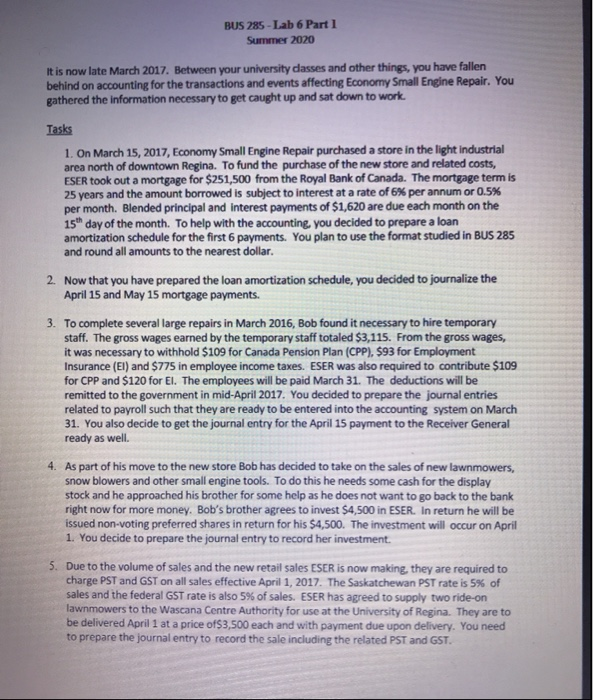

BUS 285 - Lab 6 Part 1 Summer 2020 It is now late March 2017. Between your university dasses and other things, you have fallen behind on accounting for the transactions and events affecting Economy Small Engine Repair. You gathered the information necessary to get caught up and sat down to work Tasks 1. On March 15, 2017, Economy Small Engine Repair purchased a store in the light industrial area north of downtown Regina. To fund the purchase of the new store and related costs, ESER took out a mortgage for $251,500 from the Royal Bank of Canada. The mortgage term is 25 years and the amount borrowed is subject to interest at a rate of 6% per annum or 0.5% per month. Blended principal and interest payments of $1,620 are due each month on the 15h day of the month. To help with the accounting, you decided to prepare a loan amortization schedule for the first 6 payments. You plan to use the format studied in BUS 285 and round all amounts to the nearest dollar. 2. Now that you have prepared the loan amortization schedule, you decided to journalize the April 15 and May 15 mortgage payments. 3. To complete several large repairs in March 2016, Bob found it necessary to hire temporary staff. The gross wages earned by the temporary staff totaled $3,115. From the gross wages, it was necessary to withhold $109 for Canada Pension Plan (CPP). $93 for Employment Insurance (EI) and $775 in employee income taxes. ESER was also required to contribute $109 for CPP and $120 for El. The employees will be paid March 31. The deductions will be remitted to the government in mid-April 2017. You decided to prepare the journal entries related to payroll such that they are ready to be entered into the accounting system on March 31. You also decide to get the journal entry for the April 15 payment to the Receiver General ready as well. 4. As part of his move to the new store Bob has decided to take on the sales of new lawnmowers, snow blowers and other small engine tools. To do this he needs some cash for the display stock and he approached his brother for some help as he does not want to go back to the bank right now for more money. Bob's brother agrees to invest $4,500 in ESER. In return he will be issued non-voting preferred shares in return for his $4,500. The investment will occur on April 1. You decide to prepare the journal entry to record her investment. 5. Due to the volume of sales and the new retail sales ESER is now making, they are required to charge PST and GST on all sales effective April 1, 2017. The Saskatchewan PST rate is 5% of sales and the federal GST rate is also 5% of sales. ESER has agreed to supply two ride-on lawnmowers to the Wascana Centre Authority for use at the University of Regina. They are to be delivered April 1 at a price of$3,500 each and with payment due upon delivery. You need to prepare the journal entry to record the sale including the related PST and GST. BUS 285 - Lab 6 Part 1 Summer 2020 It is now late March 2017. Between your university dasses and other things, you have fallen behind on accounting for the transactions and events affecting Economy Small Engine Repair. You gathered the information necessary to get caught up and sat down to work Tasks 1. On March 15, 2017, Economy Small Engine Repair purchased a store in the light industrial area north of downtown Regina. To fund the purchase of the new store and related costs, ESER took out a mortgage for $251,500 from the Royal Bank of Canada. The mortgage term is 25 years and the amount borrowed is subject to interest at a rate of 6% per annum or 0.5% per month. Blended principal and interest payments of $1,620 are due each month on the 15h day of the month. To help with the accounting, you decided to prepare a loan amortization schedule for the first 6 payments. You plan to use the format studied in BUS 285 and round all amounts to the nearest dollar. 2. Now that you have prepared the loan amortization schedule, you decided to journalize the April 15 and May 15 mortgage payments. 3. To complete several large repairs in March 2016, Bob found it necessary to hire temporary staff. The gross wages earned by the temporary staff totaled $3,115. From the gross wages, it was necessary to withhold $109 for Canada Pension Plan (CPP). $93 for Employment Insurance (EI) and $775 in employee income taxes. ESER was also required to contribute $109 for CPP and $120 for El. The employees will be paid March 31. The deductions will be remitted to the government in mid-April 2017. You decided to prepare the journal entries related to payroll such that they are ready to be entered into the accounting system on March 31. You also decide to get the journal entry for the April 15 payment to the Receiver General ready as well. 4. As part of his move to the new store Bob has decided to take on the sales of new lawnmowers, snow blowers and other small engine tools. To do this he needs some cash for the display stock and he approached his brother for some help as he does not want to go back to the bank right now for more money. Bob's brother agrees to invest $4,500 in ESER. In return he will be issued non-voting preferred shares in return for his $4,500. The investment will occur on April 1. You decide to prepare the journal entry to record her investment. 5. Due to the volume of sales and the new retail sales ESER is now making, they are required to charge PST and GST on all sales effective April 1, 2017. The Saskatchewan PST rate is 5% of sales and the federal GST rate is also 5% of sales. ESER has agreed to supply two ride-on lawnmowers to the Wascana Centre Authority for use at the University of Regina. They are to be delivered April 1 at a price of$3,500 each and with payment due upon delivery. You need to prepare the journal entry to record the sale including the related PST and GST