Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Burton Investments Ltd. is a Canadian controlled private corporation that sells office supplies. It owns 52 percent of the outstanding shares of Puligny Inc.

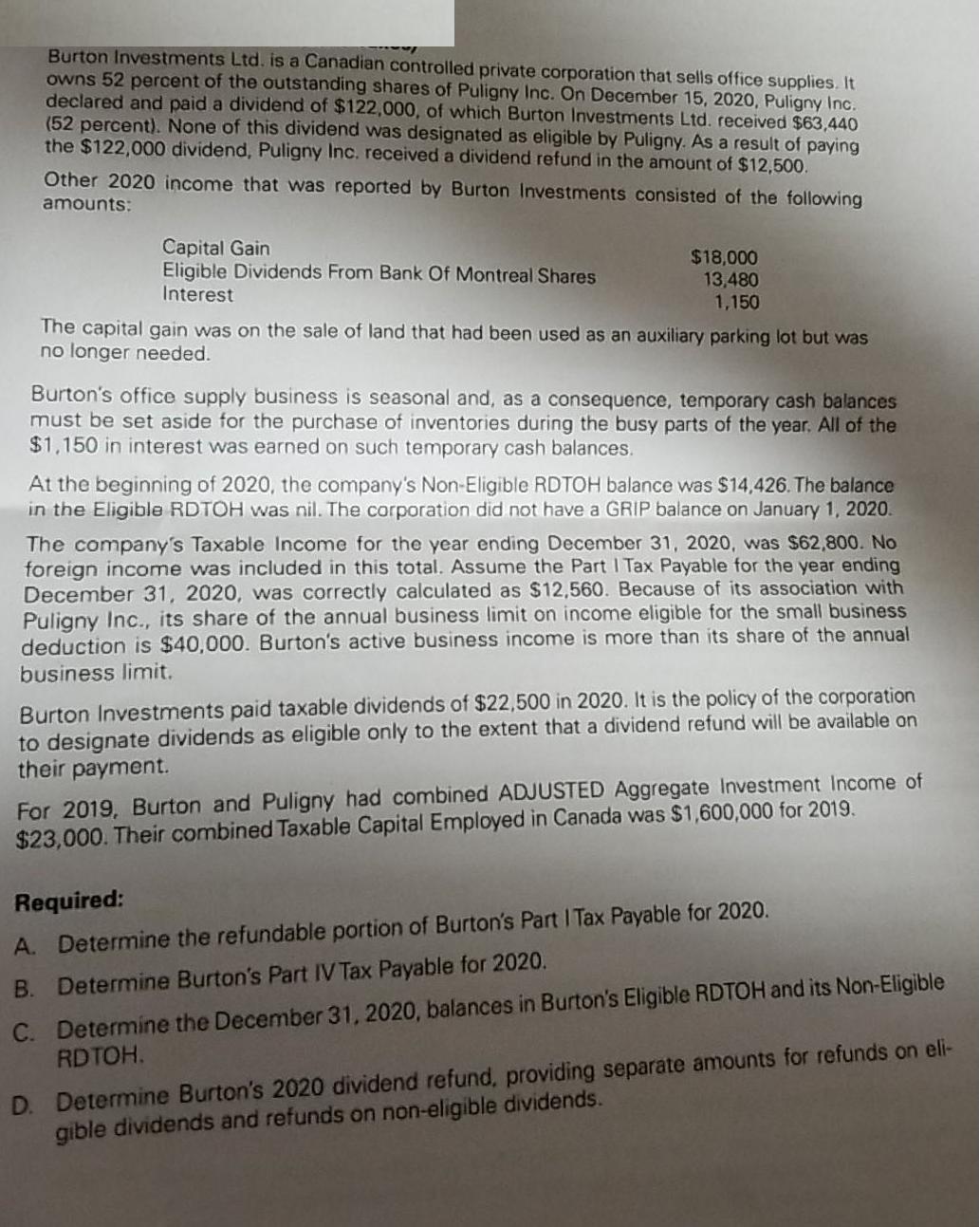

Burton Investments Ltd. is a Canadian controlled private corporation that sells office supplies. It owns 52 percent of the outstanding shares of Puligny Inc. On December 15, 2020, Puligny Inc. declared and paid a dividend of $122,000, of which Burton Investments Ltd. received $63,440 (52 percent). None of this dividend was designated as eligible by Puligny. As a result of paying the $122,000 dividend, Puligny Inc. received a dividend refund in the amount of $12,500. Other 2020 income that was reported by Burton Investments consisted of the following amounts: Capital Gain Eligible Dividends From Bank Of Montreal Shares Interest $18,000 13,480 1,150 The capital gain was on the sale of land that had been used as an auxiliary parking lot but was no longer needed. Burton's office supply business is seasonal and, as a consequence, temporary cash balances must be set aside for the purchase of inventories during the busy parts of the year, All of the $1,150 in interest was earned on such temporary cash balances. At the beginning of 2020, the company's Non-Eligible RDTOH balance was $14,426. The balance in the Eligible RDTOH was nil. The corporation did not have a GRIP balance on January 1, 2020. The company's Taxable Income for the year ending December 31, 2020, was $62,800. No foreign income was included in this total. Assume the Part I Tax Payable for the year ending December 31, 2020, was correctly calculated as $12,560. Because of its association with Puligny Inc., its share of the annual business limit on income eligible for the small business deduction is $40,000. Burton's active business income is more than its share of the annual business limit. Burton Investments paid taxable dividends of $22,500 in 2020. It is the policy of the corporation to designate dividends as eligible only to the extent that a dividend refund will be available on their payment. For 2019, Burton and Puligny had combined ADJUSTED Aggregate Investment Income of $23,000. Their combined Taxable Capital Employed in Canada was $1,600,000 for 2019. Required: A. Determine the refundable portion of Burton's Part I Tax Payable for 2020. C. Determine the December 31, 2020, balances in Burton's Eligible RDTOH and its Non-Eligible RDTOH. B. Determine Burton's Part IV Tax Payable for 2020. D. Determine Burton's 2020 dividend refund, providing separate amounts for refunds on eli- gible dividends and refunds on non-eligible dividends.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer to deteamine thee grefeurdalle Porteon f al given neurtons Paat i Tax pauall...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started