Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BUS 420 - Capital Structure - page 3 Team # 2. World Outsourcing Corp. (WOC) is an unleveraged firm with 60m shares outstanding. WOC's

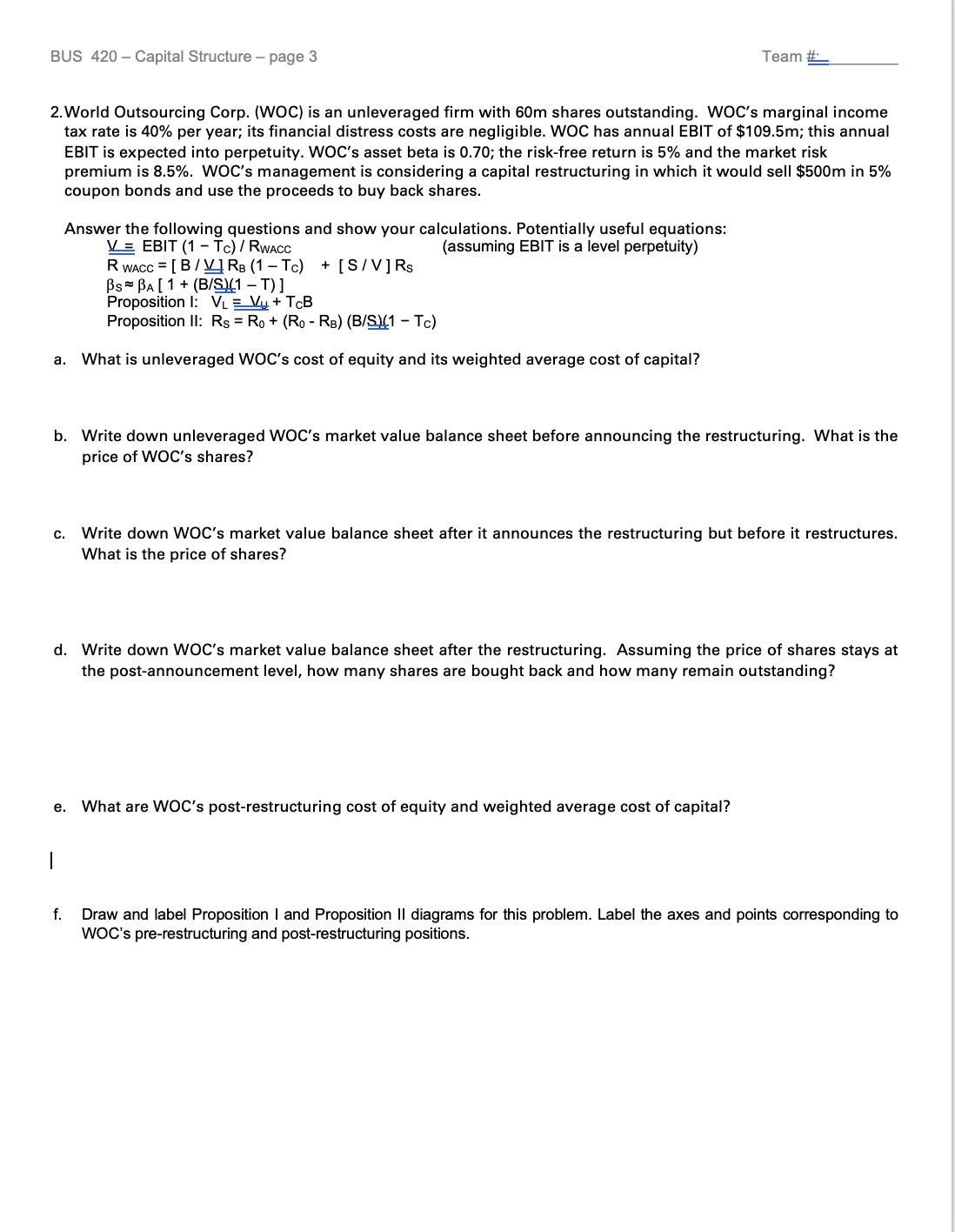

BUS 420 - Capital Structure - page 3 Team # 2. World Outsourcing Corp. (WOC) is an unleveraged firm with 60m shares outstanding. WOC's marginal income tax rate is 40% per year; its financial distress costs are negligible. WOC has annual EBIT of $109.5m; this annual EBIT is expected into perpetuity. WOC's asset beta is 0.70; the risk-free return is 5% and the market risk premium is 8.5%. WOC's management is considering a capital restructuring in which it would sell $500m in 5% coupon bonds and use the proceeds to buy back shares. a. Answer the following questions and show your calculations. Potentially useful equations: V = EBIT (1 - Tc)/RWACC R WACC [B/V RB (1 - TC) + [S/V] Rs s A [ 1 + (B/S)(1 T)] Proposition I: V = Vy + TCB Proposition II: Rs = Ro+ (Ro- RB) (B/S)(1 - TC) (assuming EBIT is a level perpetuity) What is unleveraged WOC's cost of equity and its weighted average cost of capital? b. Write down unleveraged WOC's market value balance sheet before announcing the restructuring. What is the price of WOC's shares? C. Write down WOC's market value balance sheet after it announces the restructuring but before it restructures. What is the price of shares? d. Write down WOC's market value balance sheet after the restructuring. Assuming the price of shares stays at the post-announcement level, how many shares are bought back and how many remain outstanding? | e. What are WOC's post-restructuring cost of equity and weighted average cost of capital? f. Draw and label Proposition I and Proposition II diagrams for this problem. Label the axes and points corresponding to WOC's pre-restructuring and post-restructuring positions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To find the unleveraged WOCs cost of equity Re and weighted average cost of capital WACC we need to use the following formulas Cost of Equity Re Ris...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started