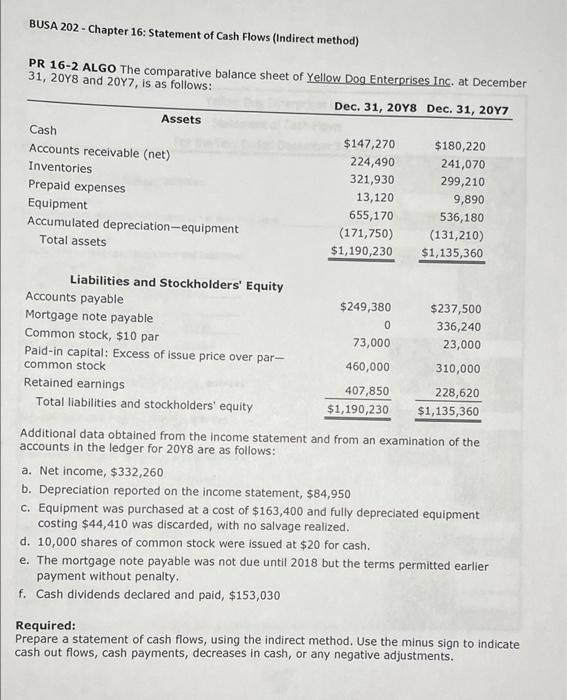

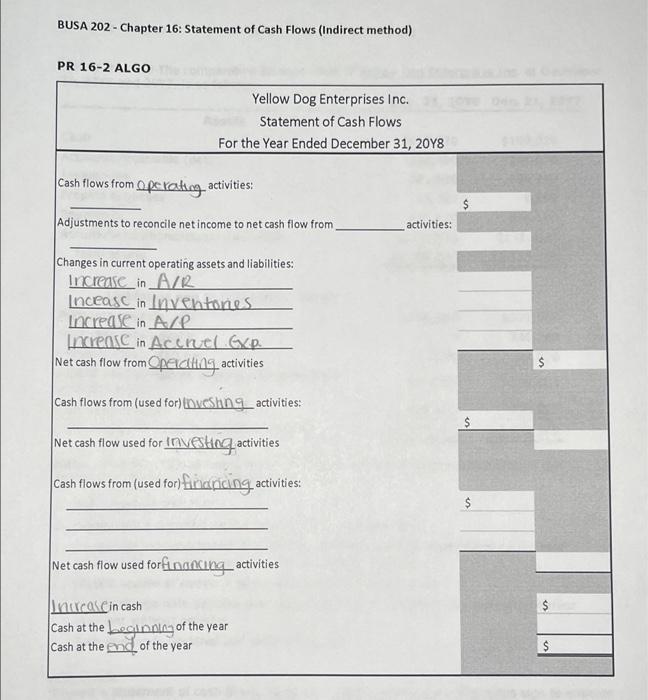

BUSA 202 - Chapter 16: Statement of Cash Flows (Indirect method) PR 16-2 ALGO The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 2048 and 2017, is as follows: Dec. 31, 20Y8 Dec. 31, 2047 Assets Cash $147,270 $180,220 Accounts receivable (net) 224,490 241,070 Inventories 321,930 299,210 Prepaid expenses 13,120 9,890 Equipment 655,170 536,180 Accumulated depreciation-equipment (171,750) (131,210) Total assets $1,190,230 $1,135,360 0 Liabilities and Stockholders' Equity Accounts payable $249,380 $237,500 Mortgage note payable 336,240 Common stock, $10 par 73,000 23,000 Pald-in capital: Excess of issue price over par- common stock 460,000 310,000 Retained earnings 407,850 228,620 Total liabilities and stockholders' equity $1,190,230 $1,135,360 Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income, $332,260 b. Depreciation reported on the income statement, $84,950 C. Equipment was purchased at a cost of $ 163,400 and fully depreciated equipment costing $44,410 was discarded, with no salvage realized. d. 10,000 shares of common stock were issued at $20 for cash. e. The mortgage note payable was not due until 2018 but the terms permitted earlier payment without penalty. f. Cash dividends declared and paid, $153,030 Required: Prepare a statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. BUSA 202 - Chapter 16: Statement of Cash Flows (Indirect method) PR 16-2 ALGO Yellow Dog Enterprises Inc. Statement of Cash Flows For the Year Ended December 31, 2048 cash flows from operating activities: $ Adjustments to reconcile net income to net cash flow from activities: Changes in current operating assets and liabilities: Increase in A/2 Inceasc_in Inventones Increase in Ale Increase in Accruel Grp Net cash flow from Opacting activities cash flows from (used for investing activities: Net cash flow used for inveshag activities cash flows from (used for) finaricing activities: $ Net cash flow used forfinancing activities $ Incoin cash cash at the beginning of the year Cash at the end of the year