Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Business Combination - AFAR2 Discussion Problem no. 1 - (Estimating Goodwill - Direct Valuation) Entity Y is contemplating on acquiring Entity X. Relevant information follows;

Business Combination - AFAR2

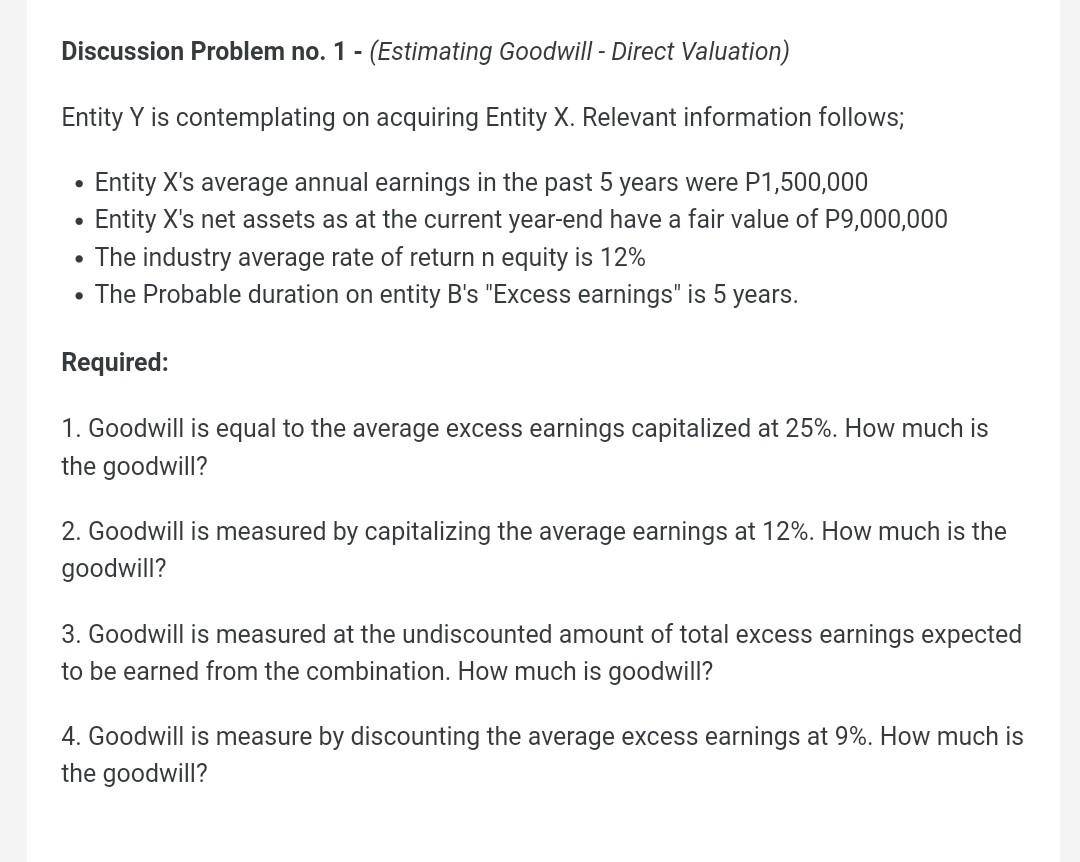

Discussion Problem no. 1 - (Estimating Goodwill - Direct Valuation) Entity Y is contemplating on acquiring Entity X. Relevant information follows; - Entity X's average annual earnings in the past 5 years were P1,500,000 - Entity X's net assets as at the current year-end have a fair value of P9,000,000 - The industry average rate of return n equity is 12% - The Probable duration on entity B's "Excess earnings" is 5 years. Required: 1. Goodwill is equal to the average excess earnings capitalized at 25%. How much is the goodwill? 2. Goodwill is measured by capitalizing the average earnings at 12%. How much is the goodwill? 3. Goodwill is measured at the undiscounted amount of total excess earnings expected to be earned from the combination. How much is goodwill? 4. Goodwill is measure by discounting the average excess earnings at 9%. How much is the goodwill? Discussion Problem no. 1 - (Estimating Goodwill - Direct Valuation) Entity Y is contemplating on acquiring Entity X. Relevant information follows; - Entity X's average annual earnings in the past 5 years were P1,500,000 - Entity X's net assets as at the current year-end have a fair value of P9,000,000 - The industry average rate of return n equity is 12% - The Probable duration on entity B's "Excess earnings" is 5 years. Required: 1. Goodwill is equal to the average excess earnings capitalized at 25%. How much is the goodwill? 2. Goodwill is measured by capitalizing the average earnings at 12%. How much is the goodwill? 3. Goodwill is measured at the undiscounted amount of total excess earnings expected to be earned from the combination. How much is goodwill? 4. Goodwill is measure by discounting the average excess earnings at 9%. How much is the goodwillStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started