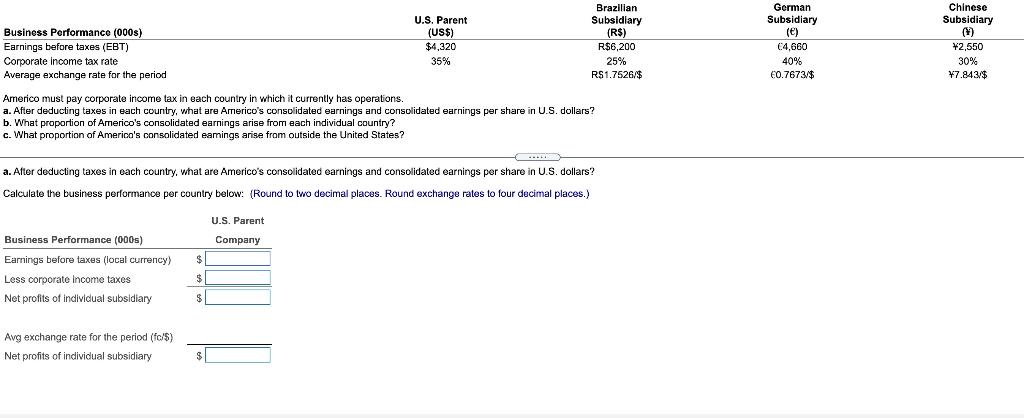

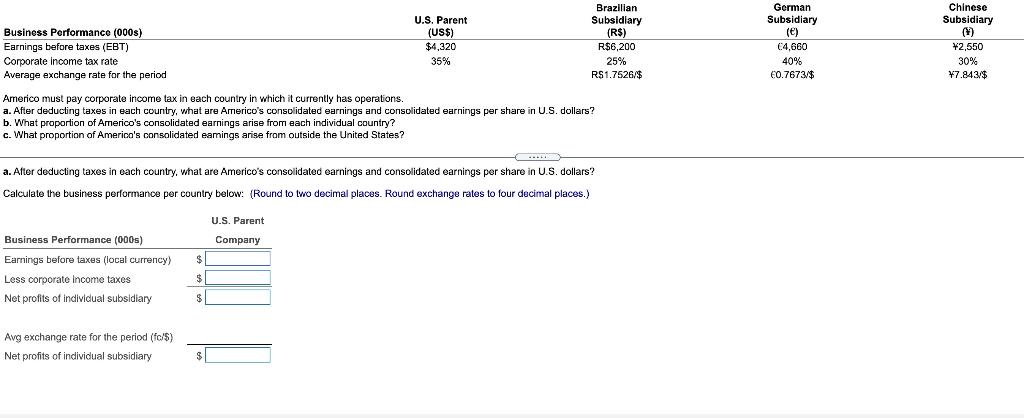

Business Performance (000s) Earnings before taxes (EBT) Corporate income tax rate Average exchange rate for the period U.S. Parent (US$) $4,320 35% Brazilian Subsidiary (R$) R$6,200 25% R$ 1.7526/$ German Subsidiary () C4,660 40% 0.7673/$ Chinese Subsidiary (4) 42,550 30% 47.843/$ Americo must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? b. What proportion of Americo's consolidated earnings arise from each individual country? c. What proportion of America's consolidated earnings arise from outside the United States? a. After deducing taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? Calculate the business performance per country below: (Round to two decimal places. Round exchange rates to four decimal places.) U.S. Parent Company $ Business Performance (000s) Earnings before taxes (local currency) Less corporate Income taxes Net profits of individual subsidiary $ $ Avg exchange rate for the period (fo/5) Net profits of individual subsidiary $ Business Performance (000s) Earnings before taxes (EBT) Corporate income tax rate Average exchange rate for the period U.S. Parent (US$) $4,320 35% Brazilian Subsidiary (R$) R$6,200 25% R$ 1.7526/$ German Subsidiary () C4,660 40% 0.7673/$ Chinese Subsidiary (4) 42,550 30% 47.843/$ Americo must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? b. What proportion of Americo's consolidated earnings arise from each individual country? c. What proportion of America's consolidated earnings arise from outside the United States? a. After deducing taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? Calculate the business performance per country below: (Round to two decimal places. Round exchange rates to four decimal places.) U.S. Parent Company $ Business Performance (000s) Earnings before taxes (local currency) Less corporate Income taxes Net profits of individual subsidiary $ $ Avg exchange rate for the period (fo/5) Net profits of individual subsidiary $