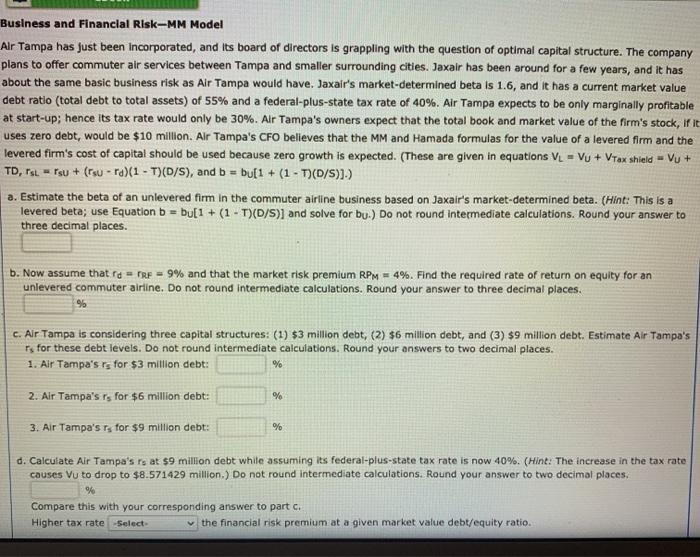

Business and Financial Risk-MM Model Alr Tampa has just been incorporated, and its board of directors is grappling with the question of optimal capital structure. The company plans to offer commuter air services between Tampa and smaller surrounding cities. Jaxair has been around for a few years, and it has about the same basic business risk as Air Tampa would have. Jaxair's market-determined beta is 1.6, and it has a current market value debt ratio (total debt to total assets) of 55% and a federal-plus-state tax rate of 40%. Air Tampa expects to be only marginally profitable at start-up; hence its tax rate would only be 30%. Air Tampa's owners expect that the total book and market value of the firm's stock, irit uses zero debt, would be $10 million. Air Tampa's CFO believes that the MM and Hamada formulas for the value of a levered firm and the levered firm's cost of capital should be used because zero growth is expected. (These are given in equations VL = VU + Vtax shield - Vu+ TD, PLfsu + (rsu - ra) (1 - T)(D/S), and b = bu[1 + (1 - T)(D/S)].) a. Estimate the beta of an unlevered firm in the commuter airline business based on Jaxair's market-determined beta. (Hint: This is a levered beta; use Equation b = bu[1 + (1 - 1)(D/S) and solve for bu.) Do not round intermediate calculations. Round your answer to three decimal places. b. Now assume that rid FR = 9% and that the market risk premium RPM = 4%. Find the required rate of return on equity for an unlevered commuter airline. Do not round intermediate calculations. Round your answer to three decimal places. c. Air Tampa is considering three capital structures: (1) $3 million debt, (2) $6 million debt, and (3) $9 million debt. Estimate Air Tampa's Ts for these debt levels. Do not round intermediate calculations. Round your answers to two decimal places. 1. Air Tampa's rs for $3 million debt: % 2. Air Tampa's rs for $6 million debt: % 3. Air Tampa's rs for $9 million debt: % d. Calculate Air Tampa's rs at $9 million debt while assuming its federal-plus-state tax rate is now 40%. (Hint: The increase in the tax rate causes Vu to drop to $8.571429 million) Do not round intermediate calculations. Round your answer to two decimal places. % Compare this with your corresponding answer to part c. Higher tax rate Select the financial risk premium at a given market value debt/equity ratio. Business and Financial Risk-MM Model Alr Tampa has just been incorporated, and its board of directors is grappling with the question of optimal capital structure. The company plans to offer commuter air services between Tampa and smaller surrounding cities. Jaxair has been around for a few years, and it has about the same basic business risk as Air Tampa would have. Jaxair's market-determined beta is 1.6, and it has a current market value debt ratio (total debt to total assets) of 55% and a federal-plus-state tax rate of 40%. Air Tampa expects to be only marginally profitable at start-up; hence its tax rate would only be 30%. Air Tampa's owners expect that the total book and market value of the firm's stock, irit uses zero debt, would be $10 million. Air Tampa's CFO believes that the MM and Hamada formulas for the value of a levered firm and the levered firm's cost of capital should be used because zero growth is expected. (These are given in equations VL = VU + Vtax shield - Vu+ TD, PLfsu + (rsu - ra) (1 - T)(D/S), and b = bu[1 + (1 - T)(D/S)].) a. Estimate the beta of an unlevered firm in the commuter airline business based on Jaxair's market-determined beta. (Hint: This is a levered beta; use Equation b = bu[1 + (1 - 1)(D/S) and solve for bu.) Do not round intermediate calculations. Round your answer to three decimal places. b. Now assume that rid FR = 9% and that the market risk premium RPM = 4%. Find the required rate of return on equity for an unlevered commuter airline. Do not round intermediate calculations. Round your answer to three decimal places. c. Air Tampa is considering three capital structures: (1) $3 million debt, (2) $6 million debt, and (3) $9 million debt. Estimate Air Tampa's Ts for these debt levels. Do not round intermediate calculations. Round your answers to two decimal places. 1. Air Tampa's rs for $3 million debt: % 2. Air Tampa's rs for $6 million debt: % 3. Air Tampa's rs for $9 million debt: % d. Calculate Air Tampa's rs at $9 million debt while assuming its federal-plus-state tax rate is now 40%. (Hint: The increase in the tax rate causes Vu to drop to $8.571429 million) Do not round intermediate calculations. Round your answer to two decimal places. % Compare this with your corresponding answer to part c. Higher tax rate Select the financial risk premium at a given market value debt/equity ratio