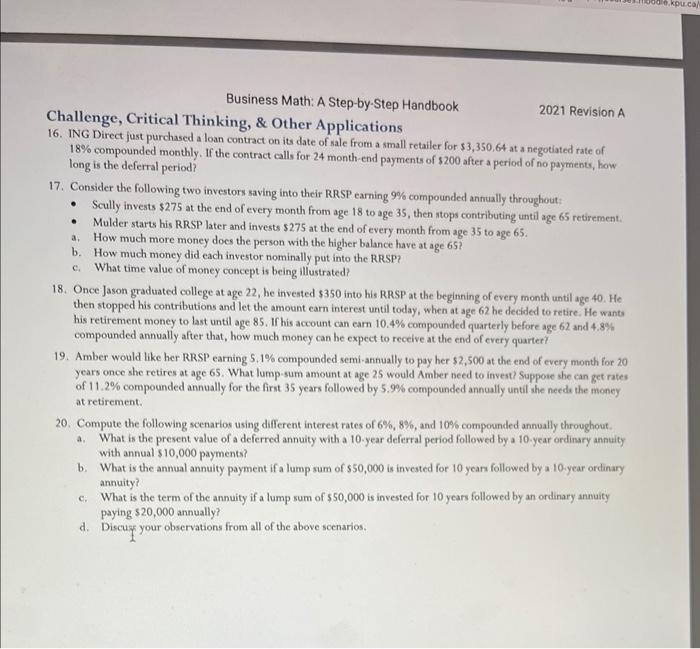

Business Math: A Step-by-Step Handbook 2021 Revision A Challenge, Critical Thinking, \& Other Applications 16. ING Direct just purchased a loan contract on its date of sale from a small retailer for $3,350,64 at a negotiated rate of 18% compounded monthly. If the contract calls for 24 month-end payments of $200 after a period of no payments, how long is the deferral period? 17. Consider the following two investors saving into their RRSP earning 9% compounded annually throughout: - Scully invests $275 at the end of every month from age 18 to age 35 , then stops contributing until age 65 retirement. - Mulder starts his RRSP later and invests $275 at the end of every month from age 35 to age 65 . a. How much more money does the person with the higher balance have at age 65 ? b. How much money did each investor nominally put into the RRSP? c. What time value of money concept is being illustrated? 18. Once Jason graduated college at age 22 , he invested $350 into his RRSP at the beginning of every month until age 40 . He then stopped his contributions and let the amount earn interest until today, when at age 62 he decided to retire. He wants his retirement money to last until age 85 . If his account can earn 10.4% compounded quarterly before age 62 and 4.8% compounded annually after that, how much money can he expect to receive at the end of every quarter? 19. Amber would like her RRSP earning 5.1% compounded semi-annually to pay her $2,500 at the end of every month for 20 years once she retires at age 65 . What lump-sum amount at age 25 would Amber need to invest Suppose she can get rates of 11.2% compounded annually for the first 35 years followed by 5.9% compounded annually until the neede the money at retirement. 20. Compute the following scenarios using different interest rates of 6%,8%, and 10% compounded annually throughout. a. What is the present value of a deferred annuity with a 10 -year deferral period followed by a 10-year ordinary annuity with annual $10,000 payments? b. What is the annual annuity payment if a lump sum of $50,000 is invested for 10 years followed by a 10 -year ordinary annuity? c. What is the term of the annuity if a lump sum of $50,000 is invested for 10 years followed by an ordinary annuity paying $20,000 annually? d. Discuy your observations from all of the above scenarios. Business Math: A Step-by-Step Handbook 2021 Revision A Challenge, Critical Thinking, \& Other Applications 16. ING Direct just purchased a loan contract on its date of sale from a small retailer for $3,350,64 at a negotiated rate of 18% compounded monthly. If the contract calls for 24 month-end payments of $200 after a period of no payments, how long is the deferral period? 17. Consider the following two investors saving into their RRSP earning 9% compounded annually throughout: - Scully invests $275 at the end of every month from age 18 to age 35 , then stops contributing until age 65 retirement. - Mulder starts his RRSP later and invests $275 at the end of every month from age 35 to age 65 . a. How much more money does the person with the higher balance have at age 65 ? b. How much money did each investor nominally put into the RRSP? c. What time value of money concept is being illustrated? 18. Once Jason graduated college at age 22 , he invested $350 into his RRSP at the beginning of every month until age 40 . He then stopped his contributions and let the amount earn interest until today, when at age 62 he decided to retire. He wants his retirement money to last until age 85 . If his account can earn 10.4% compounded quarterly before age 62 and 4.8% compounded annually after that, how much money can he expect to receive at the end of every quarter? 19. Amber would like her RRSP earning 5.1% compounded semi-annually to pay her $2,500 at the end of every month for 20 years once she retires at age 65 . What lump-sum amount at age 25 would Amber need to invest Suppose she can get rates of 11.2% compounded annually for the first 35 years followed by 5.9% compounded annually until the neede the money at retirement. 20. Compute the following scenarios using different interest rates of 6%,8%, and 10% compounded annually throughout. a. What is the present value of a deferred annuity with a 10 -year deferral period followed by a 10-year ordinary annuity with annual $10,000 payments? b. What is the annual annuity payment if a lump sum of $50,000 is invested for 10 years followed by a 10 -year ordinary annuity? c. What is the term of the annuity if a lump sum of $50,000 is invested for 10 years followed by an ordinary annuity paying $20,000 annually? d. Discuy your observations from all of the above scenarios