Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BUSINESS CALCULATOR ONLY! how do i do this on financial calculator. thank you I need this solved in financial calculator because thats ho we do

BUSINESS CALCULATOR ONLY!

how do i do this on financial calculator. thank you

I need this solved in financial calculator because thats ho we do it in class.

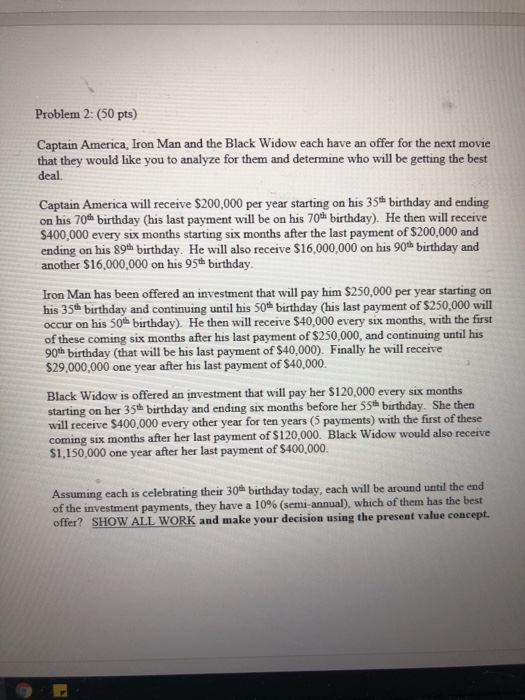

Problem 2: (50 pts) Captain America, Iron Man and the Black Widow each have an offer for the next movie that they would like you to analyze for them and determine who will be getting the best deal Captain America will receive $200,000 per year starting on his 35 birthday and ending on his 70 birthday (his last payment will be on his 70th birthday). He then will receive $400,000 every six months starting six months after the last payment of $200,000 and ending on his 89th birthday. He will also receive $16,000,000 on his 90th birthday and another $16,000,000 on his 95th birthday. Iron Man has been offered an investment that will pay him $250,000 per year starting on his 35 birthday and continuing until his 50 birthday (his last payment of $250,000 will occur on his 50th birthday). He then will receive $40,000 every six months, with the first of these coming six months after his last payment of $250,000, and continuing until his 90th birthday (that will be his last payment of $40,000). Finally he will receive $29,000,000 one year after his last payment of $40,000. Black Widow is offered an investment that will pay her $120,000 every six months starting on her 35 birthday and ending six months before her 55 birthday. She then will receive $400,000 every other year for ten years (5 payments) with the first of these coming six months after her last payment of $120,000. Black Widow would also receive $1,150,000 one year after her last payment of $400,000. Assuming each is celebrating their 30 birthday today, each will be around until the end of the investment payments, they have a 10% (semi-annual), which of them has the best offer? SHOW ALL WORK and make your decision using the present value concept. Problem 2: (50 pts) Captain America, Iron Man and the Black Widow each have an offer for the next movie that they would like you to analyze for them and determine who will be getting the best deal Captain America will receive $200,000 per year starting on his 35 birthday and ending on his 70 birthday (his last payment will be on his 70th birthday). He then will receive $400,000 every six months starting six months after the last payment of $200,000 and ending on his 89th birthday. He will also receive $16,000,000 on his 90th birthday and another $16,000,000 on his 95th birthday. Iron Man has been offered an investment that will pay him $250,000 per year starting on his 35 birthday and continuing until his 50 birthday (his last payment of $250,000 will occur on his 50th birthday). He then will receive $40,000 every six months, with the first of these coming six months after his last payment of $250,000, and continuing until his 90th birthday (that will be his last payment of $40,000). Finally he will receive $29,000,000 one year after his last payment of $40,000. Black Widow is offered an investment that will pay her $120,000 every six months starting on her 35 birthday and ending six months before her 55 birthday. She then will receive $400,000 every other year for ten years (5 payments) with the first of these coming six months after her last payment of $120,000. Black Widow would also receive $1,150,000 one year after her last payment of $400,000. Assuming each is celebrating their 30 birthday today, each will be around until the end of the investment payments, they have a 10% (semi-annual), which of them has the best offer? SHOW ALL WORK and make your decision using the present value concept Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started