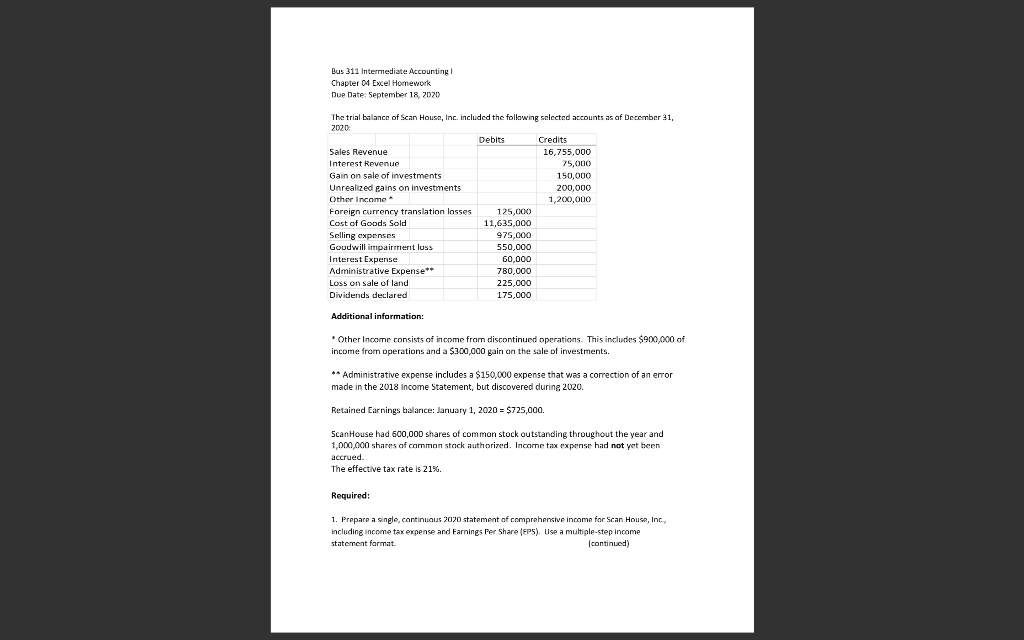

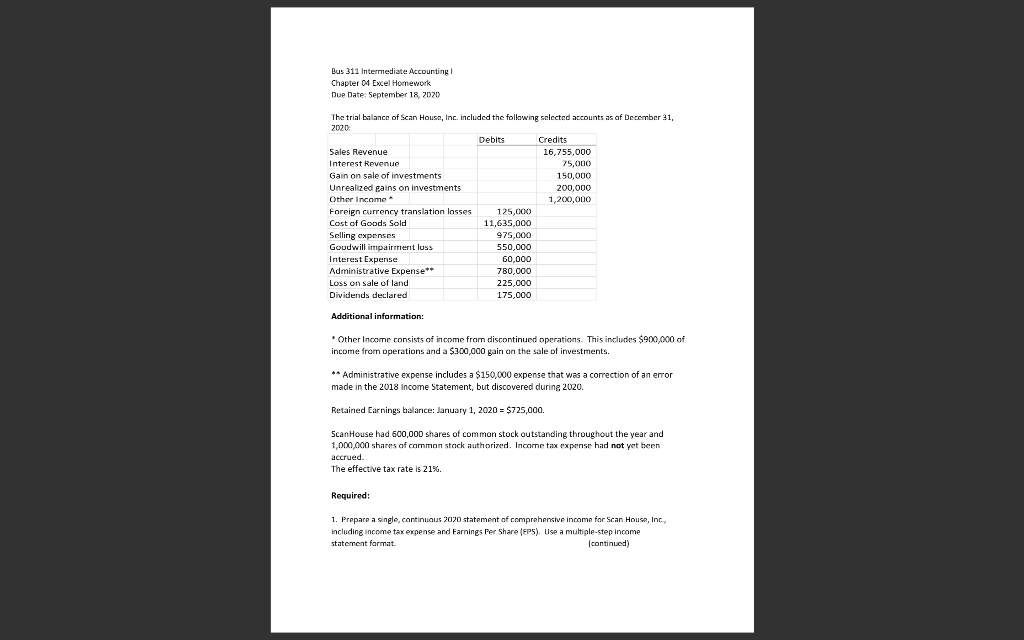

Bus 311 Intermediate Accounting Chapter 04 Excel Homework Due Date: September 18, 2020 The trial balance of Scan House, Inc. included the following selected accounts as of December 21, 2020 Debits Credits Sales Revenue 16,755,000 Interest Revenue 75,000 Gain on sale of investments 150,000 Unrealized gains on investments 200,000 Other Income 1,200,000 Foreign currency translation losses 125,000 Cost of Goods Sold 11,635,000 Selling expenses 975,000 Goudwill impairment luss 550,000 Interest Expense 60,000 Administrative Expense** 780,000 Loss on sale of land 225,000 Dividends declared 175,000 Additional information: *Other Income consists of income from discontinued operations. This includes $900,000 of income from operations and a $300,000 gain on the sale of investments. ** Administrative expense includes a $150,000 expense that was a correction of an error made in the 2018 Income Statement, but discovered during 2020. Retained Earnings balance: January 1, 2020 = $725,000. Scan House had 500,000 shares of common stock outstanding throughout the year and 1,000,000 shares of common stack authorized. Income tax expense had not yet been accrued. The effective tax rate is 21%. Required: 1. Prepare a single, continuous 2020 statement of comprehensive income for Scan House, Inc., including income tax expense and Earnings Per Share (EPS), Use a multiple-step income statement format continued) 2. Prepare a 2020 statement of retained earnings for Scan House, Inc. Reminders: Use the four-line heading as described below: Your name: Bus 311, Intermediate Accounting Assignment: Chapter 04 Excel HW Problem Due date: 9/18/20 Use commas as thousand separators (1,000,000) Do not include cents in any numbers, except for EPS Use S signs sparingly Use spellcheck and carefully proofread your solution Refer to the Excel Tips and Reminders posted in iLearn