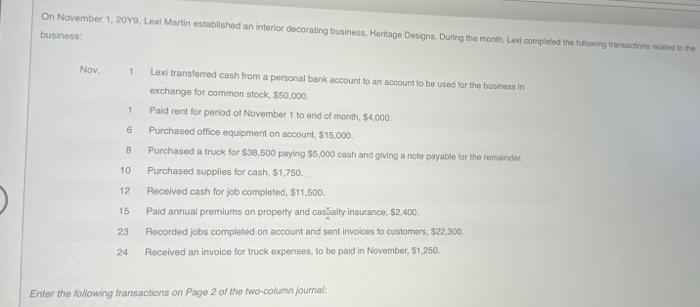

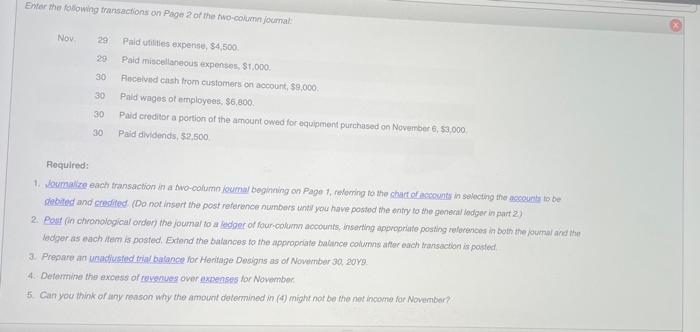

business: Nov. 1 Lexi transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $50,000. 1 Paid rent for period of November 1 to end of month, $4,000. 6 Purchased office equipment on account, $15,000. 8. Purchased a truck for $38,500 paying $5,000 cash and giving a nete payable for the fenainder. 10 Purchased supplies for cash, $1,750. 12 Recoived cash for job completed, $11,500. 15 Paid annual premiums on property and calialty insurance, $2,400. 23 Recorded jobs completed on account and sent invoices to customers, $22,300. 24 Received an invoice for truck expenses, to be paid in November, $1,250. Enter the following transactions on Page 2 of the fwo-column joumal: Nov 29 Paid utilities expense, $4,500 29: Paid miscellaheous expensers, $1,000. 30. Recelved cash from customers on account, $9,000. 30 Pald wages of employees, $6,800. 30 Paid croditor a portion of the amount owed for equipment purchased on November 6,$3,000 30 Paid dividends, 32,500 Required: 4. Defounine the excess of revenueg over expenses for November: 5. Can you think of any reason why the amount determined in (4) might not be the riet income for Novembor? 1. Joumalize each transaction in a two-column joumal beginning on Page 1, roferring to the chart of accounts in selecting the accounts to bo dobited and consited (Do not insart the post reference numbers until you have posted the entry to the general ledger in part 2) Question not attempted. Extend the balannes to the appropriate balance coumns afier each fransuction is posted Generalledger Instuctions Question not attempted. 3. Prepare an unadjusted trial balance for Heritage Designs as of November 30,20Y9 Question not attempted. Heritage Designs Score: 0/6 UNADJUSTED TRIAL BALANCE November 30,20Y9 4. Determine the excess of revenues over expenses for November. Feedback Check My Work Calculate Revenues - Expenses = Net Income Can you think of any reason why the amount determined in (4) might not be the net incorne for November? Because necessary adjustment to expenses, like depreciation has not been made. Because the closing inventory balance is missing. Because the dividends are declared but not paid. Because the cash balance is incorrect