Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Business Analytics 2nd Edition - Ch. 16 - Problem 9PE For the DoorCo Corporation decision in Problem 2, suppose that the probabilities of the three

Business Analytics 2nd Edition - Ch. 16 - Problem 9PE

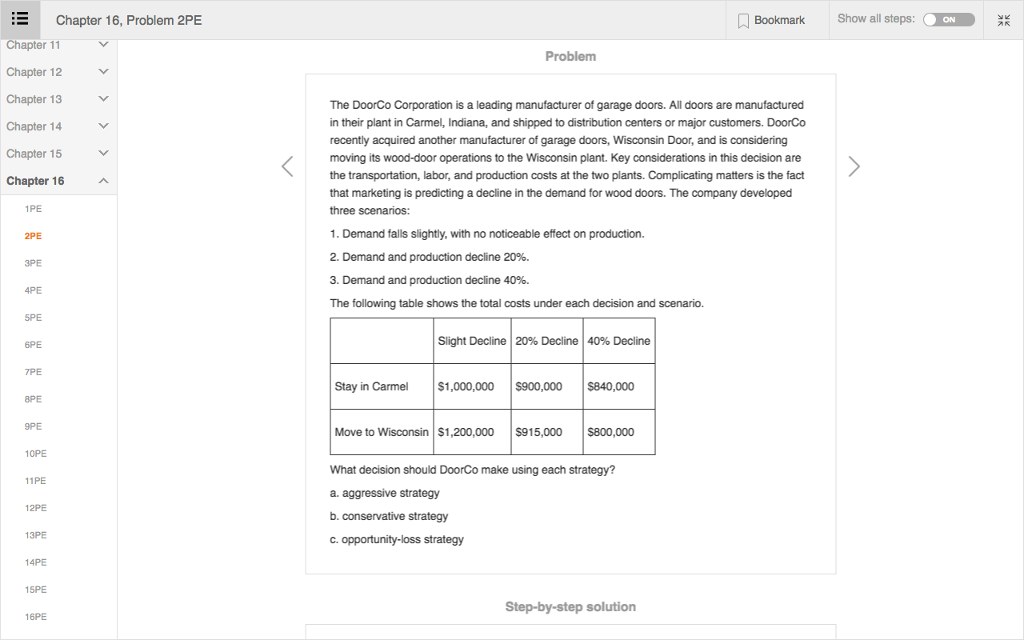

For the DoorCo Corporation decision in Problem 2, suppose that the probabilities of the three scenarios are estimated to be 0.15, 0.40, and 0.45, respectively. Find the best expected value decision.

I do not understand how to answer the first part of quetsion #2 which is in the picture above. I beleive that you just have to change the 1-3 with the probabilities in question 9. All the information that I see in the book is listed above.

E Chapter 16, Problem 2PE Chapter 11 Chapter 12 Chapter 13 Chapter 14 v Chapter 15 Chapter 16 PE Bookmark Problem The DoorCo Corporation is a leading manufacturer of garage doors. All doors are manufactured in their plant in Carmel, Indiana, and shipped to distribution centers or major customers. DoorCo recently acquired another manufacturer of garage doors, Wisconsin Door, and is considering moving its wood-door operations to the Wisconsin plant. Key considerations in this decision are the transportation, labor, and production costs at the two plants. Complicating matters is the fact that marketing is predicting a decline in the demand for wood doors. The company developed three scenarios: 1. Demand falls slightly, with no noticeable effect on production 2. Demand and production decline 20%. 3. Demand and production decline 40%. The following table shows the total costs under each decision and scenario. Slight Decline 20% Decline 40% Decline Stay in Carmel S1,000,000 $900,000 $840,000 Move to Wisconsin $1,200,000 $915,000 $800,000 What decision should DoorCo make using each strategy? a. aggressive strategy b. conservative strategy c. opportunity-loss strategy Step-by-step solution Show all steps: ON

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started