for additional formatting issue Page 2 of 2 Bus 311 Intermediate Accounting Chapter 04 Excel Homework Due Date: September 18, 2020 The trial balance of Scan House, Inc. included the following selected accounts as of December 21, 2020 Debits Credits Sales Revenue 16,755,000 Interest Revenue 75,000 Gain on sale of investments 150,000 Unrealized gains on investments 200,000 Other Income 1,200,000 Foreign currency translation losses 125,000 Cost of Goods Sold 11,635,000 Selling expenses 975,000 Goudwill impairment luss 550,000 Interest Expense 60,000 Administrative Expense** 780,000 Loss on sale of land 225,000 Dividends declared 175,000 Additional information: *Other Income consists of income from discontinued operations. This includes $900,000 of income from operations and a $300,000 gain on the sale of investments. ** Administrative expense includes a $150,000 expense that was a correction of an error made in the 2018 Income Statement, but discovered during 2020. Retained Earnings balance: January 1, 2020 = $725,000. Scan House had 500,000 shares of common stock outstanding throughout the year and 1,000,000 shares of common stack authorized. Income tax expense had not yet been accrued. The effective tax rate is 21%. Required: 1. Prepare a single, continuous 2020 statement of comprehensive income for Scan House, Inc., including income tax expense and Earnings Per Share (EPS), Use a multiple-step income statement format continued) 2. Prepare a 2020 statement of retained earnings for Scan House, Inc. Reminders: Use the four-line heading as described below: Your name: Bus 311, Intermediate Accounting Assignment: Chapter 04 Excel HW Problem Due date: 9/18/20 Use commas as thousand separators (1,000,000) Do not include cents in any numbers, except for EPS Use S signs sparingly Use spellcheck and carefully proofread your solution Refer to the Excel Tips and Reminders posted in iLearn for additional formatting issue Page 2 of 2