Answered step by step

Verified Expert Solution

Question

1 Approved Answer

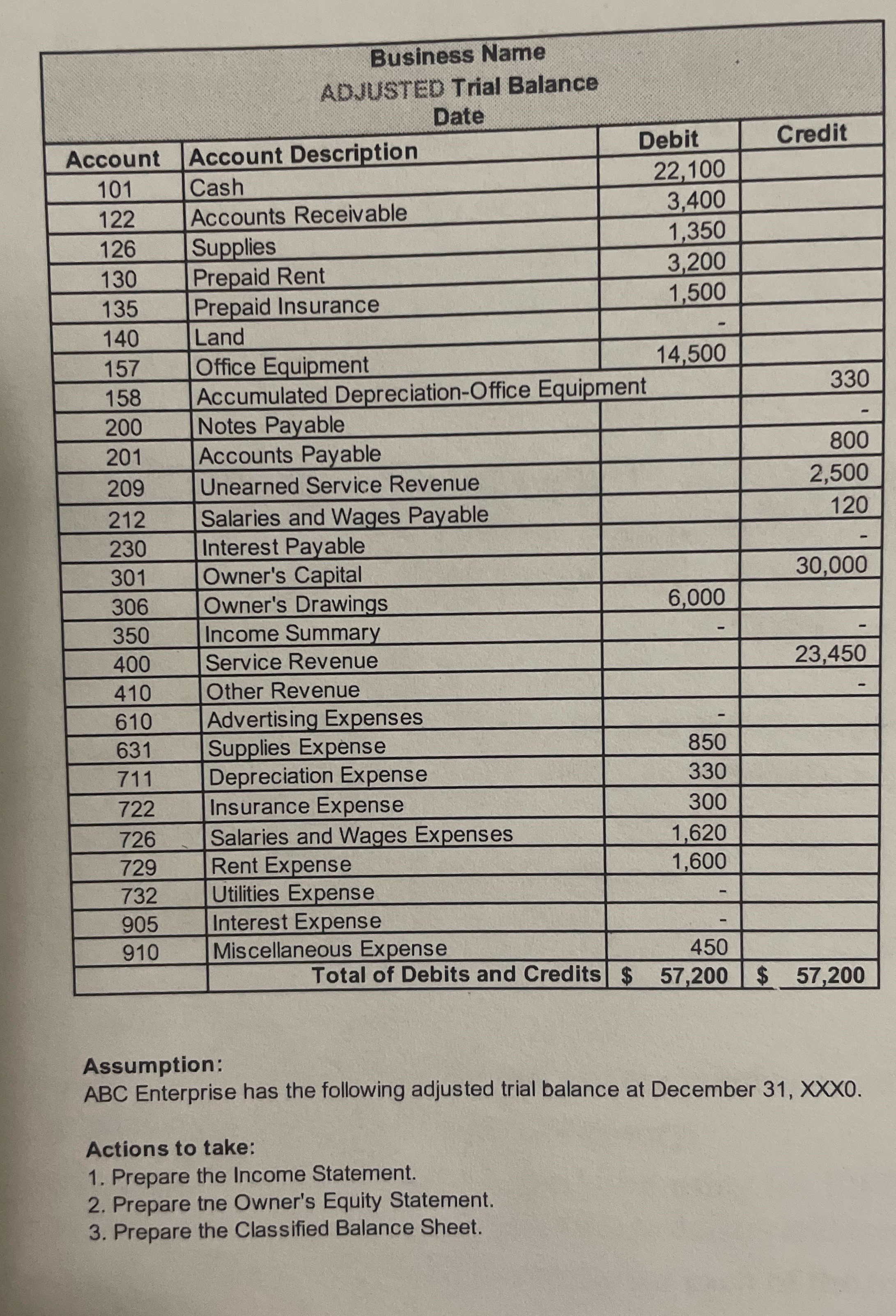

Business Name ADJUSTED Trial Balance Date Account Account Description 101 Cash 122 Accounts Receivable 126 Supplies 130 Prepaid Rent Debit Credit 22,100 3,400 1,350

Business Name ADJUSTED Trial Balance Date Account Account Description 101 Cash 122 Accounts Receivable 126 Supplies 130 Prepaid Rent Debit Credit 22,100 3,400 1,350 3,200 135 Prepaid Insurance 1,500 - 140 Land 157 Office Equipment 14,500 158 200 Notes Payable 201 209 Accumulated Depreciation-Office Equipment Accounts Payable Unearned Service Revenue 330 800 212 Salaries and Wages Payable 230 Interest Payable 301 Owner's Capital 306 Owner's Drawings 350 Income Summary 400 Service Revenue 2,500 120 30,000 6,000 23,450 410 Other Revenue 610 Advertising Expenses 631 Supplies Expense 850 711 Depreciation Expense 330 722 Insurance Expense 300 726 Salaries and Wages Expenses 1,620 729 Rent Expense 1,600 732 Utilities Expense - 905 Interest Expense 910 Miscellaneous Expense 450 Total of Debits and Credits $ 57,200 $ 57,200 Assumption: ABC Enterprise has the following adjusted trial balance at December 31, XXX0. Actions to take: 1. Prepare the Income Statement. 2. Prepare tne Owner's Equity Statement. 3. Prepare the Classified Balance Sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started