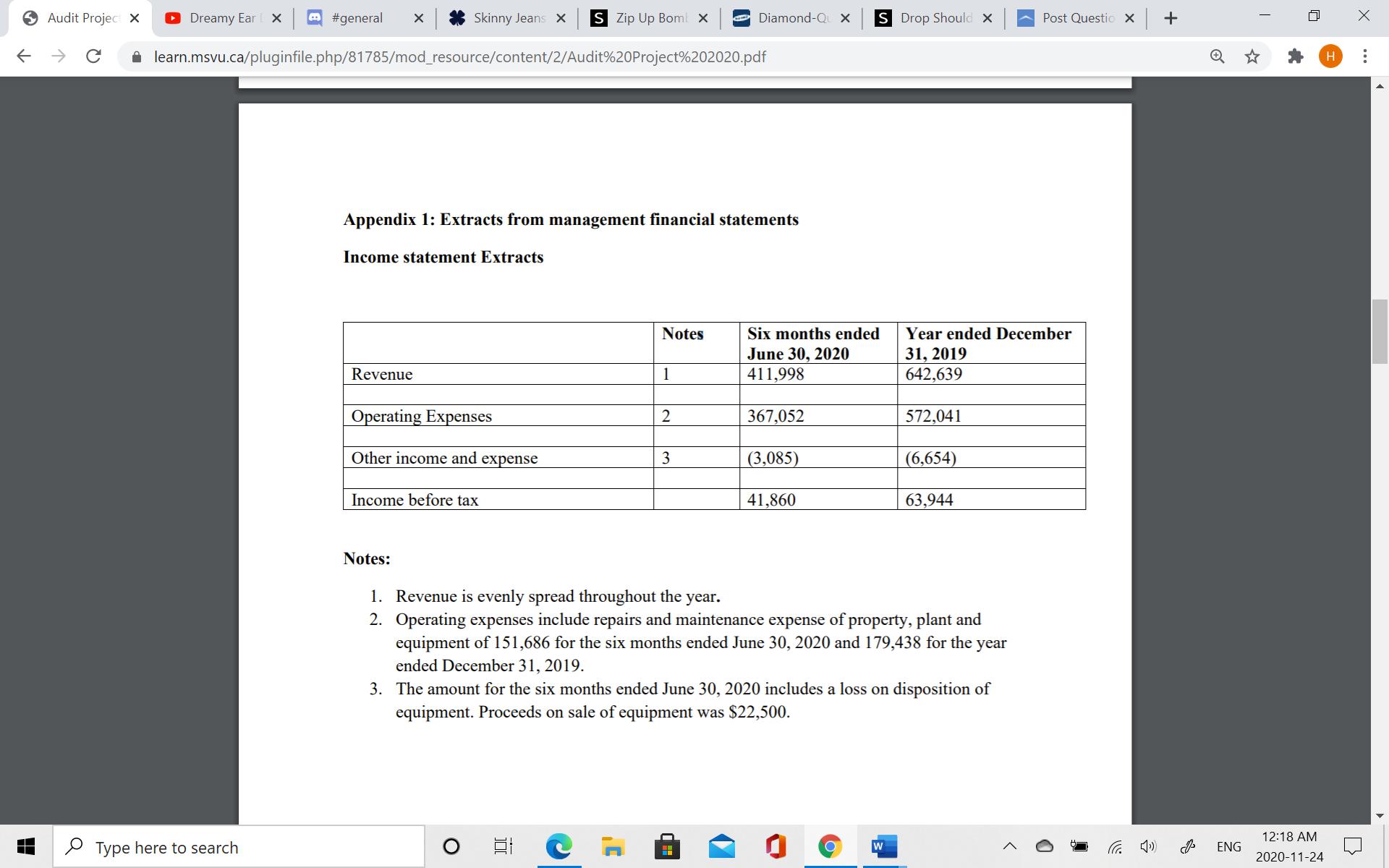

Audit Projec X O Dreamy Ear O #general Skinny Jeans x S Zip Up Boml x O Diamond-Q X S Drop Should X Post Questio x A learn.msvu.ca/pluginfile.php/81785/mod_resource/content/2/Audit%20Project%202020.pdf Appendix 1: Extracts from management financial statements Income statement Extracts Notes Six months ended Year ended December June 30, 2020 411,998 31, 2019 642,639 Revenue 1 Operating Expenses 2 367,052 572,041 Other income and expense 3 (3,085) |(6,654) Income before tax 41,860 63,944 Notes: 1. Revenue is evenly spread throughout the year. 2. Operating expenses include repairs and maintenance expense of property, plant and equipment of 151,686 for the six months ended June 30, 2020 and 179,438 for the year ended December 31, 2019. 3. The amount for the six months ended June 30, 2020 includes a loss on disposition of equipment. Proceeds on sale of equipment was $22,500. 12:18 AM P Type here to search O ENG 2020-11-24

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A review program for property plant and gear PPE is a bunch of steps that the review group need to follow for the legitimate execution of the review o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started