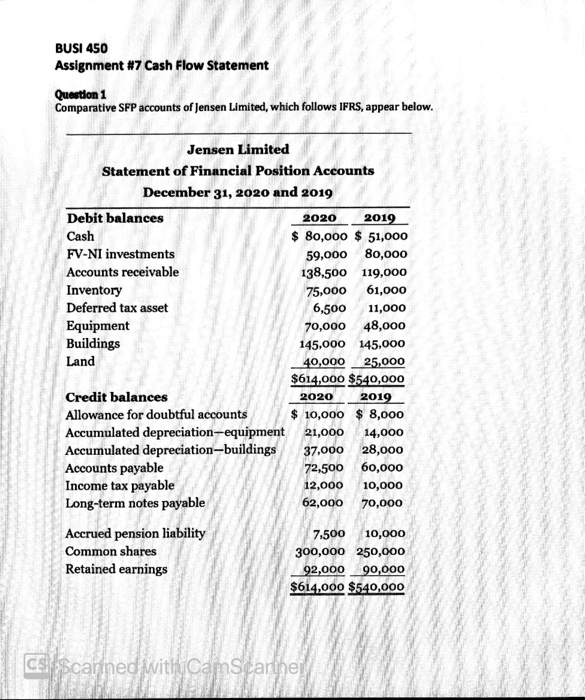

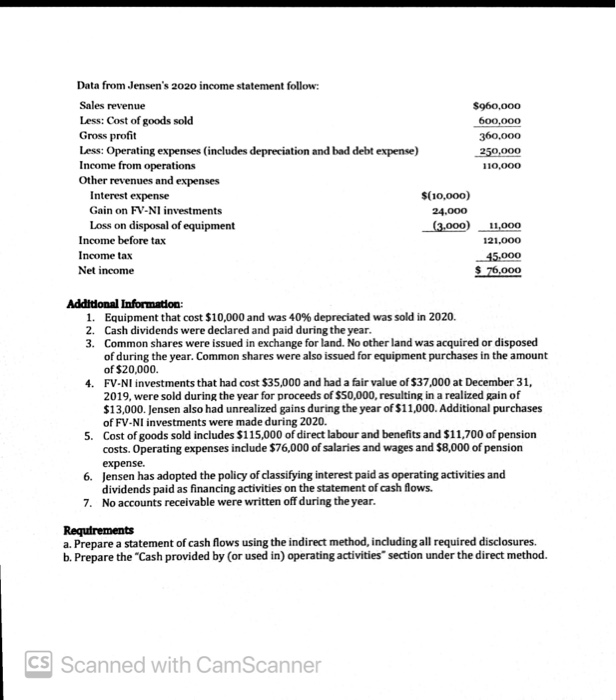

BUSI 450 Assignment #7 Cash Flow Statement Question 1 Comparative SFP accounts of Jensen Limited, which follows IFRS, appear below. 2020 Jensen Limited Statement of Financial Position Accounts December 31, 2020 and 2019 Debit balances 2019 Cash $ 80,000 $ 51,000 FV-NI investments 59,000 80,000 Accounts receivable 138,500 119,000 Inventory 75,000 61,000 Deferred tax asset 6,500 11,000 Equipment 70,000 48,000 Buildings 145,000 145,000 Land 40,000 25,000 $614,000 $540,000 Credit balances 2019 Allowance for doubtful accounts $ 10,000 $ 8,000 Accumulated depreciation-equipment 21,000 14,000 Accumulated depreciation-buildings 37,000 28,000 Accounts payable 72,500 60,000 Income tax payable 12,000 10,000 Long-term notes payable 62,000 70,000 Accrued pension liability 7,500 10,000 Common shares 300,000 250,000 Retained earnings 92,000 90,000 $614,000 $540,000 2020 Cs Scarined with iCamScarlher 110,000 Data from Jensen's 2020 income statement follow: Sales revenue $960,000 Less: Cost of goods sold 600,000 Gross profit 360,000 Less: Operating expenses (includes depreciation and bad debt expense) 250,000 Income from operations Other revenues and expenses Interest expense $(10,000) Gain on FV-N1 investments 24,000 Loss on disposal of equipment (3,000) Income before tax 121,000 Income tax 45.000 Net income $ 76,000 11,000 Additional Information: 1. Equipment that cost $10,000 and was 40% depreciated was sold in 2020. 2. Cash dividends were declared and paid during the year. 3. Common shares were issued in exchange for land. No other land was acquired or disposed of during the year. Common shares were also issued for equipment purchases in the amount of $20,000. 4. FV-Nl investments that had cost $35,000 and had a fair value of $37,000 at December 31, 2019, were sold during the year for proceeds of $50,000, resulting in a realized gain of $13,000. Jensen also had unrealized gains during the year of $11,000. Additional purchases of FV-NI investments were made during 2020. 5. Cost of goods sold includes $115,000 of direct labour and benefits and $11,700 of pension costs. Operating expenses include $76,000 of salaries and wages and $8,000 of pension expense. 6. Jensen has adopted the policy of classifying interest paid as operating activities and dividends paid as financing activities on the statement of cash flows. 7. No accounts receivable were written off during the year. Requtrements a. Prepare a statement of cash flows using the indirect method, including all required disclosures. b. Prepare the "Cash provided by (or used in) operating activities" section under the direct method. CS Scanned with CamScanner