Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Business Case 1- Manafa paid up capital is 100,000 SAR 2- Purchased computer for 5,000 SAR on credit 3- Manafa purchased goods with cost

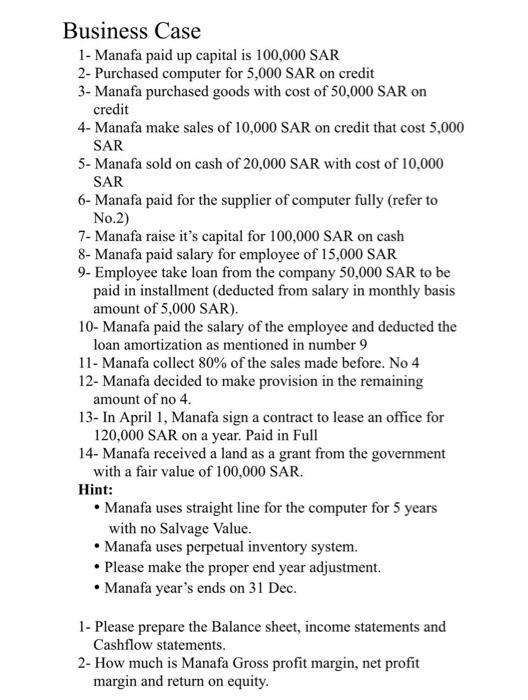

Business Case 1- Manafa paid up capital is 100,000 SAR 2- Purchased computer for 5,000 SAR on credit 3- Manafa purchased goods with cost of 50,000 SAR on credit 4- Manafa make sales of 10,000 SAR on credit that cost 5,000 SAR 5- Manafa sold on cash of 20,000 SAR with cost of 10,000 SAR 6- Manafa paid for the supplier of computer fully (refer to No.2) 7- Manafa raise it's capital for 100,000 SAR on cash 8- Manafa paid salary for employee of 15,000 SAR 9- Employee take loan from the company 50,000 SAR to be paid in installment (deducted from salary in monthly basis amount of 5,000 SAR). 10- Manafa paid the salary of the employee and deducted the loan amortization as mentioned in number 9 11- Manafa collect 80% of the sales made before. No 4 12- Manafa decided to make provision in the remaining amount of no 4. 13- In April 1, Manafa sign a contract to lease an office for 120,000 SAR on a year. Paid in Full 14- Manafa received a land as a grant from the government with a fair value of 100,000 SAR. Hint: Manafa uses straight line for the computer for 5 years with no Salvage Value. Manafa uses perpetual inventory system. Please make the proper end year adjustment. Manafa year's ends on 31 Dec. 1- Please prepare the Balance sheet, income statements and Cashflow statements. 2- How much is Manafa Gross profit margin, net profit margin and return on equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution 1 Balance Sheet as of December 31 Assets Cash 150000 20000 100000 5000 15000 50000 120000 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started