Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Burwell Manufacturing is organized into two divisions (Agriculture and Mining) and a corporate headquarters. The financial group of the corporate staff prepared financial operating

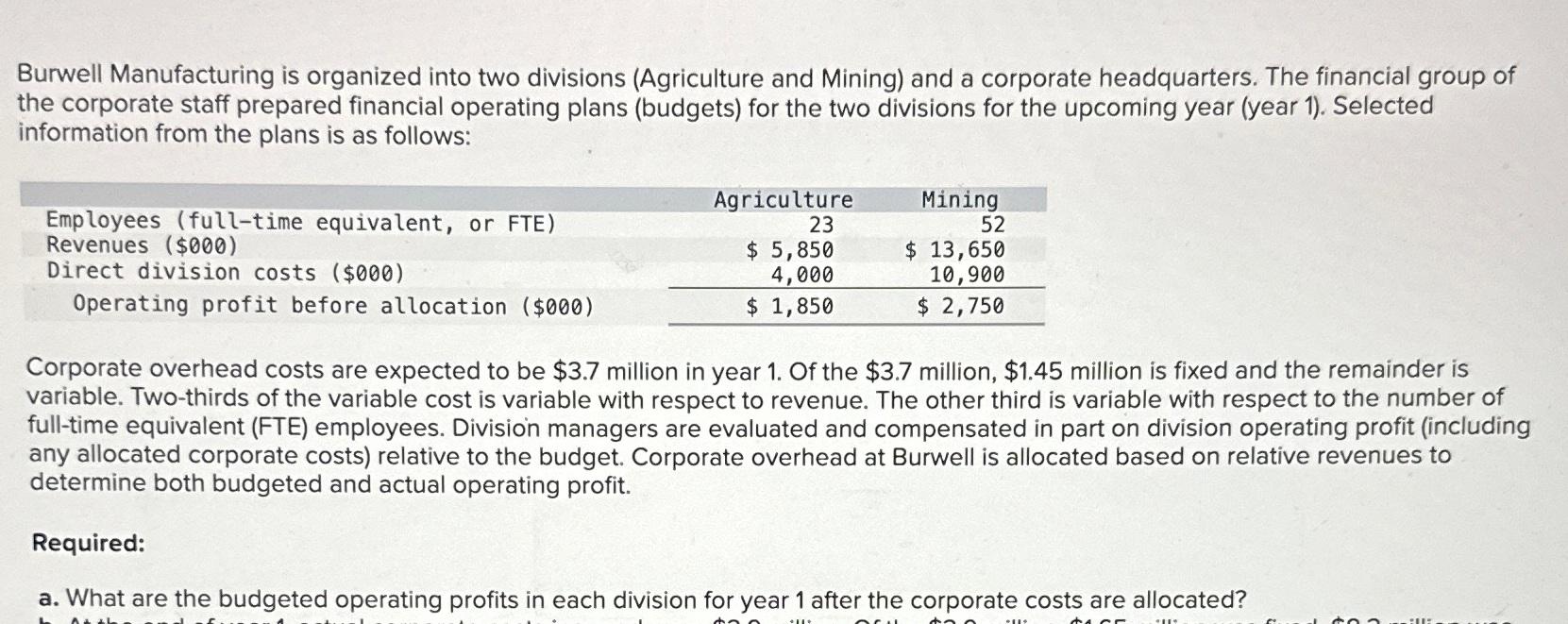

Burwell Manufacturing is organized into two divisions (Agriculture and Mining) and a corporate headquarters. The financial group of the corporate staff prepared financial operating plans (budgets) for the two divisions for the upcoming year (year 1). Selected information from the plans is as follows: Employees (full-time equivalent, or FTE) Revenues ($000) Direct division costs ($000) Operating profit before allocation ($000) Agriculture 23 Mining 52 $ 13,650 10,900 $ 2,750 $ 5,850 4,000 $ 1,850 Corporate overhead costs are expected to be $3.7 million in year 1. Of the $3.7 million, $1.45 million is fixed and the remainder is variable. Two-thirds of the variable cost is variable with respect to revenue. The other third is variable with respect to the number of full-time equivalent (FTE) employees. Division managers are evaluated and compensated in part on division operating profit (including any allocated corporate costs) relative to the budget. Corporate overhead at Burwell is allocated based on relative revenues to determine both budgeted and actual operating profit. Required: a. What are the budgeted operating profits in each division for year 1 after the corporate costs are allocated?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the budgeted operating profits in each division for year 1 after corporate costs are allocated we need to follow these steps 1 Determine the total corporate overhead costs 2 Allocate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664273abeca1b_980170.pdf

180 KBs PDF File

664273abeca1b_980170.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started